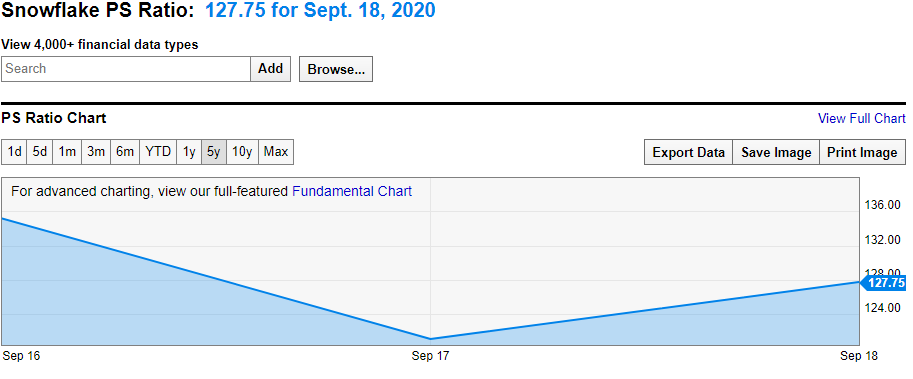

The hot cloud software firm Snowflake ($SNOW) went public on Wednesday, September 16, and the stock went nuts.

Despite its IPO price of $120 per share, the stock closed its first day of trading at $253.93 after reaching an intraday high of $319.00.

Tech IPOs are scarce, and Snowflake’s IPO is one of the most anticipated in years. And that was before Warren Buffett’s Berkshire Hathaway hopped aboard.

On a price-to-sales basis, they’re more expensive than even Zoom (95x) and Shopify (50x), which have gone parabolic in recent months.

This probably serves as a strong indication that the market is starved for the upcoming tech IPOs from firms like Unity and Asana.

What Does Snowflake Do?

Snowflake does data integration on the cloud.

Large companies that utilize many technologies have tons of data, mostly stored in different formats and styles. This makes it hard to aggregate all of your databases to analyze them together.

Snowflake aims to solve that problem.

Many refer to their industry as “data-warehouse-as-a-service” (DWAAS?), with some of their competitors being Amazon’s Redshift, Hadoop, and Cloudera. According to Mandeep Singh on the Bloomberg Intelligence Podcast, Snowflake has a significant advantage in helping companies aggregate data from different cloud services.

For example, if a company uses AWS, Azure, and Salesforce, Snowflake aggregates and analyzes it.

Snowflake serves as a break to vendor lock-in. Services like Amazon’s Redshift or Google’s BigQuery perform similar services to Snowflake, but they lock you into their cloud service too. You can’t use AWS as your cloud and analyze your data with BigQuery.

LinkedIn ranked the company as the number one hottest startup to work for in 2019.

Warren Buffett Is Invested

Not investing in technology firms is one of the many things that Buffett is famous for. After the dot-com bubble, he was praised for avoiding tech stocks’ lofty valuations and not investing in things he didn’t truly understand.

When high-growth tech firms became the secular trend after the global financial crisis, and have remained such for the past decade, the view of many critics on Buffett’s reluctance to touch tech went from admirable to critical.

It’s the classic “by not being involved, you’re missing out on returns” judgment often lofted at perma-bears and goldbugs who refuse to own most US equities.

In 2018, at least one of Berkshire Hathaway’s portfolio managers, Todd Combs, broke its tradition of not investing in early-stage technology companies with their investments into two fintech companies.

Berkshire is once again dipping their toe into the water of the high-growth technology corner of the market. They invested roughly $573 million into Snowflake, according to reports.

That’s approximately $250 million in the IPO and another 4 million shares from existing private holders of Snowflake shares. This is the first time that Berkshire has invested in an IPO throughout Buffett’s 55 years at the firm’s helm.

However, Berkshire reached this deal based on the expected IPO price of $70-$80, which Snowflake hiked at the last second to $120.

