Contents

-

-

-

-

-

-

- Covered Call

- Covered Strangle

- Protected Covered Strangle

- Adding A Stop-Loss

- Bullish Example

- The Greeks

- Choppy Market

- Post Analysis

-

-

-

-

-

The protected covered strangle strategy is an advanced options strategy that is a modification of the covered strangle, which you should get familiar with first.

Think of this as “part 2” of the previous article.

The protected covered strangle adds an additional protective put option, thereby reducing the downside risk and enabling it to switch from a bullish to a bearish direction.

Like the heavily armored military tanks, it adds protection and can swivel directions quickly but uses a lot of capital.

Maybe we should call this strategy “The Tank.”

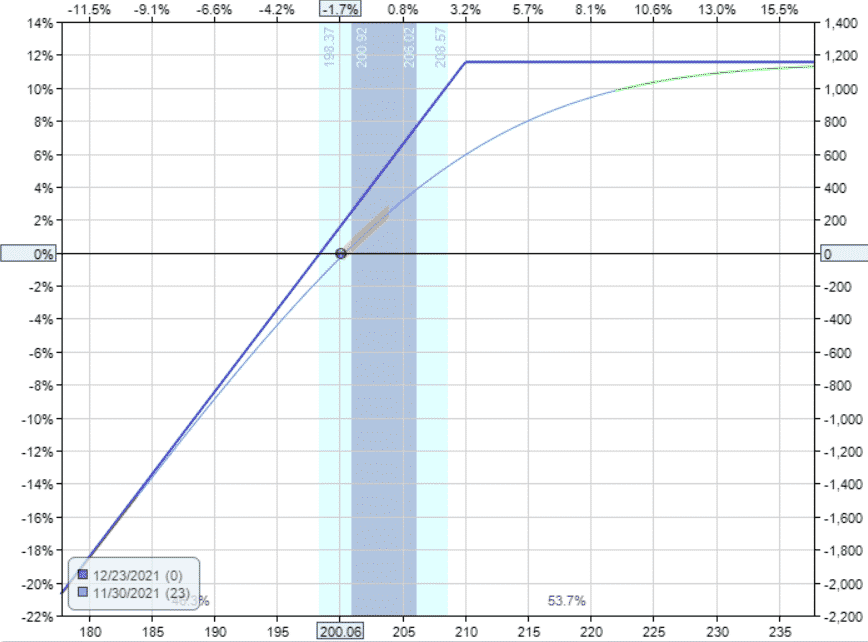

Covered Call

We will start with a covered call and build up the Tank.

