Unusual Whales is an options analytics platform that mainly focuses on unusual options trades through monitoring option sweep and block trades.

They have many other tools available, though, that make this platform slightly different than some of the other options flow platforms out there.

They give users access to Gamma exposure across strikes and tickers, allow historical flow downloads, and follow/track high-profile portfolios such as Nancy Pelosi and Dave Portnoy.

These are just some of this platform’s features, though we will look at all the features Unusual Whales has and whether it is worth it for a trader.

Contents

-

-

-

-

-

- Options Tools

- Stock Tools

- Ticker Explorer

- Other Tools and Data

- Drawbacks

- Education and Pricing

- What’s The Verdict

-

-

-

-

Options Tools

Outside of the congressional trading tweets, Options flow is what Unusual Whales is probably best known for.

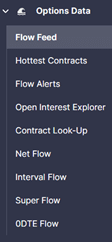

They have options flow trackers that help traders analyze option flow in almost any way possible. In addition to the “Flow Feed,” which we will take a deeper look at below, they also have pre-built feeds that allow a trader to view different aspects of the options activity for that day.

Some of these feeds include:

0DTE Flow – This options flow only displays trades on contracts expiring the same day for a selected ticker. You can see which side, the volume, and the pace of the trading.

Net Flow – This allows you to monitor the next options premium for a specific ticker over the day. You can visualize it by either total call and put premium or just by net (long vs short) premium regardless of side.

Hottest Contracts – This is pretty self-explanatory; this feed shows you the most popular contracts throughout the day.

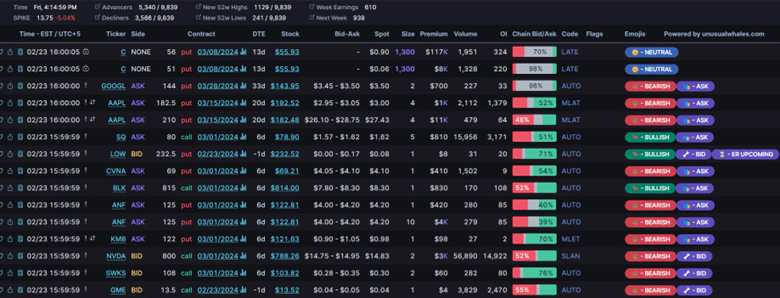

Flow Feed – This is their flagship tool and shows you every options trade that comes across the books as they happen during the day.

This allows a trader complete access to the order book, and Unusual Whales has done a great job with its interface.

It allows a trader to filter this data however they see fit.

Traders can filter by expiration date, open interest, volume, sector, index, skew, trade type (Sweep, Block, etc.), and conditionals such as volume > Open Interest.

The actual display interface is very clean and provides more than enough data for the contract, such as strike, ticker, underlying price, volume, open interest, order type, and more.

Finally, they have these flags called “Emoji Trading,” which assigns certain emojis to certain order flow types. This is not my favorite thing as it seems cluttered, but many traders like this feature.

Stock Tools

Now that we have completed a brief overview of some options tools let’s look at some stock tools.

Unusual Whales has this data under two separate tabs on the navigation menu: Market Data and Stock Data.

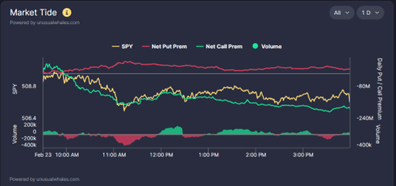

Under the Market Data section, traders have access to the Market Overview, which shows the net overall put and call premium in addition to the SPY index price, popular tickers for options flow, and how other index ETFs are doing.

Under the Market Data sections, traders can also access a stock screener.

Still, unlike traditional screeners, the Unusual Whales screener allows a trader to look for stocks based on options flow details.

Additional tools include news, Sector and ETF flow, and analyst ratings.

The second location for stock information is under the Stock Data section on their navigation bar.

This has other unique tools like a Pause/Halt feed that shows which tickers were halted in real-time along with several other pieces of information such as volume, time of halt, the reason for halt, and the sector that the name trades in.

Two other closely related tools are the Dark pool and Whale feed.

The dark pool feed shows the trader the dark pool trades, the size, volume, and settlement information.

The Whales Feed shows similar information but focuses more on unusual equities trade that doesn’t necessarily happen off-book (in a dark pool).

Ticker Explorer

The next set of tools we will focus on are under the Ticker Explorer heading on their navigation menu, and these tools focus on individual statistics about a selected ticker.

The first section is the overview tab; it shows all the remaining sections in one dashboard-like appearance.

