Besides listening to the news and reading Internet posts for trade ideas, it’s not that there is anything wrong with that.

Today, we look at some tools to help find trade ideas.

In particular, we want to find free tools – because everyone loves free (why not?)

Contents

-

-

-

-

-

- Stock Screener

- Heat Map

- Sector Rotation

- Contrarian Play

- Summary

-

-

-

-

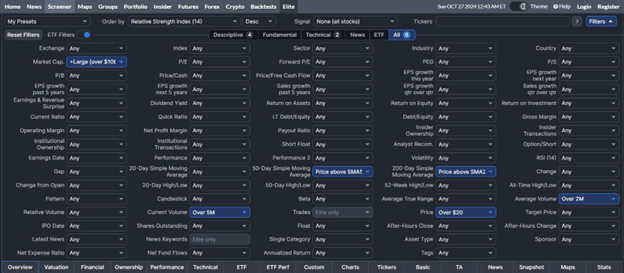

Stock Screener

Every stock-picking investor needs a good stock screener.

Among the free screeners, FinViz has one of the best.

Just look at the number of technical and fundamental criteria you can screen for.

For example, I have screened for stocks with a large market cap with good volume and price above the 50 and 200 simple moving averages.

And since I’m not interested in penny stocks, I asked for stocks whose price per share is at least $20.

Specific metrics can order the results. Here, I have ordered the results by RSI.

A nice feature is that I can simply hover over the symbol and get a quick snapshot glance at the chart.

Heat Map

The heat map in FinViz gives you a quick visual on spotting stocks that are on the move up or down.

This particular heat map shows all 500 stocks in the S&P 500, organized by sector.

Larger squares depict large companies.

The size of the square represents the company’s market capitalization.

To be listed in the S&P 500, the company must be at least decent.

Value investors might be looking for temporarily beaten-down stocks but good companies to add to their portfolios.

Momentum investors might be looking for stocks that are making large moves up or down.

Green and red means that stock is up or down.

The brighter the green or red, the larger the move.

Depending on the investor’s trading timeframe, they can select the timeframe in the left menu.

We are showing the daily performance in the above screenshot.

However, one can easily change it to weekly or monthly.

Intraday is also available but requires a paid membership.

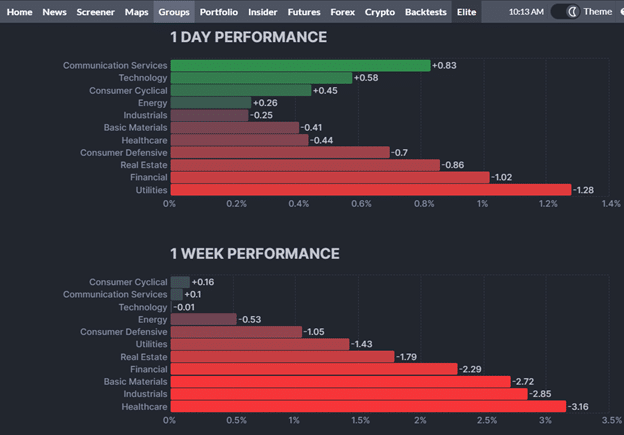

Sector Rotation

The Groups tab in FinViz allows investors to see sector rotation.

It tells them which market sector is doing well or not so well for a given time frame (such as one day, one week, month, etc).

A shorter-term investor might see that Communication Services’ stocks have been doing well in the past day.

Clicking on the green bar of the chart will give a list of all the stocks in the Communication Services sector.

A momentum investor might further filter them by market cap and volume and sort them by descending RSI to see the recent top performers listed on top.

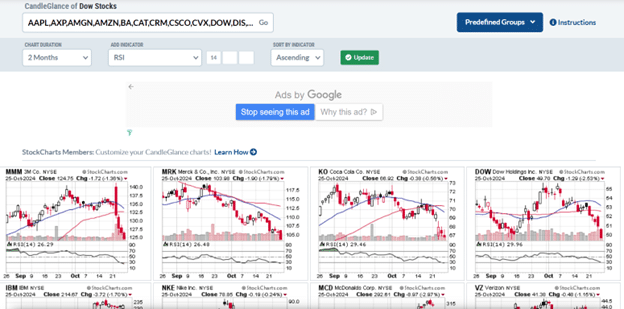

Contrarian Play

A contrarian investor might sort RSI in the opposite direction, looking for a stock with a low (or oversold) RSI, expecting the stock to go up and revert back to the mean.

Another tool that can help with this is the CandleStick Glance in StockCharts.com.

Here, I have selected the “Dow Stocks” from the Predefined Groups and sorted them by RSI, with the lowest (most oversold) listed first.

The contrarian investor can pick from the oversold stock pattern the one they think might bottom out and is about to reverse up.

Summary

Whether you are looking to buy some stock for your portfolio or looking for the next underlying asset to run the Wheel Options Strategy on, you need some tools to help you pick effectively and efficiently.

Sure, you can manually go through charts one by one.

That may be just as effective, but it is not efficient.

Hopefully, this article has given you some tips to make your search effective and efficient.

We hope you enjoyed this article on two free tools for finding trade ideas.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/finding-trade-ideas/