Contents

-

-

-

-

-

-

-

-

- One Complete Wheel

- Taking Profits Earlier

- Keep Logs

- What Delta to Sell?

- The Wheel For Smaller Accounts

- Don’t Forget The Dividend

- Locking In A Loss

- Various Adjustments

- Keeping Things Simple

- The Wheel On A Downtrend

- Variations Of The Wheel

- Conclusion

-

-

-

-

-

-

-

The options wheel strategy has grown in popularity in recent years due to new books and social media coverage of the topic.

However, investors have been using this strategy since the beginning of options trading.

Back then, there wasn’t a catchy name like “The Wheel” to attribute to the strategy.

The fact that this strategy continues to be used today means that it has passed the test of time.

The strategy works — provided that you are working with high-quality stocks (and that it doesn’t go down significantly).

The Wheel strategy works.

Sellers of options have a slight edge because, most of the time, they are getting paid slightly more than the risk they are taking.

And it works slightly better in higher implied volatility regimes.

The premise of the Wheel strategy is that you want to sell cash-secured puts to collect options premium.

If you are assigned the stock, hold the stock and sell covered calls to also collect options premium.

When your stock is called away, repeat the Wheel.

The Wheel is a bullish strategy. Select large market-cap stocks that you don’t mind owning and that you think will go up. It would be nice if they also paid a dividend.

Start looking for companies that are part of the Dow Jones Index, the S&P 500, or Nasdaq.

They are in the index for a reason.

I’m pretty sure they are not going out of business anytime soon.

Or look at our list of best stocks for the Wheel.

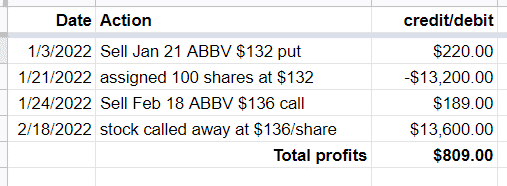

One Complete Wheel

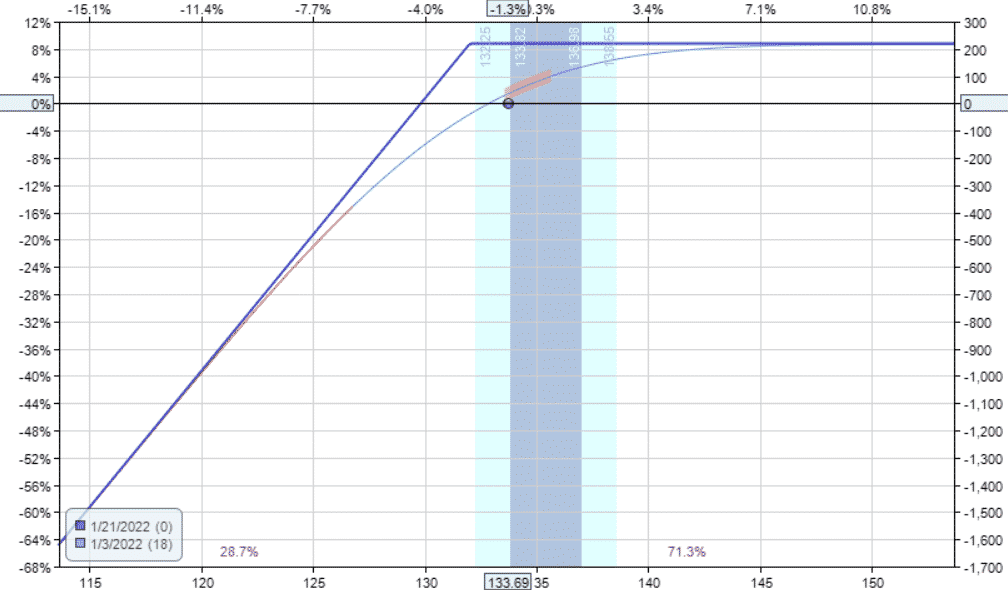

To see what happens when the strategy is working, let’s use AbbVie (ABBV), which provides a dividend and is a member of the S&P 500 index.

Suppose we start the Wheel on January 3, 2022, selling a cash-secured put.

Date: January 3rd, 2022

Price: ABBV at $133.69

Sell one Jan 21 ABBV $132 put @ $2.20

Credit: $220

We collected $222. This will also be our max profit on the sale of the short put.