Roughly 10% of Snowflake’s shares outstanding are in their float, meaning the vast majority of shares are locked up in either restricted stocks and options, IPO lockups, or held by insiders.

Based on Friday’s closing price of $240, only $6.4B worth of its shares are out there in the float.

With Snowflake being one of the most anticipated IPOs of the current market cycle, plus the added hype of a Berkshire Hathaway investment, that $6.4B is easily distorted by traders and exuberant investors.

On Wednesday, the first day of trading, Snowflake traded 36.2 million shares, compared to the public float of just 28 million. This means that the float completely changed hands about 1.3 times, which indicates a very high level of short-term trading activity.

As traders ourselves, we know that we’re not driven by valuation or rational price discovery; we fade and ride trends, no matter where they arise.

Because Snowflake is a hot IPO with a limited float, many short sellers probably had trouble locating shares to sell and/or paying for the borrow fees. Friction for short sellers tends to result in a market that hesitates to trade down.

A recent example is Nikola’s stock (NKLA). Even though a bearish report by an activist short seller prompted an SEC investigation, but the stock only traded down 20% from an already lofty valuation due to extremely high borrow rates and hard-to-borrow status.

Based on this, the evidence overwhelmingly points towards the share price being inflated by momentum traders, which can last until the float grows. So, the question here is, when will shares be added to the float?

According to analysis from Lukas Wolgram on SeekingAlpha, another 11.3 million of employee shares will hit the float by mid-December 2020, which is roughly 40% of today’s float. Further, if the IPO price does well (133% of the IPO price) for the 15 trading days following December 15, 2020, another 38 million shares are added to the float.

Here’s a graph from his article, pulled directly from Snowflake SEC filings:

This could mean that Snowflake’s float can go from around 28 million today to roughly 77 million by the end of December. On top of that, all restricted shares become available shortly after the company reports its second quarterly report.

All in all, the float is very small today, relative to where it will be a few months down the line.

The State of the IPO Process

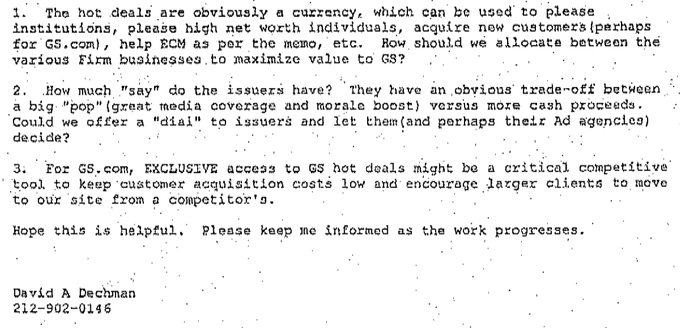

The prevailing narrative among the finance community is that the Snowflake IPO was significantly underpriced, even at $120, and that underwriters leveraged this underpricing to reward high net worth clients who do business with them.

It’s easy to see this line of thinking, given that the stock closed at more than double the IPO price on the first day of trading. However, the company insiders did agree to these prices, so it can’t have been that underpriced.

Prominent venture capitalist Bill Gurley penned a Twitter thread on the subject harshly criticized the IPO process, in which underwriters were the prime target.

His argument is essentially that underwriters intentionally misprice IPOs to give clients the great deals, incentivizing them to continue to do business with the banks.

Here’s an interesting email which he posted on his Twitter:

Bottom Line

2020 has been a slow year for tech IPOs. The trend for unicorns has been to remain private as long as possible.

Being a public company requires tons of legal and management headaches, after all. But it does look like the implosion of WeWork’s pre-IPO valuation has scared many of these private companies to reconsider remaining private for too long.

As such, several interesting tech firms are set to go public in the coming months, like Unity, Palantir, and Asana. Snowflake might serve as an indication of what’s to come for these future IPOs.

The post Snowflake IPO Was Everything we Hoped For appeared first on Warrior Trading.