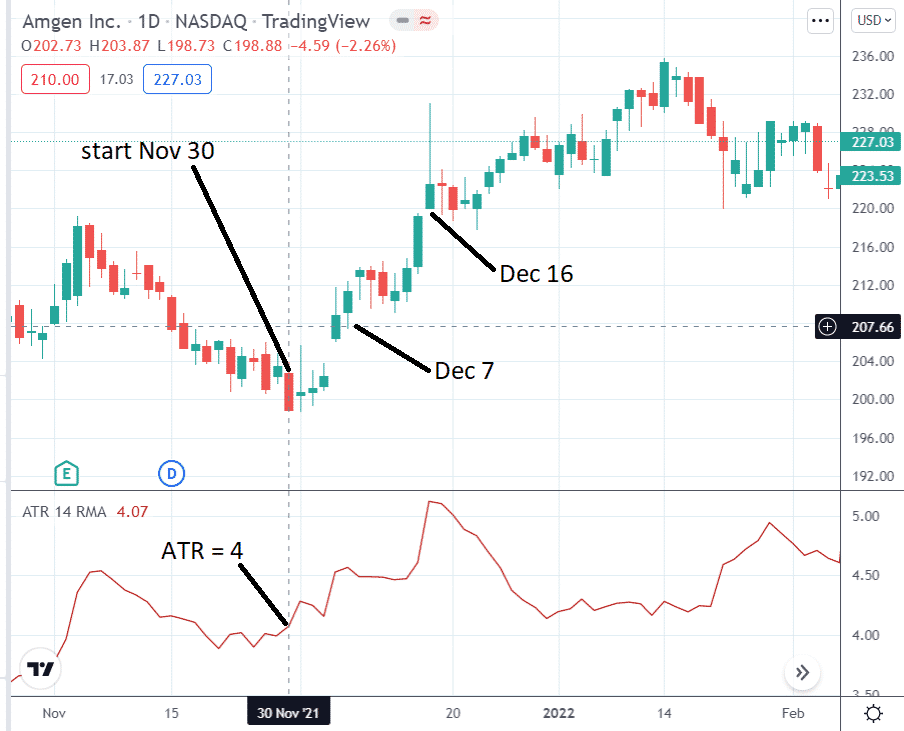

Take a look at the simple covered call example on Amgen (AMGN)

Date: Nov 30, 2021

Buy 100 shares AMGN @ $200.06

Sell one Dec 23 AMGN $210 call @ $1.62

source: OptionNet Explorer

It is a call option covered by 100 shares of stock. Hence the name covered call.