Next is their charting tab, which allows the trader to chart the stock right inside the Unusual Whales Platform through a Tradingview-style chart; after that are the Volatility and Gex tools. The volatility tool shows every possible volatility metric a trader can think of.

It shows the smile (an actual measurement), skew, reversal skew, term structure, and volatility by options strike, just to name a few of the calculations available.

The Gex tool is next down the list, which measures a ticker’s Gamma exposure, Vanna, Charm, and Delta exposure.

This is pretty simple: You can select the measure you want, and it will display it for you. To the right is a Gex example on Telsa stock.

These are a few of the more popular tools in this section.

Traders also have access to things such as analyst opinions, seasonality, greeks, option chain data, earnings, shorts, and insider transaction data.

This is incredibly useful information regardless of what kind of trader you are.

Other Tools and Data

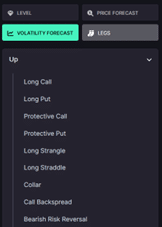

Several other tools are potentially worth highlighting on the Unusual Whales platform, the first of which is the Options Strategies tool.

This is an educational tool, but it has a few twists that make it incredibly useful to a trader. First, a beginner can simply click on the strategy and learn how it works with a nice visual graph.

For more advanced traders, you can select volatility or price forecast, and the module will display options and strategies that will benefit from your forecasted action.

For instance, if you think that volatility will increase in the coming weeks, you can select “Volatility Forecast” and choose “Up,” it will display all the strategies that benefit from increased volatility. See the screenshot to the left.

Think of this like a scanner but for the strategy instead of the stock.

The next tool is the options calculator.

This tool lets you load up a ticker and an options strategy and instantly see the profit and loss profile of the strategy.

There is nothing super fancy about this tool; it’s just very useful to have it built into the platform.

After that is the “Portfolios” tool, and if you have ever seen one of their tweets about tracking congressional traders, this is where you can view the information.

Here, you can search for a fund, manager, politician, or even celebrity if they trade and see what their portfolio moves are like.

Currently, this tool is available at an additional subscription, which we will discuss in a later section.

The last two items worth reviewing are the data shop and their API. Included with your subscription is a small credit to their data shop (at least at the time of this writing), which allows the trader to download historical information for a ticker that consists of either price data or options trade data.

The prices depend on the type, granularity, and length of the data required, and you can always pay for the data if your credits don’t cover it. Finally, there is their new API.

Currently only available to Lifetime subscribers, it allows you access to many of these tools in a data format that can be used programmatically.

This won’t matter to most people, but it is a cool feature for someone looking to fine-tune their trading strategy.

Drawbacks

With descriptions of most of the tools above, let’s discuss some of the drawbacks of Unusual Whales.

First, there is a cost associated with this tool. It’s not particularly large, but it’s still a recurring cost.

Second, if you are looking for more traditional scanners for your trading, this is not the place to go.

Their scanning tool is very comprehensive but almost entirely options-based, so you will be hard-pressed to find anything around equity price or fundamentals.

Third, there is your trading strategy.

This tool is probably not for you if you are more of an investor than a trader.

This is aimed at more active traders who want information on volatility, Gamma, options flows, and large trade prints; it would be overkill for a long-term investor.

Lastly, there is the learning curve and sheer volume of information.

It can be incredibly intimidating if you aren’t familiar with trading options flows and using options as a tool to help source trade.

They do have an incredible community and education resources, though, which we will look at now.

Education and Pricing

Unusual Whales has a very active discord community where many traders share how they use the tools and trades they are looking at.

The mods and power users are also very helpful if you have questions about the platform or how to use it.

In addition, several Twitter accounts focus solely on creating scanners to use with Unusual Whales, and they usually post tutorials about them and the platform.

If neither of those is something you want to use, they have an education section on their website about options in general and their tools and an exclamation point (!) somewhere on each tool that shows how to use it and the information it displays.

Price-wise, Unusual Whales is pretty competitive, coming in at $48/month for their standard subscription.

They also offer a yearly plan with additional perks, such as the portfolios section, for $448/year.

As mentioned above, one can purchase the portfolios section for an additional $10/month.

What’s The Verdict

Now that you have seen all of the tools that Unusual Whales have to offer and some of the drawbacks, what’s the verdict?

Is Unusual Whales worth it?

If you are a long-term investor or swing trades for months at a time, this is probably not a tool for you. It would not match your trading style and would likely be a $48/month waste.

If, however, you are an active options trader, there is a potential benefit for this tool if you can afford it.

The options scans, the live flow, and access to options data could really help hone your trading strategy.

Ultimately, though, the decision is whether you can afford the service at $48/month and if you can see these tools helping your trading.

We hope you enjoyed this Unusual Whales review

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/unusual-whales-review/