Forex trading is a popular industry that lets people make money by exchanging one currency for the other. It is a large industry that processes trillions of dollars every day, making it bigger than the stock, cryptocurrencies, and commodities.

There are many different approaches to making profits in currencies, depending on your trading style.

In this case we are interested in lokking at the technical aspect, thus in this article we will look at the best indicators to use in forex trading.

How to analyze forex pairs

Forex traders use several approaches to determine whether to buy or sell a currency pair. The first broad approach is known as fundamental analysis and it involves looking at the broad activity in the financial market.

For example, in this, you can look at whether the Federal Reserve will hike interest rates and how it will impact a currency pair. Similarly, you can assess the economic growth of a country or key data like employment, manufacturing, industrial production, and inflation.

The other approach is known as technical analysis. This method has three main categories. First, it involves using technical indicators like moving averages and the Relative Strength Index (RSI). These indicators are used for several reasons, including trend-following, momentum, and volume.

Second, it involves using chart patterns like triangles, rectangles, and head and shoulders. Finally, there is candlestick patterns like doji, harami, shooting star, hammer, and morning star among others.

Best forex indicators for day trading

Moving averages

Trend-following is one of the best approaches in forex trading. It is notable because it involves identifying an existing trend and following it. To properly trends, the best approach is to use technical indicators like moving averages.

Moving averages simply attempt to look at the average price of a forex pair over time. A good example of how the indicator works is to look at what happened during the Covid pandemic. At the time, countries like the United States used to publish their daily Covid-19 cases.

For comparison purposes, they then calculated a moving average. As such, if the total cases on Friday is 2,000 and the 7-day moving average is 500, it means that the situation is getting worse.

There are several types of moving averages in forex. These types simply attempt to solve the challenges that the other averages have.

For example, simple moving average (SMA) looks at the average over a certain period. The exponential moving average, on the other hand, focuses on recent days or periods.

The best way of using moving averages is in trend-following. This is where you buy a pair when it is above moving averages, as shown above.

You can also use it to trade reversals. A common approach is known as death cross or golden cross. A golden cross is where the 200-day and 50-day moving averages crossover at a lower price. It signals that the bullish trend will continue.

Bollinger Bands

Bollinger Bands is a technical indicator that is derived from moving averages and standard deviation. It is calculated by first calculating the moving average of a currency pair and then finding its negative and positive standard deviations. The resulting indicator is made up of a moving average and two bands.

Traders use Bollinger Bands in several ways. First, you can use it in trend-following. In this, if a currency pair is rising, you can place a buy trade as long as it is between the middle and upper lines of the bands. A stronger case is made when the pair is strongly at the upper side of the bands.

Second, you can use Bollinger Bands to confirm reversals. In this case, a reversal will typically happen when the price moves below the middle line of the Bollinger Band.

Further, you can use it to gauge volatility. If it is so wide, it means that there is significant volatility in the market.

Relative Strength Index (RSI)

The RSI is an indicator that looks at the current and historical strength of an asset. It is the most popular oscillator in the financial industry.

The RSI is made up of a line and two key levels that identify the overbought and oversold levels. When a forex pair reaches its overbought level, it is usually a sign to sell. Similarly, when it gets to the oversold level, it is usually a sign to buy.

You can also use the RSI to trade divergencies. A divergence happens when the RSI is rising at a time when the price is falling. It usually sends a signal that a trend is losing its strength.

As such, when it happens, it is usually a sign to exit an existing trade or start a new one in the other direction. You can also use the RSI in trend-following. Here, you buy an asset when the RSI is rising and vice versa.

VWAP

The Volume Weighted Average Price (VWAP) is another important technical indicator to use in technical analysis in forex trading. As the name suggests, the VWAP looks at the average price of an asset compared to its volume.

Volume is an important part in trading because it shows how traders are positioning themselves. Unlike other indicators, the VWAP is an intraday tool that resets every session.

Ideally, traders place buy trades when a rising forex pair crosses the VWAP indicator. It also places a short trade when the asset crosses the VWAP going downwards, as shown below. Traders hold these positions until there are signs of a reversal.

Stochastic Oscillator

The Stochastic Oscillator is another popular indicator used in forex trading. It is an oscillator that, just like the Relative Strength Index (RSI), aims to identify overbought and oversold levels. It compares the closing price of an asset to a range of prices over a certain period.

The indicator is made up of two lines: %K and %D. Also, it has the overbought and oversold levels. As such, in most cases, traders short the asset when it moves to the overbought level and vice versa. You can also use it in trend-following, where you buy when the price is rising.

Ichimoku Kinko Hyo

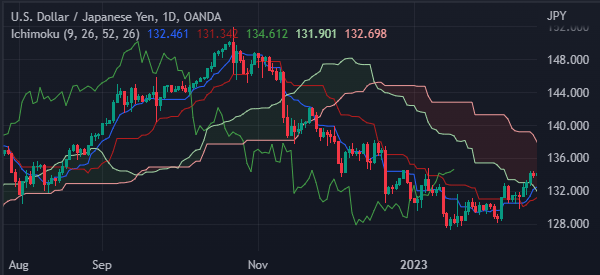

Ichimoku Kinko Hyo, is a trend indicator that has numerous parts, including the tenkan sen, kijun sen, senkou span A and senkou span B, and other parts.

A first look of the Ichimoku is usually scary because of its numerous moving parts. However, using the indicator is actually simple.

The easiest way is to filter out all lines and remain with the Ichimoku cloud. When a rising currency pair moves above the cloud, it is a sign to buy. Similarly, if it moves below the cloud, it is usually a sign to place a sell trade.

For example, in the chart below, a buy signal will be confirmed if the price manages to move above the Ichimoku cloud.

Average Directional Index

The Average Directional Index is a technical indicator that measures the strength of a trend. While it has a close resemblance to an oscillator, the indicator is usually categorized as a trend tool.

When an asset is rising, the strength of the trend is usually seen when it moves above 20. While the ADX is a popular indicator, it is not used alone. In most cases, traders use it in combination with other indicators like moving averages and the Relative Strength Index (RSI).

Fibonacci Retracement

The Fibonacci Retracement is not a technical indicator but it is an essential tool when analyzing assets. It is a mathematical tool that is based on the approach known as Fibonacci sequence. As a result, it has key levels based on the sequence like the 50%, 38.2%, and 23.6% levels.

The tool is drawn by connecting the highest and lowest swings. A good example of this indicator at work is shown below.

Summary

There are many indicators that you can use in forex trading. But we believe that these ones are the best ones to use. They are all easy to understand, interpret, and use.

Notably, you don’t need to know how to use all of them. Instead, you can master two or three of them, coupled with the Fibonacci Retracement and you will be fine.

External useful resources

- What is the most reliable forex indicator? – Quora