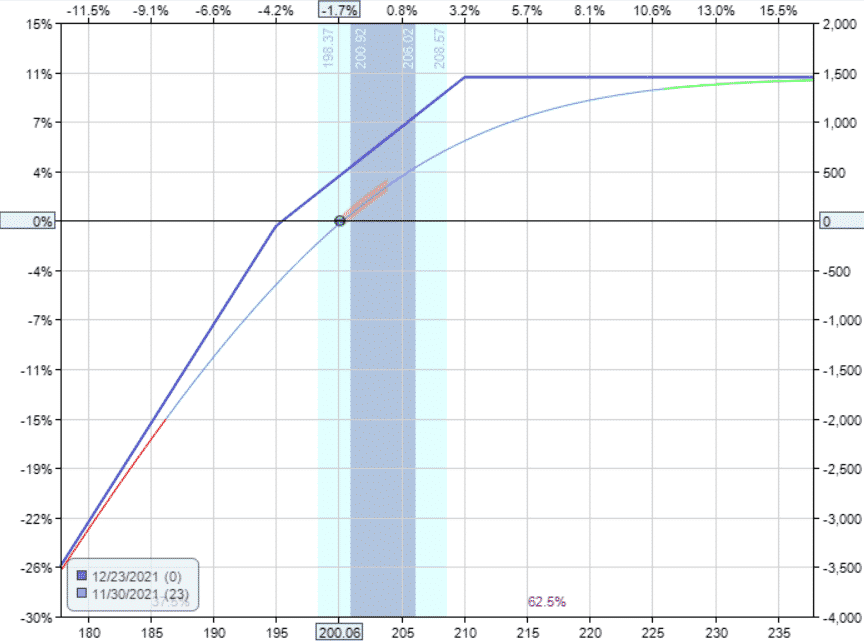

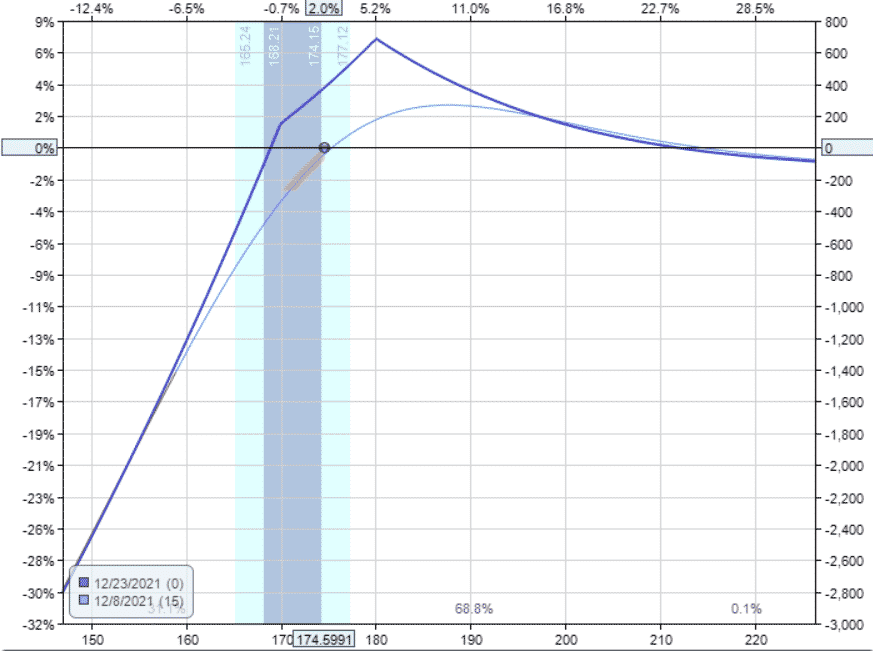

Covered Strangle

Now we want to sell more premium by selling a put option as well.

This trade is the covered strangle.

Buy 100 shares AMGN @ $200.06

Sell one Dec 23 AMGN $210 call @ $1.62

Sell one Dec 23 AMGN $195 put @ $2.94

It is a strangle plus 100 shares of stock, which makes the payoff diagram looks like this:

Because of the additional short put, the covered strangle is more bullish and has more positive delta than the covered call.

Its upside is capped like the covered call, but it has unlimited downside loss.

The drop-off on the left side is even steeper than a covered call.

An investor would not want to be in this strategy in a market crash.

They would lose money on the shares of stock and lose money on the sold put option.

The premium collected on one tiny 24-delta call option will not save the trade when the underlying price goes down significantly.

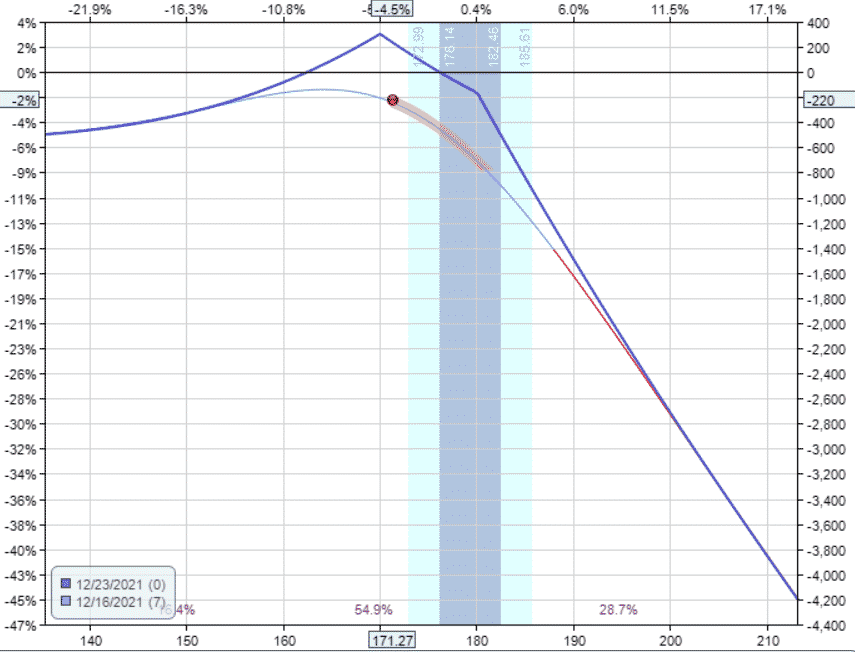

Protected Covered Strangle

Therefore, we buy an additional long put option for protection that has expiration further out in time. And that completes our protected covered strangle.

