Contents

-

-

-

-

-

- Example Case Study

- Steps For The Protected Wheel

- Compared To The Regular Wheel

- Final Summary | LEGO Stock

-

-

-

-

The wheel options strategy is an excellent income-generating strategy that we have discussed before.

However, it is not without risk. It has undefined risk in all phases of the wheel.

The short put, long stock, and covered call are all undefined risk.

A significant amount of money can be lost in a market crash during any of these phases.

I’m writing this when the VIX closed above 30 at a nine-month high, and no one knows what the market will do on Monday.

While cash is a position, how about, we tweak the wheel strategy so that it has defined risk all the way.

Then we can more safely trade it during uncertain times. We will compare how it does compare to the regular wheel strategy.

Example Case Study

We will run the protected wheel strategy on Cola-Cola (KO) during the year 2020.

This will be a reasonable representative time period consisting of bearish first six months, which includes the pandemic selloff.

The price of KO fell 18.7% during the first half of the year.

It recovered during the last six months of the year when it when up 22.3%.

This will be our representative bullish trend.

If we want to see how the protected wheel did in an overall neutral move, look at the entire year 2020, where Coca-Cola started at $54.99 and ended the year nearly at the same price of $54.84.

Coca-Cola is a good stock to do the wheel on because it is a stable large-cap company that pays decent dividends with the following ex-dividend dates (which we shall consider if the stock gets assigned).

Mar 13, 2020: $0.41/share

Jun 12, 2020: $0.41/share

Sep 14, 2020: $0.41/share

Nov 30, 2020: $0.41/share

KO’s beta of 0.69 makes it a less volatile stock suitable for wheel trades.

However, the year 2020 turned out to be quite a volatile year.

Steps for the Protected Wheel

First, familiarize yourself with the standard wheel strategy described here.

Then we modify it so that we sell a put spread instead of a short put in the protected wheel strategy.

If we get assigned and own stock, we buy a six-month at-the-money put to protect our stock position.

The following backtest was run with OptionNet Explorer, where we sold short puts and covered calls at the market open, and we calculate the profit and loss at the dates shown at the close of market day.

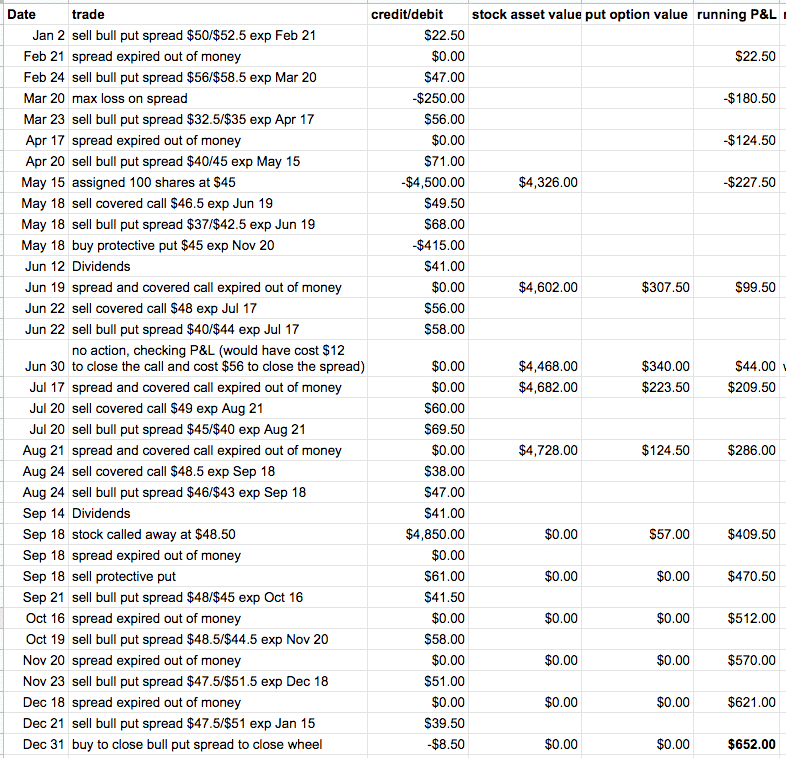

On January 2, 2020, we started by selling the $50/$52.5 bull put spread and collected a credit of $22.50.

When this spread expired out-of-the-money at the end-of-day on February 21, well sell another bull put spread the following Monday at the open.

With the price of KO at $59.64, the short put strike was chosen at $58.5 (around 30-delta) and the long put strike at $56.

This collected a credit of $47. With the spread width at $2.50, the max loss on this spread would be $203 = $250 – $47.

On expiration March 20, the price of KO was down to $38.30 (a drop of nearly 36%).

This is near the bottom of the market crash in March 2020.

Price had dropped straight down through the entire spread like a hot knife through butter.

The spread is at a max loss.

But because the bull put spread was a defined-risk position, we had only to pay out $250 at the March 20 expiration.

Adding all the credit received, the net profit and loss (P&L) is a loss of –$180.50 so far.

Continuing the strategy, we sell another spread and collected $56 on March 23.

The spread expired worthless.

We sell the $40/$45 bull put spread on April 20, collecting a credit of $71 with a max loss of $429 = $500 – $71.

The risk-to-reward ratio is 6.

At expiration on May 15, the price of KO is $43.26, which is below the short put strike of $45 yet above the long put of $40.

We are assigned 100 shares of KO at $45.

In other words, we were obligated to spend $4500 to buy these 100 shares, which are worth only $4326.

Referring to the spreadsheet above, if we tally all the incoming credits and outgoing debits to this point and add the value of the stock asset we own, the current loss is $227.50.