The payoff diagram looks like this:

source: OptionNet Explorer

On expiration on January 21, ABBV closed at $131.98, just 2 pennies below our short strike of $132.

This means that we are obligated to buy 100 shares of ABBV at $132 per share.

And indeed, on Monday morning, we see –$13,200 taken out of our account.

Now that we have 100 shares, we will sell a covered call.

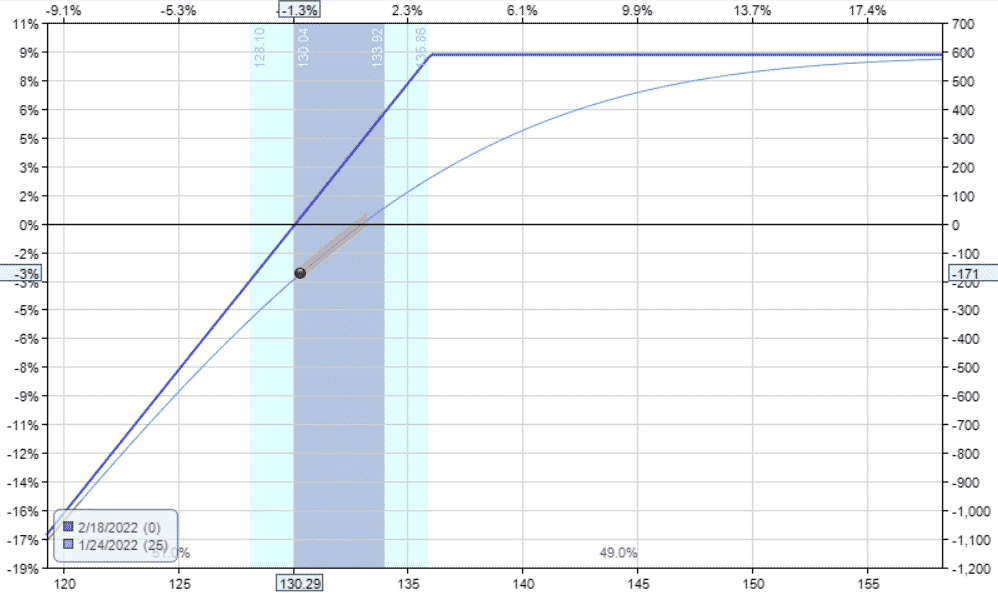

Date: Jan 24, 2022

Price: ABBV @ $130.29

Sell one Feb 18 ABBV $136 call @ $1.89

The payoff diagram looks quite similar to an upward-sloping graph:

On February 18 expiration, ABBV closed at $144.03, which is above our short strike of $136.

Hence our stock is called away at $136 per share, and $13600 is credited back to our account.

We now don’t have any stock or options left.

This trade completes the Wheel with a net profit of $809.

Considering that we should keep $14,000 aside as planned capital usage, $809 would be about a 5.8% return in one and a half months.

In this example, we were pretty aggressive in collecting premiums by selling puts and calls quite close to the money in the 30-delta to the 40-delta range.

Taking Profits Earlier

In the previous example, we held the short options all the way to expiration.

Some investors would prefer to take profits on the options earlier.

Our general rule of thumb for bull put spreads (and short puts and iron condors) is to take 50% of the profit if it occurs less than 50% of the trade duration.

We don’t mind taking ownership of the stock in the wheel strategy.

So we tend to sell closer to the money and hold it closer to expiration, taking a larger percentage of the max profit on the option.

Let’s look at the ABBV example again.

This time we take profit on the short put if it reaches 80% of max profit.

We had collected $220 on ABBV short put.

The 80% of max profit is $176. So you can put a good-to-cancel buy-to-close order if the put option price drops below $0.44 per share.

Another way to think of it is that we want to buy back the short option by paying only 20% of its original price.

Two weeks later, on January 18, the order triggered, and we bought back the short put for $44, keeping $176 of the original credit as profit.

We repeat the process, selling another put on January 19, taking a credit for $164:

Date: Jan 19, 2022

Price: ABBV @ $136.43

Sell one Feb 18 ABBV $130 put @ $1.64

Credit: $164

This short put was at 25-delta with 30 days to expiration.

We plan to take a profit of $131 from this trade.

That is 80% of $164.

