Today we are talking about selling iron condors.

This article is meant as a sequel to my earlier article on Iron Condors, which you may want to read first.

In this article, I will reference concepts in the previous article and introduce new, more advanced concepts with new examples from 2022.

Contents

- Example on RUT

- Position Delta

- Put Call Skew

- Take Profit

- Time In Trade

- How Long To Stay In A Condor

- SPX Example

- Planning The Take-Profit And Stop Loss Level

- Adjustment Time

- What Could We Have Done Differently?

- FAQs

- Conclusion

Example on RUT

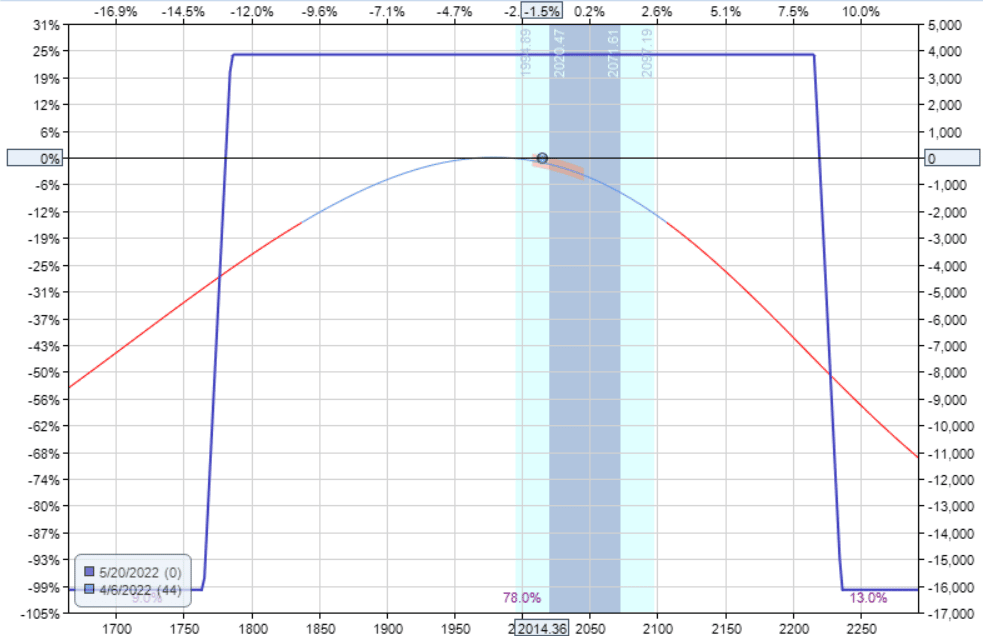

Let’s jump right in with an Iron Condor example of 10 contracts on RUT with 44 days to expiration.

Date: April 6, 2022

Price: RUT @ 2014

Buy ten May 20 RUT 1765 put @ $16.30

Sell ten May 20 RUT 1785 put @ $18.55

Sell ten May 20 RUT 2215 call @ $6.25

Buy ten May 20 RUT 2235 call @ $4.65

Net credit: $3850

Max risk: $16,150

This is the type of iron condors that I like to do, selling at the 10 to 15 delta with somewhat further out time duration.

We run the example trade using OptionNet Explorer, which gives us this payoff graph at the start of the trade.

source: OptionNet Explorer

The initial Greeks are:

Delta: -10.67

Vega: -359.85

Theta: 93.56

Gamma: -0.03

Position Delta

The position delta for ten contracts is -10.67.

This is equivalent to a negative one delta per contract.

I like to start the condor with the magnitude of delta to be one or less per contract for delta-neutrality.

Some traders will want the delta to be as close to zero as possible.

While others prefer to have it be just ever so slightly negative to hedge the short vega, basically, if the market goes down hard, the increase in volatility would hurt P&L.

But having some negative delta will help the P&L so that the net effect is that the condor will not be hurt as bad.

Put Call Skew

You don’t need to sell the shorts at the same delta.

In this example, the short put strike was sold at the 15-delta.

The short call strike was sold at the 10-delta.