Buy 100 shares AMGN @ $200.06

Sell one Dec 23 AMGN $210 call @ $1.62

Sell one Dec 23 AMGN $195 put @ $2.94

Buy one Apr 14 AMGN $200 put @ $12.85

Total Debit: $20,835

We bought an at-the-money put with 135 days to expiration.

The long protective put can either protect the stock position or protect the short put, but it cannot protect both.

Therefore, as can be seen from the graph, the overall strategy is still an unlimited loss strategy.

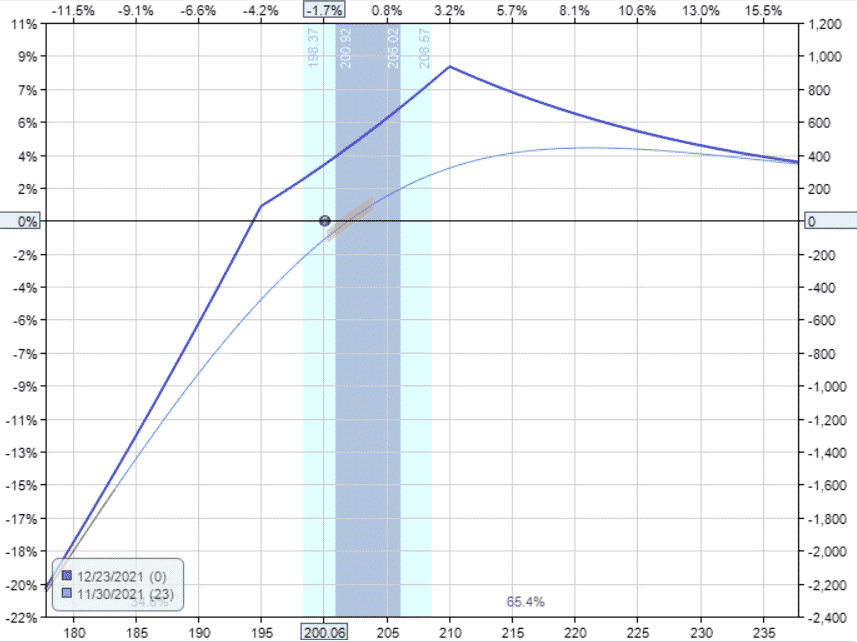

Adding A Stop-Loss

We can add an optional stop-loss on the stock position.

Using the ATR to determine the stop-loss location, we placed the stop-loss at $196 with AMGN at $200 and its ATR being about 4.

Make sure to place the stop loss above the short put.

Since our short put strike is at $195, we are fine.

We want to ensure we get rid of our 100 shares before we get assigned another 100 shares.

We are willing to sell the 100 shares at $196.

Then if assigned, we are willing (and must) buy 100 shares at $195. In effect, we would have sold high and bought low — if that were to happen.

Bullish Example

Stepping through this trade, day by day, in OptionNet Explorer, we see that the protected covered strangle reached 5% profit on December 7 in about a week.

This is probably a good place to take the $549 profit because the profits are starting to get capped as the underlying price increases.

On December 16, after the stock moved up more, the profit was still around 5%.

source: OptionNet Explorer

source: TradingView.com

The Greeks

Let’s talk about the Greeks. These are what they were at the beginning of the trade.

Delta: 62.30

Theta: 14.73

Vega: 14.40

Gamma: -4.28

The protected covered strangle is less bullish than the covered strangle and has less delta dollars exposure.

Because the long put has negative theta, the protected covered strangle will have less theta.

Nevertheless, it will still have positive theta.

Depending on how far out in time you buy the long put, you can get the protected covered strangle to have positive vega.

This is in contrast to the typical premium-selling strategies (credit spreads and iron condors), which have negative vega.

So a positive vega can be a good hedge to your other negative vega positions, which may suffer when implied volatility increases.

