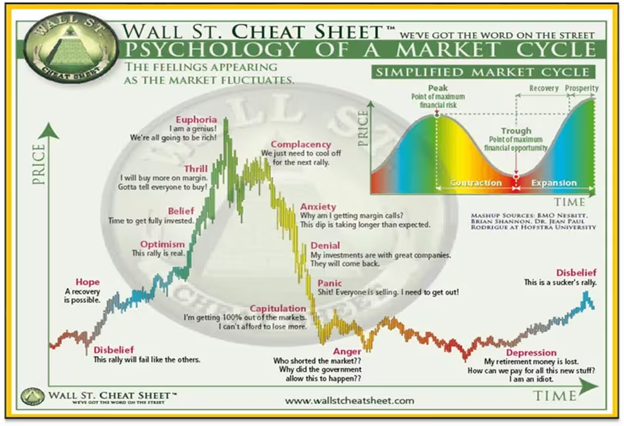

The “Wall Street Cheat Sheet” has been around forever; it’s just been known by many different names.

It visually represents what drives every market everywhere: human psychology.

By understanding the nature of market psychology and how it affects market cycles, you can better prepare for them and make more informed investment decisions.

Below, we will look into each section of the Cheat Sheet, some of the major characteristics, and potential ways to trade them.

Contents

-

-

-

-

-

- Disbelief

- Hope

- Optimism

- Belief/Thrill

- Euphoria

- Complacency

- Anxiety/Denial

- Panic/Capitiulation/Anger

- Depression

- Conclusion

-

-

-

-

Disbelief

First, let’s start with the End/Beginning of the cycle.

In the disbelief stage of the cycle, the market has come off a steep drop, often 20% or more (the classical definition of a bear market). In this stage, no one believes the market will rebound, and they are preparing for more pain.

This is where you buy dividend stocks and continue to average in.

There is no upside priced into the markets, and many deals can be had.

You can best position yourself for the next bull market in this situation.

Hope

The cycle’s next stage is hope when investors slowly realize that the investing winter is over.

Markets seem much more stable, and price appreciation is more consistent here.

Similar to Disbelief, simply Dollar Cost Averaging is the best trade here.

Buying solid growth names is also good here if you have additional capital.

Prices are increasing, but there is still some trepidation.

Optimism

This is the point in the cycle where the news narrative shifts.

That is a hallmark of this stage when all talking heads believe the market has entered a new bull run.

The difference between this and later stages is also what preceded it.

For us to be at the optimistic stage, the market must be coming off a bear market/crash and have been stagnant for some time.

Now is the time to add more capital to the markets in general.

Prices are starting to advance more quickly.

Belief/Thrill

These two are lumped together because they often have interchangeable characteristics.

In these two stages, the market is the place to be; it produces outsized gains compared to the more conservative investments that were popular during the last phases.

In this stage, the market will often dominate the news cycle, and you will start to hear about people who have made staggering sums of money and were long from the bottom.

This is the time in the cycle to get most aggressive.

Holding less cash and cash equivalent securities and staying mostly invested in the indexes and stocks.

Euphoria

This is the point where everything always wins.

Companies with no publicly traded business will get IPOs and trade at crazy multiplies of sales, often with no real earnings (think the SPAC craze and WeWork).

Here is the point where everyone will have a market tip for you, and even people who have never shown any interest will want to tell you what they are invested in.

This is the point to start transitioning back to cash/equivalents.

Always stay partially invested in the market, but at this point, take profits or buy protection using puts.

It’s okay to miss the rest of the move because the risk/reward is lopsided against you.

Complacency

This likely occurs after a market correction of greater than 10%.

People will talk about the market’s ” overheated ” and how this correction and sideways action is “constructive,” this is met with violent rallies that often give hope of a continued upward move but are almost always met with more selling.

This is the point to sell and take profits and money out of the market if you haven’t already; this is the last stop before we start to lose ground.

Anxiety/Denial

Again, these two are lumped together because they are often interchangeable.

Here, we have broken the low made after the Euphoic top, and selling is starting to intensify.

News is running about how days are red, and the Fed/Banks need to help stem it; this is where people start to cope with the price action “just a big dip” or “the next buying opportunity,” especially those who buy in the euphoria stage.

You should be back to just Dollar Cost Averaging using the profits from the last few stages.

Panic/Capitiulation/Anger

Again, these are all grouped because they likely happen around the same time.

The average trader is now severely red on the account, margin calls have likely started, and they are angry and short-sellers, the government, and themselves (although they often don’t know the last one).

Price action here is the most violent, as everyone wants to be out of the market.

The savvy investor just continues to dollar cost average here.

Let those profits from the top go back to work.

This stage marks the end of the major selling, so some investors start to ramp up capital even if they are early.

Depression

The last stage in the cycle is when everyone says they will never invest again.

The late 2000s and early 2010s have flavors of this.

People are beaten down when they have lost huge amounts of money, and their retirement accounts look terrible.

Many are now sitting in cash, having closed at or near the bottom of the move.

This is the stage that every Dollar Cost Average advocate references; due to the preceding panic, many active traders will miss buying at or around the bottom, so Dollar Cost averaging truly is the best trade here.

Slowly accumulating shares for when the market rebounds.

Conclusion

Here is a high-level breakdown of all the Wall Street Cheat Sheet stages.

While everyone always thinks about how these work on large 2008 and Tech bubble-style crashes, it’s important to note that the same psychology is also at play in normal market rotations.

It’s all about psychology and where you are from.

While it’s nearly impossible to catch the absolute bottom and absolute top, having some idea of where we are in the cycle is helpful for your investing and trading.

We hope you enjoyed this article on the Wall Street Cheat Sheet.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/wall-street-cheat-sheet/