If you don’t want to watch the trade, put in a good-to-cancel order to buy back the short put at $0.33 or lower — $0.33 is 20% of $1.64.

On February 3, we made our profit target and exited the trade, netting a $131 profit.

We sell another put:

Date: Feb 4, 2022

Price: ABBV @ $140.57

Sell one Feb 18 ABBV $137 put @ $1.22

Credit: $122

The expiration was only 14 days away because that was the next monthly expiration.

We prefer monthly expirations due to their greater liquidity.

You can sell at 45 days-to-expiration (DTE), 30 DTE, or even 7 DTE as per your preference.

On February 9, we exit this trade with a $98 profit by paying $24 to buy back the short put.

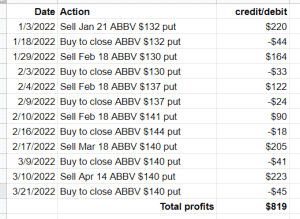

Keep Logs

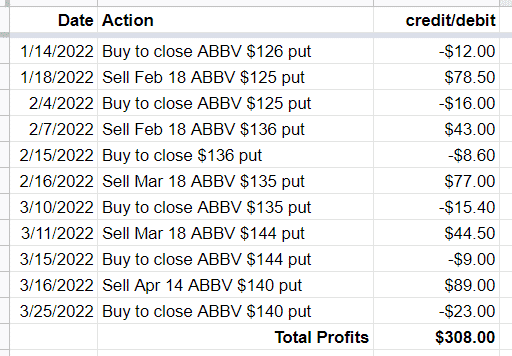

When doing the Wheel, it is important to track your trades to see the net P&L (profit and loss) at each step of the way.

In the below spreadsheet, we recorded the above trades and the subsequent trades if we were to continue selling puts on ABBV.

You can see that in three months, we made $819 — just from collecting premiums.

In this example, we have avoided stock assignment by taking profits earlier.

Considering that we need to put aside $14,000 of capital to buy 100 shares in case of assignment, a 5.9% return on capital in three months.

Here is the price chart of AbbVie during that three months:

If we happen to catch a nice price run-up, the Wheel can generate some good income (sometimes even without needing to own the stock).

Speaking of owning the stock.

How does our return compare with the stock owner of 100 shares during that same period?

In the first example, suppose a stock owner purchased ABBV at $133.95 on January 3 and held it to the end of the day on February 18 when $144.03.

The stock owner made a $1008 gain, while we made $809.

In the second example, the stock owner made $2610, while we made $819.

In a very bullish market or stock (as is the case with ABBV), the long stock position will outperform.

In a bearish stock (as we shall see later), the Wheel will outperform the long stock.

The Wheel is still a bullish strategy. It is just that it has more downside protection than long stock.

What Delta to Sell?

A very common question is what delta to sell the short put and covered call.

There is no one correct answer.

It is a trader’s choice and preference and depends on how much you want to take ownership of the stock.

Other investors will use support, resistance, and Bollinger bands to select their strikes instead of delta.

Some will calculate the percentage collected for the option’s extrinsic value and target a percentage range (2% to 4%).

For example, receiving $220 to sell the $132 strike means a 1.7% return if the option expires out-of-the-money. $2.20/($132-$2.20) = 1.7%

If you sell puts closer to the money, you collect a larger credit.

But in the event that the price makes a large drop, you could lose a lot more money at the stock assignment.

If you sell calls closer to the money, you are collecting a larger credit and hence have more downside protection.

But you are at a greater risk of capping your gains should the price go up a lot.

In the case of ABBV, if we were to have sold further away from the money at the 15-delta.

We would still have gains, but they would not have been as large.

The Wheel For Smaller Accounts

We can do the Wheel on lower-price stocks for smaller accounts — not penny stocks.

Remember, we still want high-quality stocks.