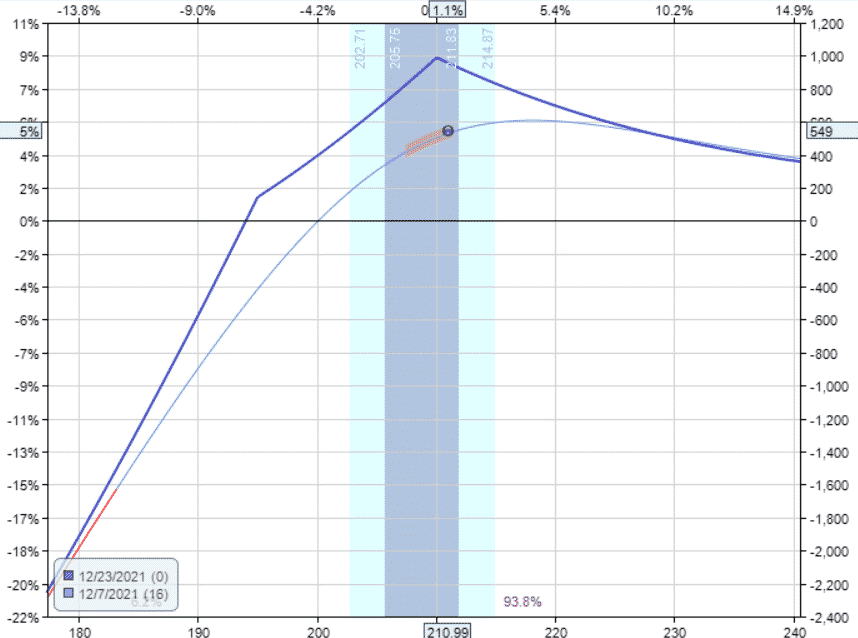

Choppy Market

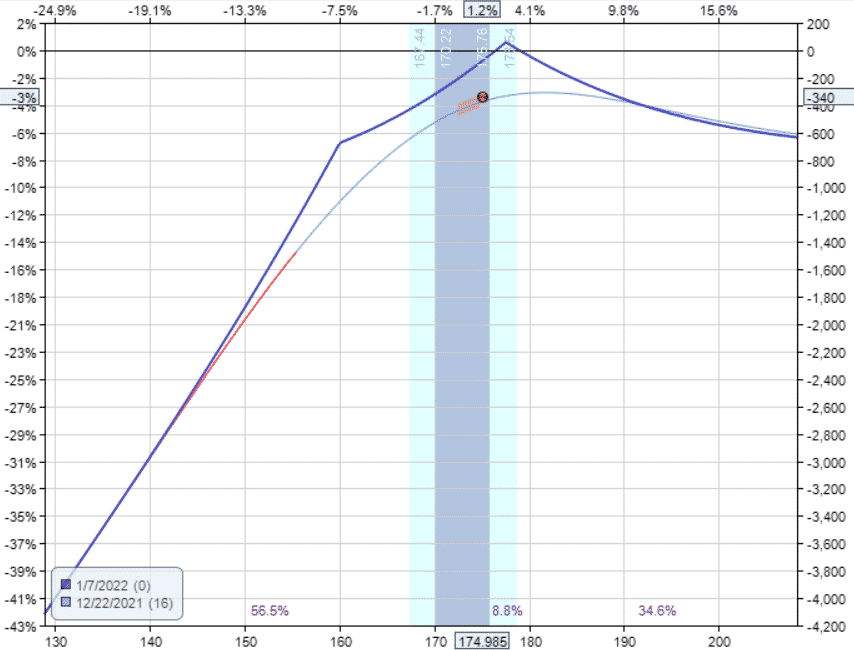

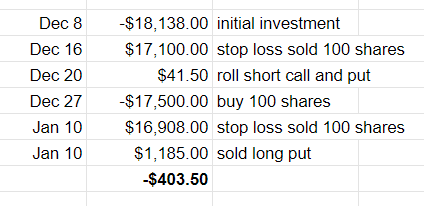

Let’s take a look at the protected covered strangle on AAPL on December 8, 2021:

