The Seagull option strategy is a unique options structure.

It aims to take a directional view on the price of an underlying stock while avoiding paying a debit to do so.

This article will outline the Seagull options strategy.

We will then discuss the advantages and disadvantages and when to use this strategy in a portfolio.

Contents

-

-

-

-

- The Basics – What Is A Seagull Option Strategy?

- When to Place Seagull Options Trades

- Should I Place a Seagull For A Credit Or Debit?

- Trade Example

- Concluding Remarks

-

-

-

The Basics – What Is A Seagull Option Strategy?

A Seagull options trade is a three-legged options strategy.

It is placed using calls and puts.

A Seagull is, first and foremost, a directional strategy.

A bullish Seagull trade is placed by buying a call debit spread and then selling a put (to offset some or all of the cost of the debit spread).

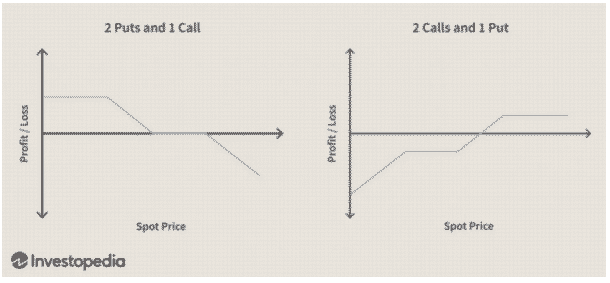

In contrast, a bearish Seagull trade is placed by buying a put debit spread and then selling an out-of-the-money call again to offset some of the cost of the spread.

Source: Investopedia

We can see that that the trade has a defined reward, which is the payoff of the debit spread plus the credit received on the naked option.

Despite this, the naked option has an unlimited risk to the downside for a bullish seagull and to the upside for a bearish one.

Despite this, the Seagull will usually have a high percentage of profit for taking this unlimited risk.

While a debit spread out-of-the-money is worthless on expiration, a Seagull may only lose a small amount or nothing at all if the stock stays unchanged or only moves slightly against the investor.

When to Place Seagull Options Trades

Remember, a Seagull is mainly a directional trade.

For example, by placing a bullish Seagull, we express that we think the stock price will appreciate though that’s not all.

We also say that we feel it’s doubtful the stock has a significant move to the downside.

This is in contrast to a call debit spread where we could believe the stock will most likely go up but may blow out to the downside, thus taking the defined risk of the spread vs. simply buying shares.

In a way, a Seagull is almost similar to an out-of-the-money covered call in the view it expresses.

In terms of the view expressed on volatility, the picture is a bit more mixed.

A call debit spread that is out-of-the-money will be long volatility.

A sold put is short volatility.

These two factors mute themselves out to a degree, though the structure will still usually be short volatility.

As the trade evolves depending on the underlying value, this view can change, and the position can become either long or short volatility as expiration approaches.

Should I Place a Seagull For A Credit Or Debit?

Some investors like placing Seagulls for a credit or net-zero cost.

This means that the price paid for the call or put debit is equivalent to the premium received.

Despite this, there is no issue paying a slight debit for Seagull trades.

This will result in a little more leniency in the short option leg, where you can go further out-of-the-money.

For higher conviction trades pushing for a credit or net-zero cost may make sense.

In contrast, paying a small debit ensures more protection from a move against the trader for average trade.

Trade Example

Here is an example of a trade someone could put on in Exxon Mobil and the thought process behind it.

Thesis: Oil stocks have been overlooked and have underperformed over the last decade.

Recently, there has been a move into energy names, which seems to underline a longer-term move into value and cyclical names from the technological sector and rate-sensitive stocks.

While the oil price could go down, perhaps the losses of oil stocks would be muted based on these underlying trends and still depressed valuations.

We have established our bullish view while also noting that we think downside risk is muted.

Now let’s set up our bullish Seagull trade using Exxon Mobil.

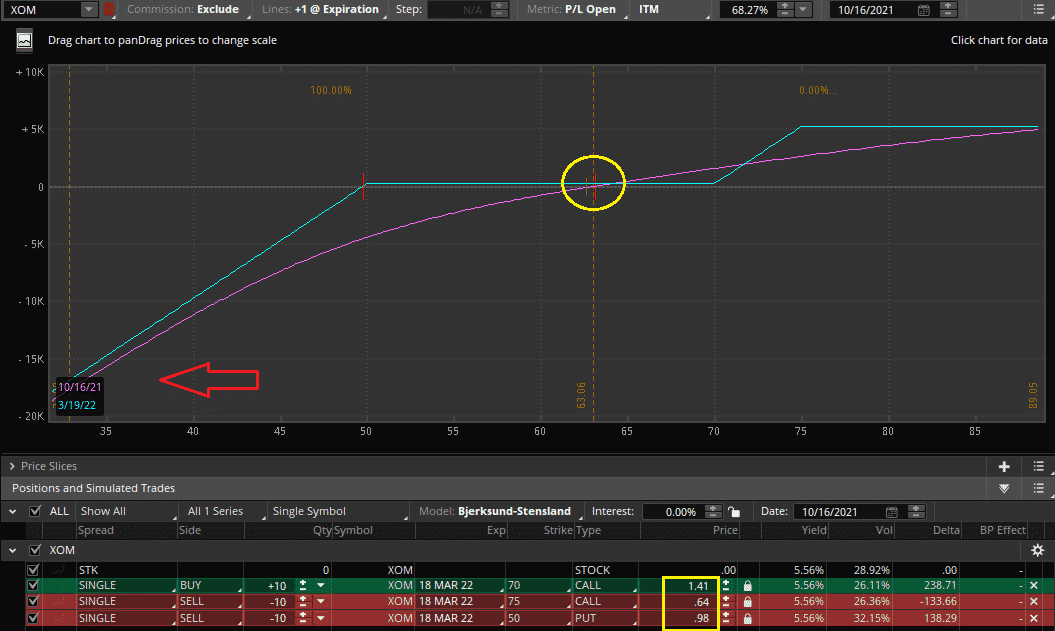

Here we have bought 10 70/75 Call debit spread for a cost of $770.

We have then sold the same amount of 50 puts, receiving a credit of $980 for a net credit on the trade of $220.

If the stock stays anywhere between $50 and $70, we receive this credit.

If Exxon mobile moves up even further, we can earn a maximum of $5,220.

Of course, the risk on the trade is a significant move down, shown by the red arrow.

We can also see that our short put delta takes over the position as we approach our short strike.

What Is The Worst Case Scenario?

In a worst-case scenario, we could easily lose upwards of $20,000.

Hence, when placing this trade, we do not expect that type of move and will cut the position or manage deltas if things get too out of hand.

While this position arguably has no additional risk than a simple long stock position.

The illusion of less risk by placing these trades for a credit can easily cause overexposure.

Even if the position does eventually come back, by then, the options could have expired, or if you sized too large, you could already be liquidated.

Concluding Remarks

The Seagull options structure allows investors to place a directional view on an underlying price of a stock without paying much if anything to do so.

This is done by trading a call or a put debit spread and then selling an out-of-the-money option that helps offset the debit.

A bullish Seagull can be attractive when an investor is confident in some appreciation of the share price while also being bullish on a companies fundamentals and doubtful that a large collapse could happen.

In contrast, a bearish Seagull can make sense when an investor expects a steady decline in the share price with little risk of a huge rally or short squeeze.

Due to the unlimited risk, Seagulls can be dangerous if they are overleveraged and not hedged or closed if the position starts to fall apart.

What are your thoughts on trading Seagulls?

Are they one of your preferred options structures?

Feel free to let us know in the comments below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/seagull-option-strategy/