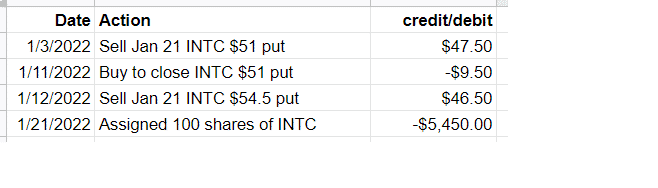

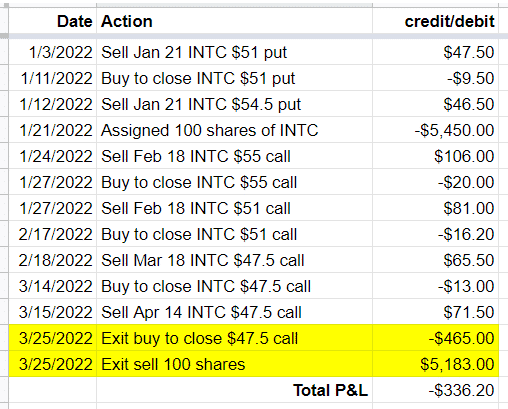

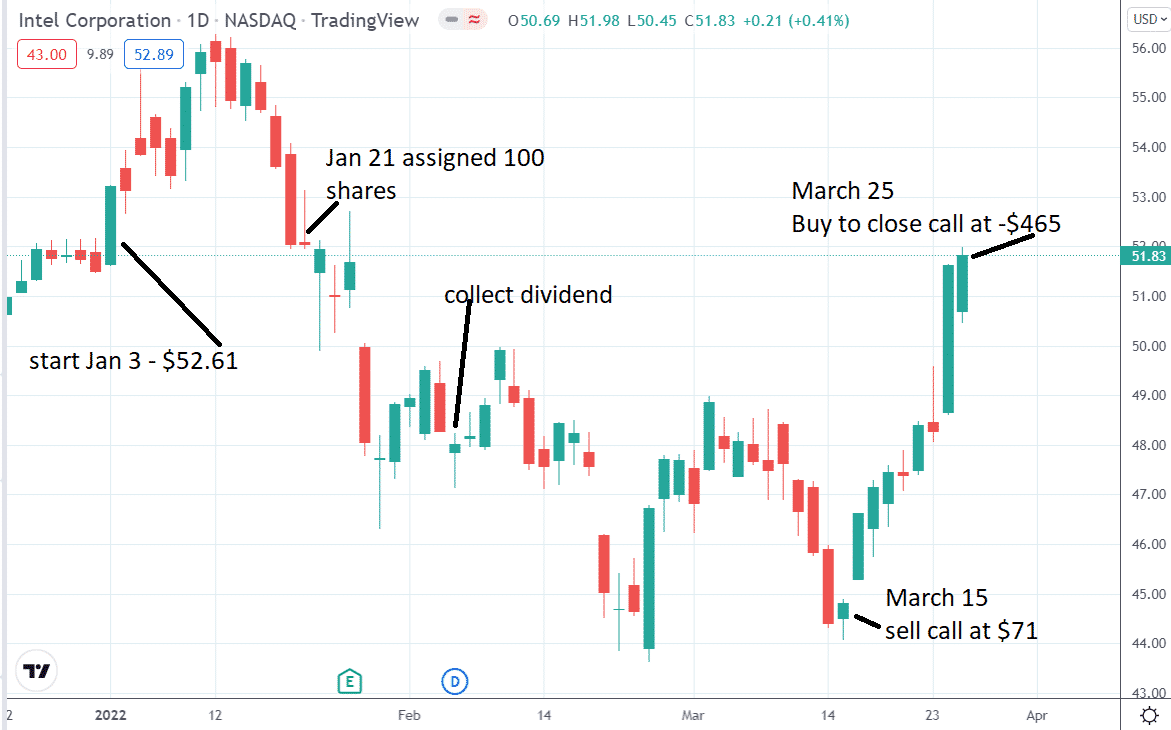

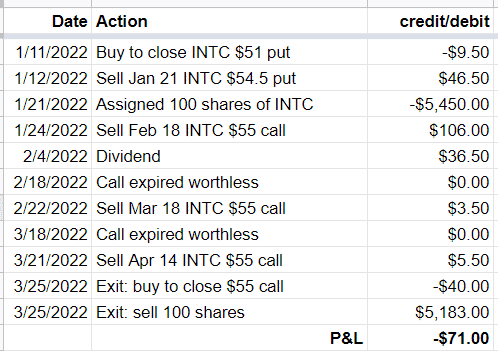

Let’s take Intel (INTC), a company with a $211 billion market cap and a member of the Dow Jones index, S&P500, and the Nasdaq.