Buy 100 shares of AAPL @ $174.60

Stop-loss at $171

Sell one Dec 23 AAPL $180 call @ $2.13

Sell one Dec 23 AAPL $170 put @ $2.56

Buy one Mar 18 AAPL $175 put @ $11.48

Debit: $18,138

On December 16, the day started great with AAPL at $180.80, and we are up 3.26% with $307.09 of profit.

Before the day was over, AAPL dropped below $171, and it was not even an earnings day.

This triggered our stop-loss order, and 100 shares were sold at $171.

Our payoff diagram switched from a bullish to a bearish strategy without the stock.

Our P&L is down –$220.

If Apple were to continue to go down, we would be on target to make 5%.

But if Apple were to go back up, the graph shows an unlimited loss on the upside due to the short call still in place.

To ensure we are “covered” if the price goes back up, we set a buy stop order to buy 100 shares of AAPL if the price goes above $179.

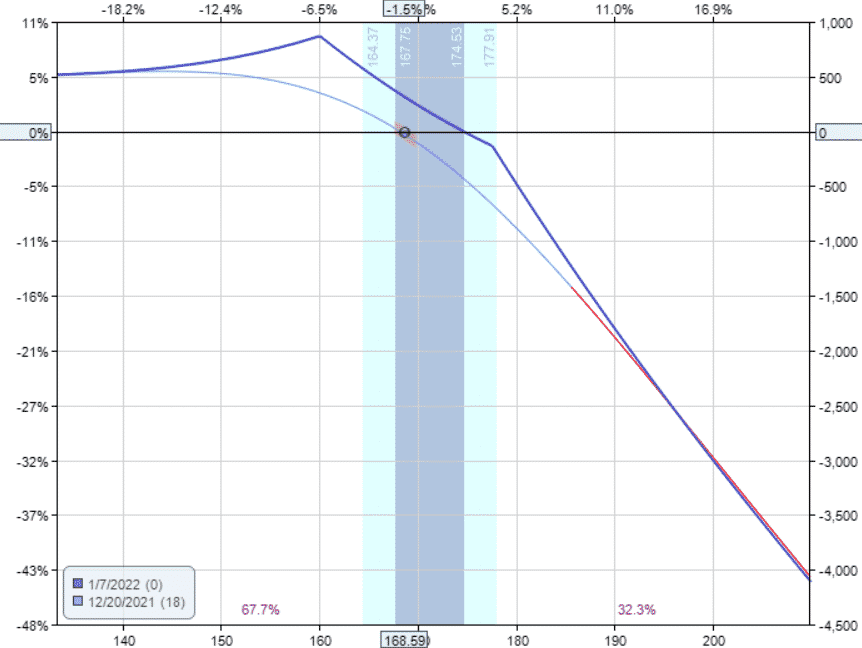

On Monday, December 20, our short call and short put have only three days till expiration.

Our P&L is back to breakeven so that we could take the trade-off here.

But let’s continue by buying back the short call and put options and selling another strangle for the January 7 expiration.

Buy to close one December 23 AAPL $180 call

Buy to close one December 23 AAPL $170 put

Sell to open one January 7 AAPL 177.5 call

Sell to open one January 7 AAPL $160 put

Credit: $41.50

Because of the short call’s new location, remember to re-adjust our buy-stop order to now $175.

