Contents

-

-

-

-

-

- Level One Thinking

- Level Two Thinking

- Level Three Thinking

- Level Four Thinking

- Level Five Thinking

- Level Six Thinking

- Final Thoughts

-

-

-

-

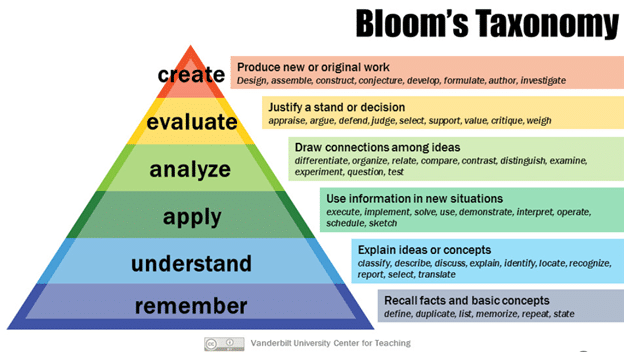

In the world of education, Bloom’s Taxonomy is an often-used framework for categorizing the different levels of thinking that a learner goes through as he or she attempts to master a subject.

That subject can be anything from micro-biology to trading options.

Of course, we are going to talk in the context of the latter today.

Here is a nice graphic created by the Vanderbilt University Center for Teaching to help us conceptualize Bloom’s Taxonomy and its six levels.

Source: Vanderbilt University Center for Teaching

Level One Thinking

At the base of the pyramid, the foundation, if you will, is the first level of thinking labeled as “remember.”

At this very basic level is the ability to remember and recall facts.

This level is the easiest to achieve and is achieved by most learners of a subject matter.

This is why this level is depicted as the widest level at the base of the pyramid.

In terms of options investing, the learner simply needs to remember that a put option is:

“a contract that gives the holder the right, but not the obligation, to sell a specific amount of an underlying asset (such as a stock, ETF, or index) at the strike price prior to the contract expiration date.”

And that a call option is:

“A contract that gives the holder the right, but not the obligation, to buy a specific amount of an underlying asset (such as a stock, ETF, or index) at the strike price prior to the contract expiration date.”

Just repeat this ten or twenty times, and the learner will be able to regurgitate that definition in short order.

At level one, the learner knows that delta has to do with price movement of the underlying, theta has to do with time, and vega has to do with changes in implied volatility.

Level Two Thinking

Knowing the definition is not enough.

Level two thinking is to understand the concepts.

Why are they important?

What are they used for?

This level is labeled as “understand” because the learner understands the concepts and is able to explain them.

At level two, the learner understands that a put option can be used to protect a stock investor from a drop in the stock price because the put option enables the holder to sell that stock at a predetermined price regardless of how far the stock has dropped.

A call option can be used to speculate on a stock price rise.

If such a rise happens, the holder of the call option can profit by being able to buy the stock at a predetermined price that is lower than its current price.

The learner understands that delta can change as the price of the underlying moves, and the amount of this change increases as indicated by an increase in gamma when an option gets closer to expiration.

Level Three Thinking

Time to level up.

At level three, the learner is able to “apply” the concepts.

Through dedicated time practicing, the learner has mastered the procedural process of selling and buying combinations of put and call options in vertical and horizontal spreads as well as more complex option structures such as iron condors, butterflies, and double diagonals.

The learner is able to observe market conditions and demonstrate the proper selection of strike prices in and out of the money at various DTEs (days to expiration).

At this point, we can say that the learner is able to trade options.

Level Four Thinking

Level four thinking requires deeper knowledge and higher-order thinking.

Labeled as “analyze,” it requires the learner to be able to make connections among ideas and compare and contrast different concepts.

What is the difference between a vertical spread and a time spread?

Under what conditions is it better to use one versus the other?

What are the pros and cons of an iron condor strategy versus a butterfly strategy?

A level four thinker should be able to answer such questions.

While the learner understands the effect of increased gamma at lower DTEs, the learner is also able to analyze whether this will help or hurt the position, given the current level of implied volatility of the underlying asset and its expected move.

The learner is able to analyze how directional or non-directional the position is and whether the increased theta at the lower DTEs is able to compensate for the increased price movement risk.

And so on.

Level Five Thinking

Level five takes it one step further.

Not only is the learner able to distinguish and organize concepts, the learner is able to make critical judgments.

We call this level the ability to “evaluate.”

The learner is able to evaluate new options strategies that are newly introduced to the learner.

The learner is able to defend and argue one’s point of view.

The learner may say:

“This new options strategy is interesting in that it uses a butterfly for premium selling hedged by a long vega time spread. But the theta decay at such a long DTE is quite low that I do not believe it will be able to extract enough profits to recover potential drawdowns of large market moves.”

Or something like that.

Level Six Thinking

Level six is the highest level of thinking in Bloom’s Taxonomy.

It is achieved only by a few.

It is at the tip of the pyramid, like climbing to the top of Mount Everest.

These are the people who can come up with novel new ideas and option strategies based on their mastery of the previous levels.

The following are just a few examples.

I’m sure there are many more level-six options thinkers that have created things that I’ve never seen.

Scot Ruble created the Razzle Dazzle, which is a long vertical spread financed by shorter-duration credit spreads.

Jay Bailey uses a novel way to adjust a credit spread in trouble by using a longer-dated debit spread.

Dan Sheridan pairs a downside calendar with an upside butterfly at low DTE from 3 to 9 days.

Mark Fenton modifies the traditional double diagonal by moving the long legs closer to the money than the short legs.

Brian Johnson spends years studying the behavior of the Greeks and backtesting various options structures in an attempt to find the best market-neutral income strategy.

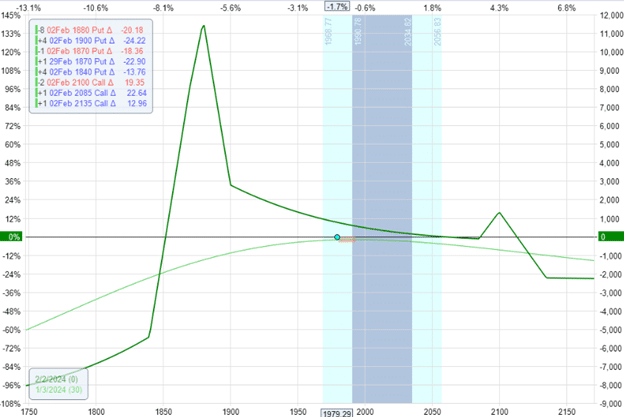

Trying out things like this:

The point is, at level six, the learner is doing things that most option investors might not ever do.

It is at this level that fund managers combine various options structures spread across different price levels to form an overall risk profile for the entire portfolio.

Final Thoughts

Is it necessary to get to level six in order to be a profitable options investor?

No, it is not.

Is it even possible to truly master options trading?

I’ve heard people who have traded options for decades still claim that they have not mastered it.

Perhaps they are just being humble.

Or perhaps options trading can not be truly mastered because the market is constantly evolving.

But do you need to completely master options trading to be profitable?

No, you don’t.

You just need to at least achieve level three and ideally be at level four – just good enough to extract money out of the market more often than it takes.

There is no fine line between the six learning levels.

Who can really say whether someone is at level four or at level five?

These are just rough guides in any case.

Is it possible to be at level six and still not be a profitable options trader?

Yes, that’s possible, too.

There is more to options trading than thinking levels.

Psychology, risk management, and a strategy with edge are also necessary pieces.

Good luck on your journey.

We hope you enjoyed this article on the six levels of learning options.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/six-levels-of-learning-options/