With a price per share of around $60, you only need to set aside $6,000 capital. However, that also means smaller premiums.

By inspecting the backtest log, we notice that the credit on the short put only collects between $40 and $50. (depending on the delta and the days to expiration).

After selling a put on January 3 and taking profits at 80% of the max profit, we sold another put on January 12.

Date: Jan 12, 2022

Price: INTC @ $55.46

Sell one Jan 21 INTC $54.5 put @ $0.465

Credit: $46.50

This time the 80% profit target was not hit.

At the end of the expiration day on January 21, the INTC price was $52.04.

Since this is lower than our short strike of $54.5, we have to buy 100 shares of INTC at $54.5 per share — even though the market price of INTC is $52.04. We lost $246.

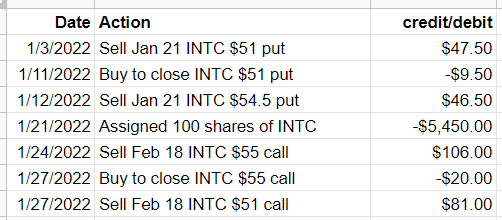

Now that we have got assigned 100 shares, we will sell a covered call the following Monday:

Date: Jan 24, 2022

Price: INTC @ $50.95

Sell one Feb 18 INTC $55 call @ $1.06

Credit: $106

Now, we are collecting credits on the call side (instead of the put side).

This $106 credit is also the max we can make on the covered call.

Three days later, on January 27, after Intel’s earnings announcement, the price gapped down 3% on the open and continued down another 3.9% during the day.

The call option price dropped to $0.20 — about 20% of the initial credit of $1.06.

Although we are profiting from the short call, we would rather that the stock price goes up. Remember, we own 100 shares.

Based on the payoff diagram, the profits of the covered call increase as the stock price increases.

Since the short call has gotten so far out of the money (at the 9-delta) and lost so much of its value, we can buy back the short call so that we can sell another call closer to the money to try to take in more credit.

Date: Jan 27

Price: INTC @ $48.56

Buy to close Feb 18 INTC $55 call @ $0.20

Sell to open Feb 18 INTC $51 call @ $0.81

This is known as rolling the short call down from the $55 strike to the $51 strike.

Our new short $51 call is closer to the money near the 30-delta.

Likewise, as we did on the put side, we can also put in a good-to-cancel order to buy-to-close the short call if its value drops below 20% of the credit received.

This order was triggered on February 17, and the short call was bought back at $0.16.

Although monitoring daily, let’s say that we didn’t see that our order got triggered until the following day, in which case we immediately sold another call on February 18.

We continue to sell covered calls in this fashion, selling another on March 15.

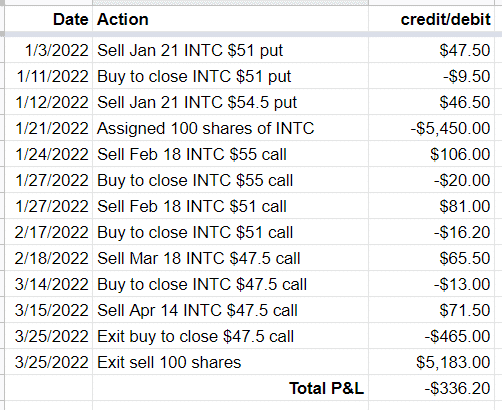

Although, as of March 25, our stock still had not been called away, we can choose to exit the position at any time.

If we were to exit the position, we would buy back the short call and then sell our 100 shares — in that order (not the other way around).

See the two highlighted rows below.

On March 25, it costs $465 to buy back the short call. We sold the call for $71.50 and now have to buy it back for $465.

We lost $394 on this short call.

This is because INTC rallied up hard during that time.

Although we were able to sell the shares at $51.83/share, it was at a price lower than the price of $54.50 when we were assigned the shares.