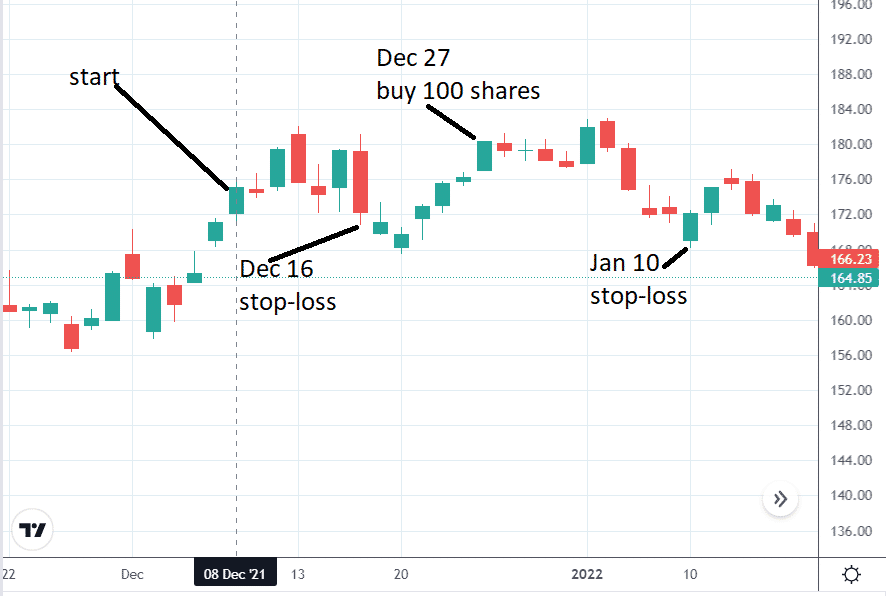

Shortly after, AAPL reversed and started to go back up. On December 27, it went above $175 and triggered our buy-stop.

After adding 100 shares, our graph has now become bullish again.

Without any further adjustment, it only has a small tip of chance of getting back above zero — regardless of how high the price of AAPL goes.

This is because the short call with a strike at $177.5 is capping our gains, and the long put is dragging down profits.

We are willing to let AAPL get called away at $177.5 because we bought 100 shares at $175.

As soon as that happens, we no longer need the long put and can sell that.

We also set a stop-loss on our stock to sell if it drops below $170.

Let’s see what happens.

On Friday expiration January 7, both our short call and short put expired worthless.

The stock was not called away because AAPL at $172.

17 is below the call strike.

We are left with 100 shares of AAPL worth $17217 per share and a long put worth $1020.

AAPL opened at $169.08 the following Monday, January 10.

This price is below our stop loss set at $170.

So we end up selling all 100 shares at the open at $169.08.

The only thing left now is the long put option expiring on March 18.

That is of no use now, and the put option is sold for $1185.

In total, the net loss is –$403.50, or 2.2% of the initial investment of $18,138.

Post Analysis

The “Tank” is not invincible.

Someway, somehow, the market is able to able to extract money out of our bank account.

Just as important as studying how to extract money out of the market, learn how the market extract money out of us.

A study of this example, a study of your trade logs, a study of your manual backtesting results can give you clues.

Let’s take a look at Apple’s price action to see how the market was able to achieve this.

The price came down to $171 to threaten our short put, whose strike is at $170.

This triggers the stop loss causing us to sell our stock.

Shortly after, the price reversed up to $175, now threatening our short call at $177.50.

This reversal triggers our buy-stop to buy 100 shares to help cover our short.

And we are also buying because we think the price will continue up.

But it doesn’t.

It reverses and then goes down below $170, triggering a stop-loss again, causing us to sell our stock because we fear the price might continue to drop or the market might crash or whatever.

But of course, after we sell, the price reverses to go up the following two days.

Because of this choppiness in the price action, some investors may not want to use a stop-loss since there is already a protective put.

The back-and-forth price action had the Tank swivel from bullish to bearish and then back to bullish again.

For certain accounts (especially retirement IRA accounts), they will not let you set a stop loss when you have a covered call in place.

Because if the stop-loss is triggered, you will have no stock to cover the short call.

When a naked short call is prohibited in your account, you can use a call spread instead.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/covered-short-strangle/