By now, most active traders are well aware of a Chinese real estate company called Evergrande.

Everyone in the financial media is panicking about the company’s danger to the global financial system, with the company earning the moniker “the Chinese Lehman,” as a reference to devastating effects investment bank Lehman Brothers’ collapse had on the economy back in 2008.

As a result, traders and investors are worried about Evergrande’s potential to cause a domino effect in the global markets and create another financial crisis.

In this article, we’ll explain the situation, why people are worried about it, who Evergrande is, and if the situation is real or overhyped.

Who is Evergrande?

Evergrande is the second largest property developer in China, with large apartment buildings mostly being their bread and butter (although they operate in dozens of other businesses like electric vehicles).

What Is Happening?

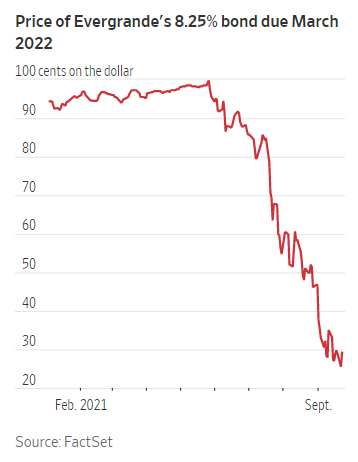

Evergrande has a ton of debt, debt that is now trading at around 30 cents on the dollar.

They’re currently the most indebted company in China and they’re having credit problems. Big credit problems.

The company has historically tapped several sources of credit, like those from domestic Chinese banks and bond investors, foreign investors, customer deposits, and even loans from their own employees.

All of these stakeholders are at risk of being wiped out or taking a massive haircut and it’s getting people worried about knock-on effects throughout the global financial system.

The chart below displays the dire debt situation Evergrande has found itself in, needing to pay back over $7 billion worth of bonds in the next year alone.

The market is worried about Evergrande’s ability to repay that debt, as Evergrand is both overleveraged and having trouble competing in their own markets, so there’s no obvious way for the company to raise cash to get out of this snafu.

Furthermore, China recently tightened borrowing on property developers, preventing Evergrande from tapping the credit markets for more cash.

Even selling off assets is likely to cause trouble, as nobody wants to be the first buyer when there’s an entire avalanche of property likely to hit the market afterwards.

To give this asset-sell-off issue some real-world perspective, imagine your local real estate developer owned 50% of the houses in your neighborhood.

Your local newspaper is writing stories about the company’s financial woes and how they’re having trouble paying the bank back. Suddenly a representative from the company knocks at your door offering you a home for 25% below market value.

Sounds like a great deal, but you’d probably be skeptical, knowing that if the company is willing to take such a haircut on one house, they’re probably willing to do so for several houses, and you don’t want to be the first one to catch the hot potato.

That’s not to say that there won’t be people lining up to buy distressed assets from Evergrande. Instead, I’m suggesting that this potential property avalanche will likely prevent Evergrande from getting anything near fair value should they firesale some assets.

Credit problems at overleveraged companies are as psychological as they are financial, as you can see.

Which is why the worry is spreading beyond Evergrande, to other Chinese property firms as well as the entire Chinese stock and bond markets. Specifically, bond prices for nearly all Chinese property developers have taken a huge beating in the wake of this, hurting their creditworthiness, and hence, ability to borrow their way out of this mess.

Because China is a centrally controlled communist country, the fate of Evergrande is very likely in the hands of the CCP, so understanding their motives is crucial to projecting potential scenarios regarding Evergrande.

Beijing has already indicated that they don’t want to set a precedent for moral hazard by bailing out poorly managed companies, although they’ve also said that they’re willing to work with the company on a bankruptcy that makes Chinese lenders at least partly whole.

The company has already retained financial advisors, indicating a likelihood of bankruptcy preparation, according to the Wall Street Journal, the company has missed a bond payment to foreign investors, and they’ve begun selling assets, starting with a $1.5B stake in a Chinese bank. All indications that the company is preparing for the worst.

What is the Risk to the Financial System?

That really depends on who you ask. It’s clear that even Wall Street is a bit worried about Evergrande, as it’s probably partly responsible for the quite bearish price action we’ve seen in the S&P 500 lately.

If you ask permabears… they’ll tell you this is definitely the next Lehman, but ten times worse because of the Fed’s recent actions, more leverage built up in Chinese real estate, etc.

If you ask the die-hard-buy-and-holders that scoff at the idea of ever having a bearish thought, well, they’ll laugh at you for not dollar-cost-averaging the $200 you paid for that office chair into index funds.

Instead of trying to get to the ultimate truth behind a pretty complex global financial event, I’ll simply give you the main arguments I’ve been hearing from both the bears and bulls….

What The Bears Are Saying

- The crisis has already spread to other Chinese property developers like Sinic Holdings

- Four of the five largest global banks are Chinese, and they’re heavily exposed to Chinese real estate debt

- If there is a contagion, central banks can’t stimulate their way out of it because they used so much of their ‘powder’ on tackling the COVID economic crash.

- US equity prices are at record valuations, therefore even the prospect of a financial crisis likely means lower stock prices.

What The Bulls Are Saying

- There have been several predictions of financial crises arising from the failure of leveraged Chinese companies in the past, like Fosun, which never bore fruit.

- There are indications that Beijing is already working on a deal that will soften any significant damages, as they’re asking state-backed companies to purchase Evergrande assets.

- The most likely outcome is that foreign investors are wiped out, while the domestic damage is reduced.

Bottom Line

Without decades of experience and living through several economic cycles, it’s difficult to develop an instinct for what the impact of events like Evergrande will be.

But short-term traders don’t win because they can predict complicated world events better than the best strategists, they win because they take advantage of the volatility created by said events, without overanalyzing them too much.

At least that’s our two cents.

The post The Evergrande Situation: What You Need to Know appeared first on Warrior Trading.

Original source: https://www.warriortrading.com/evergrande-situation-what-you-need-to-know/