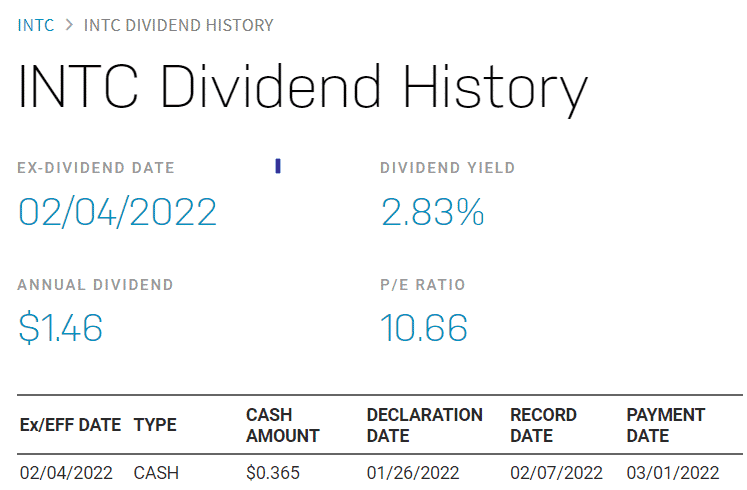

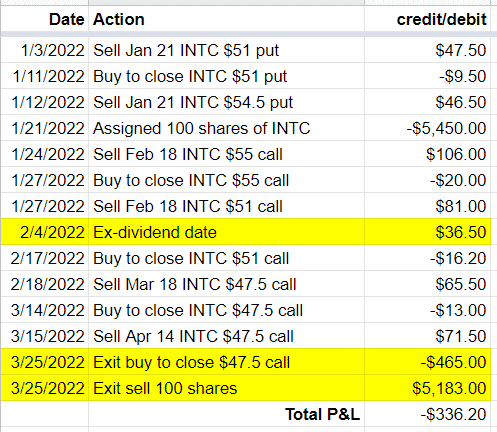

Don’t Forget The Dividend

To see the final profit-and-loss (P&L) on this Wheel, we need to add any dividends received.

On the Nasdaq site, we see that Intel’s ex-dividend date was February 4:

source: Nasdaq.com

Intel pays $0.365 per share.

We owned 100 shares at the time and collected $36.50 in dividends.

Adding this to our spreadsheet and tabulating the net P&L…

We have a loss of –$336 — even though the stock price had ended back where it started (see above price chart)

That would be around a -5.6% loss on the planned capital of $6000 — over a three-month duration.

Locking In A Loss

Take a look at our spreadsheet logs.

After taking the stock assignment at $54.50 per share, we sold the $55 call on January 24.

That is fine because $55 is above $54.50.

But then, on January 27, we sold the $51 call.

Some investors will say this is a mistake to sell a call with a strike lower than the stock’s price.

They say it is “locking in a loss” because the short call caps the stock at $51.

If, at expiration, the price recovers back up to $54.50, you will still have to sell your stock at $51, losing out on any gains above $51.

On the other hand, if we don’t sell closer to the money, we don’t collect enough premium.

If the stock doesn’t hit our short strike, we are not limiting any gains.

Which option is correct depends on what the market does.

If stock recovers back up, then the former argument is correct.

If prices continue downward, then the latter is correct.

Let’s see what the example has to say if we make sure we don’t sell covered calls lower than our purchase price:

It did better.

By not selling any calls lower than $54.50, we collected a very small premium of $3.50 and $5.50.

We are relying on the stock itself to recover. And it did recover.

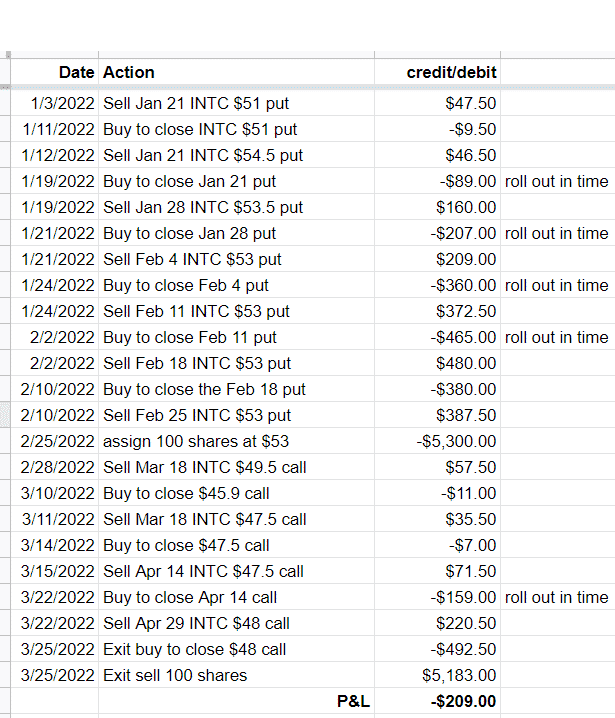

Various Adjustments

Some investors will roll the short option out in time whenever the price reaches the short strike.

