A previous article discusses Tom King’s 1-1-2 option strategy.

He has other variations of that category, such as the 1-1-1 and the “long-term 1-1-2”.

The 1-1-1 and 1-1-2 are part of the 1-1-x family of strategies.

Contents

-

-

-

-

-

- The Calendarized 1-1-2

- No Upside Risk

- Premium Selling Strategy

- Why The Calendarized 1-1-2

- Concluding Remarks

-

-

-

-

As a reminder, the “1-1” refers to one long put and one short put, forming an out-of-the-money put debit spread.

The “2” is the two further out of the money naked short puts.

For example:

A 1-1-1 is similar but with only one naked put instead of two (hence more conservative).

The Calendarized 1-1-2

On October 11, 2024, Tom King shared with the world via YouTube his calendarized 1-1-2 variant of the strategy – albeit not all of the fine details.

It is the 1-1-2 with legs at different expiration instead of all legs at the same expiration (as in the traditional 1-1-2).

The calendarized 1-1-2 has the put debit spread at 150 DTE (days to expiration) and two naked puts at 30 DTEs.

The DTEs can be customized, as can the number of naked puts (be it one or two).

As he said in his YouTube video, you have to follow your risk tolerance and not follow his.

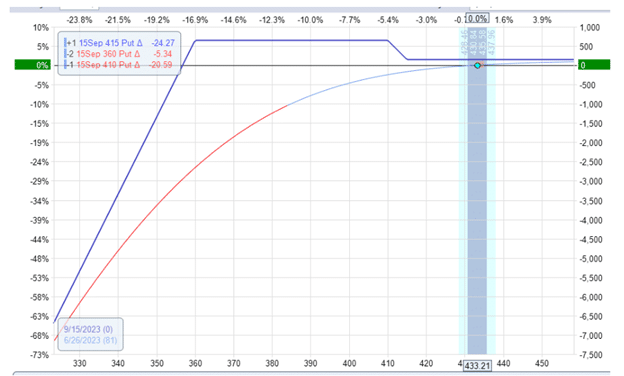

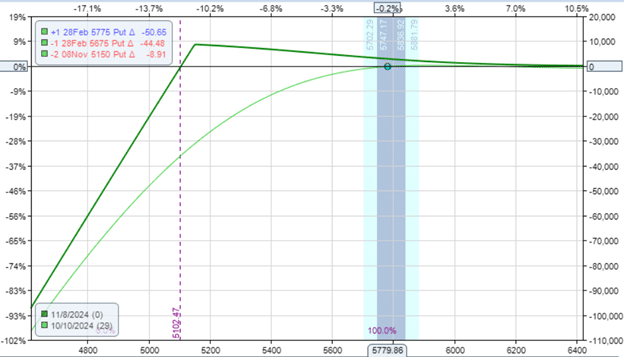

Here is an example of a calendarized 1-1-2 that I just made up on SPX to get a generalized concept of the expiration risk graph.

Date: October 10, 2024

Price: SPX @ $5780

Sell two November 8, 2024, SPX 5150 put @ $13.85

Buy one February 28, 2025, SPX 5775 put @ $177.65

Sell one February 28, 2025, SPX 5675 put @ $150.80

Credit: $85

Comparing the two graphs, one does not get as distinct of a “bear trap” in the calendarized version as in the traditional version.

Nevertheless, we still get a slanted trap where the greatest profit is achieved if SPX falls to 5150 at the expiration of the short naked puts.

The Greeks for this graph would generally be on the order of the following:

Delta: 8.30

Theta: 193.90

Vega: -365

This has a fairly decent theta/delta ratio of 23.

This is due to the shorter time horizon of the naked puts, which gives it a bit more theta (but also with a bit more gamma).

I’m not saying this is his exact setup, as I was never a member of his service.

In any case, he typically trades the 1-1-2 on ES futures.

However, he did mention that the option structure can be applied to other assets.

Also, the key to the trade is in the adjustment, which he will not tell you on a public YouTube.

This is to know when and how to roll the naked puts if the price goes down against the trade.

And even if he tells you, it still requires study and practice to get the art of put-rolling right.

The only clue he gives is that if the delta of the naked puts double, then consider doing something.

No Upside Risk

In this particular example, because we have received an overall initial credit, there is no upside risk to the trade given the configuration that it is currently in.

No upside risk means that if the price of SPX stays above 5150 at the short-term expiration (meaning the expiration of the short naked puts), the short naked puts will expire out of the money, and we will keep the premium from the short puts.

Because the premium of the short puts completely pays for the put debit spread, the trade can not lose money if SPX stays above 5150.

This may not continue to be the case if the trade has been adjusted, especially if it has not been adjusted properly.

Premium Selling Strategy

Just like the traditional 1-1-2, this is still a negative vega trade.

It is an option for a premium selling strategy.

Tom King is a premium seller.

The sale of the naked puts is where the income is being generated.

This creates the positive theta in which income is generated as time passes, and the value of the naked puts decay.

The put debit spreads are the hedges.

They are not complete hedges because there is still an undefined downside risk if the SPX price drops.

The negative vega of the trade means that a volatility rise or spike will not benefit the trade’s P&L (profit and loss).

The calendarized version has less negative vega than the traditional 1-1-2.

Therefore, the calendarized version has less of a volatility risk.

Why The Calendarized 1-1-2

By having shorter DTEs for the naked puts, he can take the naked puts off earlier, leaving the put debit spread in place.

By layering these trades at various time intervals, he can get his portfolio to have a ratio of five put debit spreads for every two naked puts.

This gives him an added downside hedge and lesser naked put exposure.

Concluding Remarks

The calendarized 1-1-2 is another variant of Tom King’s family of 1-1-x strategies.

The added downside hedging the lower volatility risk and the wording in his video suggests that the calendarized variant came about partially due to some of the lessons learned from the August 5, 2024 volatility spike in which money was lost due to excessive amounts of naked puts.

This is by no means the only strategy that he trades.

It is just another tool in the toolbox.

We hope you enjoyed this article on the calendarized 1-1-2 option strategy.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/the-calendarized-1-1-2-option-strategy/