Why did I sell the call side at a lower delta than the put side?

It is to make the initial condor position more centered and more delta-neutral.

If I had sold the short call at the 15-delta (same as the put), the position delta would be -18 instead of -10.

I rather have the -10 because it is closer to a flat delta at the start of the trade.

Currently, the short call is 201 points away from the current price.

The short put is 229 points away.

The call is closer than the puts.

If I had sold the short call at the 15-delta, the short call strike would even be closer to the current price than what it currently is.

We don’t want that. We rather have the calls and puts be more equidistant apart.

Due to the put-call skew present in the indices such as RUT and SPX and the corresponding ETFs (IWM and SPY), it is typical that puts are further away from price than calls of the same delta.

This comes from the fact that when the markets fall, they fall much harder than when markets go up.

That is why some traders like to sell calls at a slightly lower delta than the puts.

Alternatively, some traders will achieve the same effect by reducing the number of contracts on the call side.

Take Profit

After about two weeks into the example trade on April 19, the P&L is at $1700, which is a 10% profit on the capital at risk.

The $1700 is 44% of the credit received.

Since the credit received is the maximum potential profit achievable, we have captured 44% of the max profit.

It is important for every trader to set a take-profit rule, but the amount of take-profit is very individualized for each trader.

Some traders like to base the take-profit on the percent return on the margined capital at risk.

In this case, the profit was 10%.

Other traders like to base the take-profit on the percentage captured of the maximum potential profit.

In this case, the maximum potential profit is the initial credit received of $3850.

And we have captured 44% of that.

In the former case, a 10% profit on risk is quite reasonable.

Depending if you are a conservative or aggressive trader, it can be more or less than this.

In the latter case, capturing 25% to 50% of the max credit is quite reasonable.

Time In Trade

Time in the trade is important.

I like the rule of taking profit if I have captured a greater percentage of the max credit than the percentage of time in the trade.

For example, this trade lasted 13 days.

That is 30% of the trade duration of 44 days.

In that time, we captured 44% of the max credit (more than 30%).

This means that it is favorable to take the profit.

A simplified version of the rule is to take profit if you have captured 50% of the max profit in less than 50% of the time remaining.

Some traders may prefer to get out even earlier, perhaps at a quarter to a third of the trade duration.

How Long To Stay In A Condor

Why not stay in the iron condor all the way?

Why get out so soon?

There is no edge in staying in a condor all the way to expiration.

In fact, there is a negative edge.

The delta of the short strike is an approximate probability of that strike being in-the-money at expiration.

In our example, the short put has a 15% chance of being in-the-money, and the short call has a 10% chance of being in-the-money.

Since the probability of mutually exclusive events is the sum of the probabilities, the probability of either short strikes being in-the-money at expiration is 25%.

Roughly speaking, there is a 25% of losing on the iron condor if we hold to expiration; and a 75% of winning.

Suppose every time we win, we will make $3850.

And every time we lose, we lose $16150. When we repeat that 100 times, we see that we would incur a net loss.

Win 75 times at $3850 = $288,750 Lose 25 times at $16150 = $403,750

The edge in the iron condor is to take profits early as the profits become available and to actively adjust and manage the condor as price goes against us.

In this example, we got lucky because RUT happened to stay in a range long enough for the condor to generate profits.

But we cannot expect RUT to stay in a range for all 44 days, especially in a volatile market.

In the next example, we will look at adjustments

SPX Example

I don’t want to leave you with the impression that all iron condors are as easy as the example provided.

Quite often, we will need to adjust. There are various triggers for adjustment.

One of them is when the short strike reaches 25-delta, and here are some of the possible adjustments.