Just like in the traditional wheel strategy, we sell the $46.50 covered call collecting a credit of $49.50 on May 18.

Since KO is a lower-priced stock, we are willing to take up to 200 shares. So at the same time, we sell another bull put spread for a credit of $68.

If we just hold 100 shares of long stock, this is an undefined risk position (even with the covered call in place).

Therefore, in the protected wheel strategy, we also buy a put option to protect the stock.

This makes it a defined risk strategy.

Referring to the above spreadsheet, we bought the $45 at-the-money put costing $415.

This put expires in 6 months.

Since we are holding 100 shares of KO on the ex-dividend date of June 12, we collected $41 in dividends.

On expiration June 19, both the bull put spread, and the covered call expired out-of-the-money, so no money was credited or debited.

The value of our put option is down to $307.50 due to a combination of price movement, volatility changes, and time decay.

The following Monday, June 22, we sell another covered call (collected $56), and another bull put spread (collected $58).

Let’s check the P&L at the six-month mark on June 30.

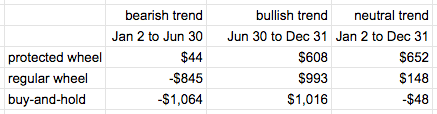

Tallying all the credits and debits and adding the current value of the 100 shares (valued at $4468) and the current value of our long protective put (valued at $340), and figuring the cost to buy-to-close the short call and put spread, we see a net P&L gain of $44.

This is quite good, considering that a buy-and-hold investor who had bought 100 shares of KO on January 2 would have lost $1064 on June 30 — a loss of 19%.

Continuing the protected wheel strategy in this way, we see that at the end of the year, the strategy nets $652 in profit even though the price of KO from the start of the year to the end of the year were essentially the same (see price chart above).

Compared to the Regular Wheel

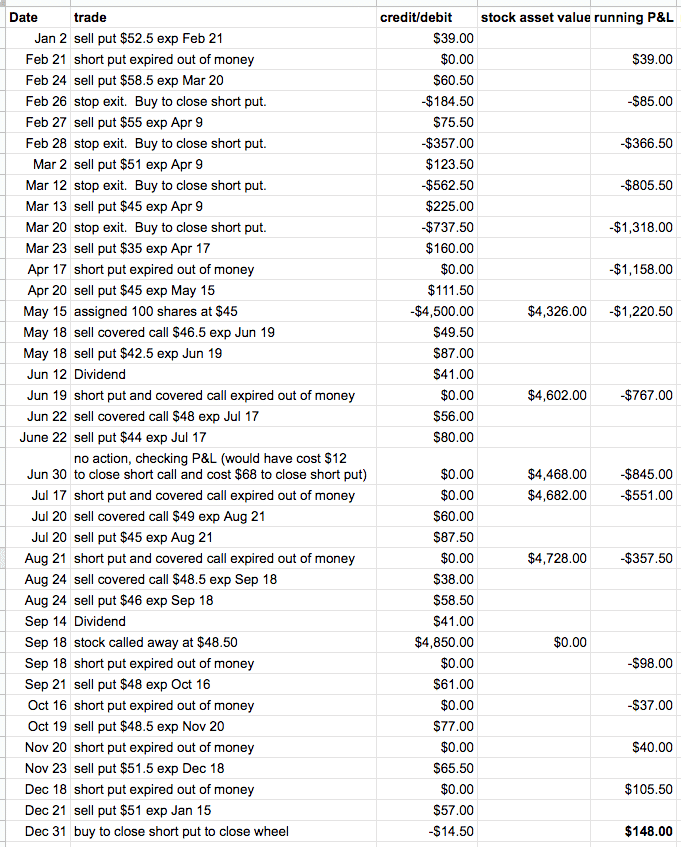

If we run the regular wheel strategy on the same timeframe, stock, and strikes, we see that the strategy took significant losses in the March crash on March 20.

Because the regular wheel is an unlimited loss strategy, many investors will have a stop loss to prevent large drawdowns.

This backtest uses the following mental stop loss rules:

Exit long stock if the stock drops 10%.

Exit short puts if its loss exceeds two times the credit received (at end-of-day closing prices)

We ran this same experiment without the use of stop losses, and the results were much worst.

We did not have to use any stop loss on the protected wheel strategy because that already has defined risk.

By the end of the first half of 2020, the wheel strategy lost $845.

However, it did a good job of recovering all of that loss from June 30 to December 31 — making a gain of $993 and resulting in an end-of-year P&L of $148.

Results

Owning long stock (just buy-and-hold) would give the largest return ($1016) in a bullish market.

But in a bearish market or market crash, the buy-and-hold long stock also incurs the greatest loss (–$1064).

Trading the regular wheel strategy can incur significant losses (–$845) in a downtrend, as seen in the first half of 2020.

But it is not as bad as the buy-and-hold strategy since the losses are offset by credits received from covered calls and short puts.

We see that the protected wheel strategy helps protect a lot of the loss in bearish conditions.

Despite the severe selloff, there was no loss in the first half of 2020.

However, it does not make as much in a bull market.

It made only $608 in the bullish latter half of 2020, while the regular wheel and long stock made $993 and $1016, respectively.

Nevertheless, because it prevented a large drawdown in a market crash, it was able to come out ahead in 2020 with a profit of $652, outperforming the other two strategies.

Remember, if a strategy incurs a 25% drawdown, it requires a 33% gain from that point to get back to break even.

From the above price chart, we can see that KO dropped 18.7% during the first half of the year.

But it required a gain of 22.3% in the second half of the year to come back to breakeven.

Limiting large losses is essential. The protected wheel strategy is a defined-risk strategy that you can consider to limit large losses.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post Blog first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/wheel-options-strategy/