If it can be done for a credit, we will roll the short option further out in time by one week.

Sometimes we might roll it one strike further away from the money if it can be done for a credit.

Here are the results.

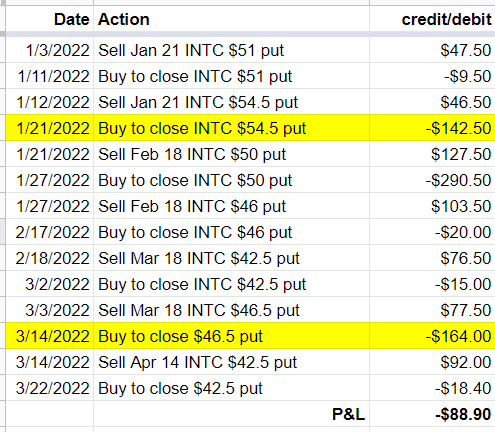

Other investors may limit the maximum loss on the short option.

If the loss on the short option exceeds twice its premium collected, close the short option.

We had to buy-to-close the short put in two instances highlighted below because its value ballooned to more than twice its original value.

In this case, we would rarely get assigned the stock.

We close the option when it is making a lot of money, and we close the option when it is losing a lot of money.

We hardly let it get to expiration.

It is as if we are trading a short put instead of the Wheel.

The point of the Wheel is to allow for the possibility of assignment.

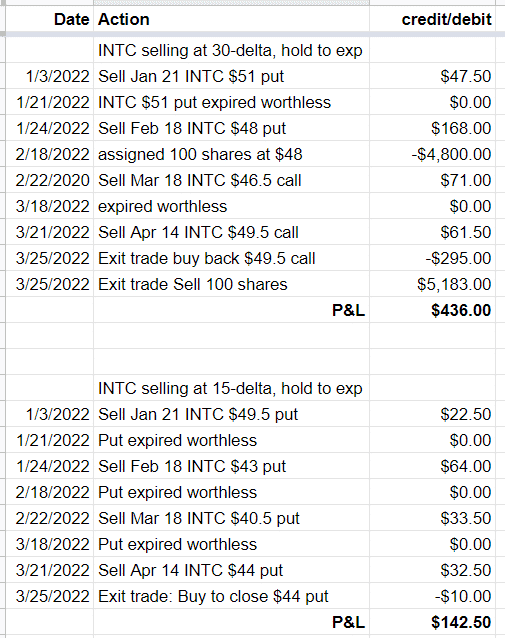

Keeping Things Simple

Okay, let’s keep things simple. Just sell the option. Hold to expiration.

And if we get assigned, we take the assignment.

That’s it.

We just let the probabilities play out.

And here is what happened to Intel selling at the 30-delta and selling at the 15-delta.

We let the Wheel do its thing, and it made money for us (even though the stock price went nowhere during that time).

