The Money Press Method claims to be a market-neutral options trading strategy that can generate consistent income by leveraging weekly options as a diagonal spread.

This makes it suitable for beginners and experienced traders looking to capitalize on time decay.

The key to this strategy is picking a good name to buy and write the options on.

Let’s check it out below and see if all the hype is warranted or if it’s just a diagonal spread.

Contents

-

-

-

-

- What Is The Money Press Method

- How To Trade The Money Press Method

- Similar Options Techniques

- Poor Man’s Covered Calls

- Pros and Cons Of The Poor Man’s Covered Call:

- Verticals

- Pros and Cons of Verticals:

- Is It Worth It?

-

-

-

What Is The Money Press Method

Preston James developed the Money Press Method to generate consistent income from the market regardless of the movement.

This method focuses on leveraging weekly put options to achieve this.

The basics of it are to look for solid stocks and then create a diagonal put spread using in-the-money and at-the-money puts.

The money press method works but accumulates the theta decay if the price stays range-bound above the lower strike or appreciates in value.

However, what makes it work in down markets is the structure of the spread.

Since the in-the-money put is the purchased side of the spread, if you get assigned the shares, they will be at a lower price (the stock price closes below the sold strike); you can instantly exercise the in-the-money option and sell it for a higher price.

This means you would need to reset the trade, but you would be at break-even or a small loss depending on how many weeks you could sell puts.

How To Trade The Money Press Method

With the basics of the method behind us, let’s look at an example of how to trade it, along with the three potential outcomes from each trade.

The first thing to do is pick the correct type of stock.

This method works best on stocks with a lot of liquidity in both the underlying and the options and has a fairly stable price movement.

For these reasons, large-cap stocks seem to be the best.

The next step is to identify the options you want to trade.

James does not give much detail about how far out to go in terms of strike for the long put, just that it should be 3-6 months out in terms of time.

One way to select the long put could be to go a multiple of the daily average true range.

After you have purchased your longer-dated put, the next step is to sell a weekly at-the-money option.

This is the simple part of the trade: look for something closing the closest Friday and sell that put.

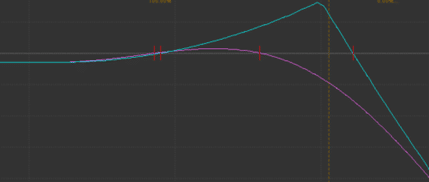

Once complete, the trade should have a risk profile similar to the one on the right.

Once this trade is on, there are three possible outcomes.

First, nothing happens, and your sold put expires out of the money.

This is a best-case scenario because you can collect the total premium amount and do it again.

The next possibility is that the price settles with the at-the-money and in-the-money put in the money.

If you let it expire, you will get assigned the shares, and you need to exercise the long put to sell the stock.

This will put you someplace on the profit/loss spectrum depending on how many weeks have been sold and the cost of the long put.

The last outcome is that prices rocket through both put strikes, having them both out of the money.

This is a worst-case scenario because the spread will be basically worthless.

At this point, you can wait for the long put to be either back in the money or close the spread and re-adjust.

This will most likely result in a loss.

These are the basics of the Money Press Method, but a few additional points are worth mentioning.

First is the possibility of a loss.

Although it is not mentioned much in the material, a loss is possible in this trade, as discussed above.

The second item worth mentioning is his stock-picking technique, using earnings upgrades.

This may work, but it would require the belief that the analysts are correct in their estimation of future earnings.

Customizing the stock selection process to fit your trading style would probably be better.

Similar Options Techniques

Given what we know about the Money Press Method, how it is placed, and how it works, we should look at other “income-producing” options techniques.

Income producing is in quotes because most of these techniques either produce a credit when executed or require multiple rounds to create positive cash flow, similar to the Money Press Method.

Poor Man’s Covered Calls

The Poor Man’s Covered Call is similar to the Money Press Method.

It works on the same principle (the diagonal spread), but this strategy uses calls instead of puts.

It is a simple strategy that involves buying a long-dated, in-the-money call option and selling a short-dated, out-of-the-money call option.

This works similarly to the standard covered call; the trader benefits from the decay of the short-dated call but utilizes LEAPS to cut the capital requirement down on the long side.

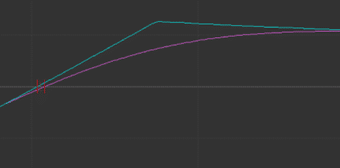

The Poor Man’s Covered call should have a risk profile that looks like this.

Pros And Cons Of The Poor Man’s Covered Call:

Reduced Capital Requirements: Works well with small to medium-sized accounts due to reduced capital requirements. This lets newer traders start to get a feel for a full-sized covered call.

Theta Decay Advantage: Time is a large part of what makes long options so difficult; selling the short-dated call helps to flip this onto the side of the trader

Management: Poor Man’s Covered Calls are fairly simple to manage, given that they only have a long and short option. If a trader feels that their view of the stock is changing, after the current short call expires, they can look to exit the long call and change names.

Options Risk: One downside of the PMCC is that you still utilize all options for a synthetic long position. This puts you as a trader at risk, and if the stock price falls too far, it will become a completely worthless position. This is not as concerning as a regular covered call, as you will just become an owner of the stock.

Margin: Another downside is the margin requirements. This is a synthetic spread, so most brokers require level 2 or 3 margin privileges to trade it. This isn’t true with covered calls; basic options and privileges are usually sufficient.

Verticals

Another potential choice for an investor looking to produce income through options is the Vertical Spread.

This is a more directional trade, but it can also produce income for the trader when structured properly.

Verticals can be both a debit and a credit spread, so we will focus on the credit version to create the cash flow.

The vertical spread is when a trader buys and sells two of the same options, either puts or calls, set for the same date but at different strikes.

You can read more about them here.

Pros And Cons Of Verticals:

Directional Spreads: These spreads can be incredibly versatile because you can trade in both directions and still create income from them. The ability to trade this way opens up many other opportunities for you as a trader because you do not have to be long, only biased for fear of margin costs.

Risk Management: Another benefit of the vertical is that risk and reward are clearly defined. As the trader, this allows you to be completely content with the amount of capital at risk before entering the trade. Additionally, it is possible to manage the trade by closing one leg and re-opening it for a different structure.

Limited Lifespan: One major drawback of the vertical when comparing it to the PMCC or the Money Press Method is that each trade is one and done. This means you must re-enter the entire trade after it expires or is closed. For the other two, you can place multiple contracts worth of short options before worrying about rolling the LEAP.

Is It Worth It?

At its core, the Money Press Method is just a diagonal spread behind a different name.

These spreads can be incredibly lucrative if placed on the right stocks and managed correctly, but they are not the magic income solution that it is pitched as.

With other types of spreads available, such as verticals and the long diagonal (PMCC), the Money Press Method should only be one tool in your trader’s toolbox.

While it is an interesting idea, the initial ebook might be worth the cost to better grasp the idea, but the monthly subscription would be difficult to justify.

There are plenty of sources of information around this site and others, as well as YouTube, that can help you become a profitable options trader and create consistent income.

We hope you enjoyed this article on The Money Press method.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/the-money-press-method/