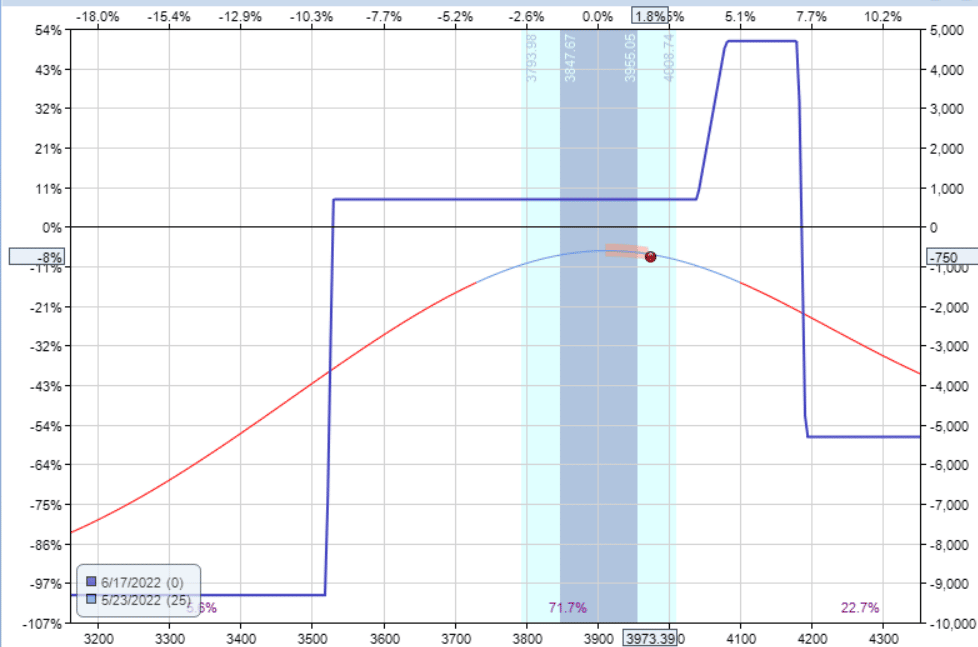

Let’s take an example in SPX — this time with 28 days to expiration.

Date: May 20, 2022

Price: SPX @ 3876

Buy ten Jun 17 SPX 3520 put @ $25.30

Sell ten Jun 17 SPX 3530 put @ $26.50

Sell ten Jun 17 SPX 4180 call @ $13.90

Buy ten June 17 SPX 4190 call @ $12.70

Net Credit: $2400 Max Risk: $7600

The short call is at 12 delta, and the short put is at 15 delta. The initial Greeks are:

Delta: -3.20

Vega: -179.00

Theta: 80.67

Gamma: -0.02

The Delta Dollars at the start of the trade is -3.2 x 3876= –$12,400.

If the trade reaches a delta dollar of plus or minus twice this, that is a warning sign, and the trade must be adjusted or exited.

In other words, if delta dollars is plus or minus $25,000 — that’s our warning.

Planning The Take-Profit And Stop Loss Level

Trying to capture 25% of the credit received would mean taking a profit of $600.

Trying to make a 10% return on the capital at risk would mean taking a profit of $760.

It’s up to you which one you want to shoot for or if you want to shoot higher.

In this example, let’s aim to get $600 out of this trade, seeing that we want to be out of the trade in a week (25% of the duration) if possible in a volatile bear market (which this trade happens to be in), better to get out sooner than later.

A return of $600 out of $7600 is 8%. We don’t want to lose much more than we would make.

So let’s set a stop-loss exit of 10%, or –$760.

Adjustment Time

Right from the start, the trade was caught in a strong bear market rally.

The next trading day on May 23, P&L is –$750, down -9.87% on the margined capital.

We have not hit the stop loss, but very close.

The position delta is -8.74, with SPX at 3973. The delta dollar is 3973 x -8.74 = -34700

This is flagging danger as it is already past twice the initial delta dollars.

Opting for adjustment #4, we buy a vertical call spread:

Date: May 23

Price: SPX @ 3973

Buy one June 17 SPX 4040 call @ $76.45

Sell one Jun 17 SPX 4080 call @ $59.35

Net Debit: –$1710

We selected those strikes because we wanted an adjustment that would reduce our position delta by two-thirds.

If we are even closer to expiration, we might want to reduce this even more.

If we had more time in the trade, we could reduce it by half might be sufficient.

The post-adjusted payoff graph looks like this:

The position delta has been reduced to -2.78.