The Wheel On A Downtrend

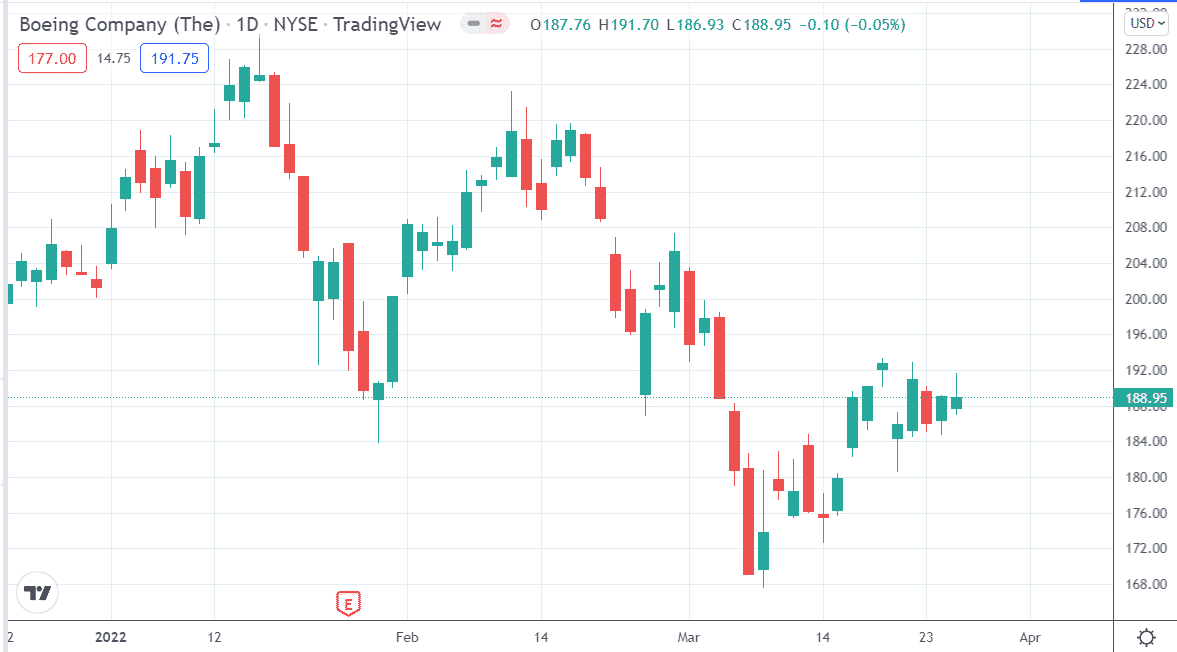

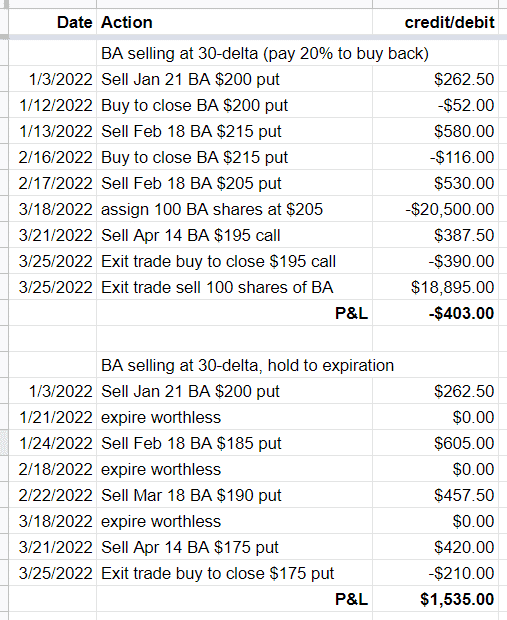

ABBV was bullish. INTC was sideways. Our final example is Boeing (BA) on a bearish trend.

We tried taking profits at 80% of max profit. And we tried holding to expiration.

In both cases, the Wheel outperformed the buy-and-hold stockholder of 100 shares during the same time period.

In the second case, the Wheel made money even when the stock price was going down.

In this example and in previous examples, it appears that there is merit in holding the short option to expiration if you are willing to take the assignment on the stock.

The time decay in our benefit is very high when the short option is close to expiration.

Variations Of The Wheel

After the stock assignment, some investors will sell a covered call plus an additional short put. This strategy is a covered strangle.

Some more aggressive investors in collecting premiums will sell the covered call and the additional short put with strikes at-the-money where premiums are the juiciest.

This is a covered straddle.

To me, those are like doing two Wheels on the same stock simultaneously.

As such, I would rather do it on two separate underlyings.

Conclusion

The Wheel is a bullish strategy. It makes money when the trend is up (as in the case of ABBV).

However, long stocks may sometimes outperform the Wheel for very bullish trends.

The Wheel provides the investor with better downside protection than holding long stock in a bearish trend.

As in the case of Boeing, it outperformed the buy-and-hold stock owner.

There are countless ways of doing the Wheel.

For every example shown here, a counter-example can be found.

Sometimes selling at the 15-delta turns out to be better.

Other times it is the 30-delta. Sometimes holding to expiration turns out to be better.

Other times taking profits on the short option is better.

It all depends on what the stock happens to do.

Running the Wheel in live trades can take a long time to play out.

It can take months or years to see enough examples to master the Wheel.

One way to accelerate your learning curve is to manually back-trade the Wheel using historical data like how we did in our examples.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/options-wheel-strategy/