So delta dollar came back down to an acceptable level of $11,000.

The adjustment reduced the risk on the upside (which is the side that the price is heading to) at the expense of increasing the risk on the downside.

Since this adjustment is a debit, this reduces our profit potential, which can be seen on the payoff graph.

Therefore, we are willing to reduce our profit target.

We are okay to take $300 profit on this trade now, instead of $600.

The next day on May 24, the price reversed back down to where it had been previously.

Both short strikes are at the 13 delta, which is perfectly centered.

We don’t need our call vertical hedge, and we decide to take it off before we lose more money on the hedge if the market continues to go down.

Date: May 24, 2022

Price: SPX @ 3890

Sell one Jun 17 SPX 4040 call @ $46.95

Buy one Jun 17 SPX 4080 call @ $35.25

Credit: $1170

The next day, the market whipsaw back up.

The position delta is -7.7. Delta dollar of –$30,453 is twice our initial delta dollars.

The P&L is –$890, which is past our stop loss point of $760.

So we would exit the trade with a loss of $890, which is -12% of the initial capital invested.

What Could We Have Done Differently?

The trade might have worked out if we had given it more duration than 28 days to expiration.

The market was just moving too much for this duration of a trade.

It might have also worked out if we checked on the trade multiple times per day instead of just once a day.

We might have been able to make the vertical spread hedge earlier instead of when the P&L was almost at our stop loss.

This is yet another reason for longer-duration trades.

If you cannot check the trade frequently enough, give it more duration.

FAQs

Why are most of the examples in RUT?

RUT is just the underlying that I’m used to trading condors on.

But yes, I do prefer to trade condors on indices such as RUT and SPX.

Because they are cash-settled, there is no assignment risk.

I do trade condors on liquid higher-priced stocks.

But stocks have company-specific events and announcements that can cause large moves in the price.

So I have to watch out for earnings events.

Even without such events, stocks generally move more on a percentage term than the indices.

For condors, we don’t like price moving.

What is the best condition to put on iron condors?

Condors work best when implied volatility is in the upper end of the range, but you still think the market will stay within a range.

That is why many traders like to put on condors on a day when the market is down, which means implied volatility has gone up.

An ideal time for condors on indices is when VIX is between 15 to 25.

Above 25, condors can still be done, but you have to be careful that the price is not moving too much or the market is in backwardation or is behaving crazy in general.

An exception may be when VIX has spiked (maybe touched the upper Bollinger Band) and is now coming down.

You want to be in a condor when volatility drops because condors benefit from dropping volatility.

As the market falls, VIX increases.

This is normal. But sometimes, after the market has been trending down, you see a down day where VIX is down.

That means fear subsides and may also be another good time for iron condors.

Another metric is to look at ATR falling.

It means the candles are getting smaller; the price stabilizes and consolidates.

Is it possible to make 10% each month using iron condors?

It may be within the realm of possibility.

But a 10% portfolio return per month is not a realistic expectation.

In our example trade, we are setting a take-profit of 10% return on one trade.

If you average in all winning trades and losing trades, the average return per trade is lower.

Suppose you increase the take-profit percentage, then yes, it is possible to have an average return of 10% on iron condors trades if you turn over iron condors every month.

However, that only means the condors are making a 10% return on the capital allocated to condors.

It does not mean that your portfolio makes a 10% return a month since you are not allocating 100% of your portfolio to condors trades.

Or at least I hope you are not. Otherwise, the drawdown would be quite hard to bear when a series of losing condor trades come.

Even when market conditions are ideal, I only allocated 20% of my portfolio to iron condors. When conditions are not ideal (as in the conditions of 2022), the allocation may be much less.

If 20% of the portfolio is in iron condors, they make 10% a month.

That only means condors contribute only a 2% return a month to the portfolio.

Conclusion

Iron condors are one of my bread-and-butter strategies.

I hope this article has provided some insight regarding how I think about whether to take profits, where to position strikes, and how to make adjustments.

We hope you enjoyed this article on selling iron condors.

If you have any questions, please leave a comment of send an email.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/selling-iron-condors/