Webull vs Robinhood is a common comparison in the online trading app world.

Traders who want the lowest possible fee schedule will definitely want to check out Robinhood and Webull. These two existed before zero commissions were the norm. But is either one of these better than the other?

Here’s our answer. . .

Webull Overview

Webull is a recent entrant in the brokerage world, starting in just 2018. Despite its young age, it has managed to put together quite an undertaking in just two years. The broker has improved its software and has added more tradable assets.

Robinhood Overview

Robinhood started just five years before Webull, so it’s not exactly a seasoned veteran in this comparison. Robinhood carries the distinction of sparking the race to $0 commissions. And it, too, has managed to add services over its brief existence.

Investment Vehicles and Services

Traders at Robinhood can buy and sell the following assets:

- Stocks

- Closed-end funds

- ETFs

- Options

- Cryptocurrencies

Webull offers the same list minus digital currencies. The broker-dealer has been promising a launch of cryptocurrency trading for some time now but hasn’t delivered.

Webull does succeed in providing access to IPOs. Robinhood customers can submit limit orders before an IPO goes live, but the service isn’t full IPO participation.

Both brokerage firms offer penny stocks but not over-the-counter instruments. Webull has a minimum share requirement on the buy side for penny stocks. To buy a stock priced at $1 or less, you’ll have to order at least 100 shares. If it’s priced at 10¢ or less, the requirement is 1,000 shares.

Dividend reinvesting and fractional-share trading are both available at Robinhood. Webull offers neither.

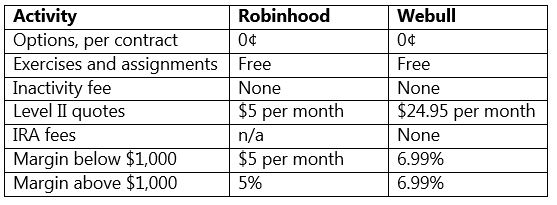

Pricing

Although Webull and Robinhood have similar commission schedules, there are a few differences.

Neither broker charges any software fees, but lets see where they differ.

Software

Both Webull and Robinhood offer digital trading tools that share some features in common. But there are important differences, too.

Website Trading

Each broker-dealer in this survey has a simple but usable website with trading capability.

Webull: Brief security profiles are available on Webull’s site without a login. After logging in, you’ll get the firm’s browser-based platform. One of the first features I noticed was simulated trading. This of course is a great way to learn the software.

The platform’s order ticket incorporates bracket orders. The stop-loss and take-profit orders have to be turned on with toggle switches. Extended-hours trading can also be enabled with a drop-down menu.

Webull’s platform offers full-screen charting with the following features:

- 14 drawing tools

- Linear, logarithmic, and % scales

- 11 technical indicators

- 8 graph styles

Robinhood: Charts on Robinhood’s web browser platform also can be displayed the width of the screen. However, the software only provides 2 graph styles. And I could only find 4 technical indicators.

The order ticket doesn’t include bracket orders, but there are limit and stop-loss orders that can be added later.

Robinhood doesn’t offer a simulated-trading mode, which is another weakness compared to its rival here. But its trade ticket does have the ability to trade fractional shares, a nice feature.

Desktop Platforms

Webull: Webull’s software has the ability to function as a discrete desktop platform if you prefer that setup. The features and interface are almost identical.

Robinhood: No desktop platform here.

Mobile Apps

Webull: The broker’s mobile app has many great features, including:

- A community forum

- Trading competitions in simulated mode

- Advanced charting

- OTO orders

Robinhood: Robinhood’s app doesn’t quite have the same level of trading capability. For example, the platform doesn’t have OTO orders. And charting is very elementary. There is also no demo mode.

Customer Service

Webull: Customer service is available over the phone at Webull during regular market hours. Besides a toll-free number, the broker has an email address and a lengthy list of FAQs. Missing are branch locations and online chat service.

Robinhood: Robinhood looks much the same here. It has an extensive question and answer page, but no branch locations. It does have a form email service that requires some online fields to be pre-filled.

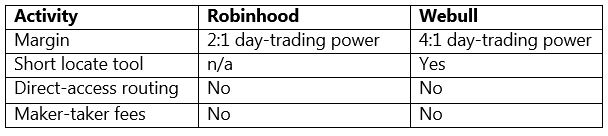

Day Trading

Day and swing trading are possible at either firm, although some services aren’t available.

For example, Robinhood doesn’t permit short selling.

Robinhood offers pattern-day trading protection. The feature can be turned on inside the mobile app. Within the settings menu, tap on Investing and then Day Trade Settings.

Cryptocurrency Trading

Webull: Webull has been promising a crypto trading service since I can remember. It has a waiting list, but that’s it for now.

Robinhood: Traders who actually want to trade cryptocurrencies can do so at Robinhood right now. Keeping with the broker’s original pledge, there are no commissions.

Currently, there are seven cryptocurrencies available at Robinhood. They are:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Dogecoin (DOGE)

Robinhood also provides quotes on a host of other cryptos. Trading is possible on both the website and mobile app. The broker doesn’t provide a great deal of information on these assets, however.

During my investigation, I found just quotes and news articles.

Options Trading

Webull: Although Webull hasn’t succeeded in rolling out cryptocurrency trading, it has succeeded in launching options trading. Level I and Level II options trading can be added to any brokerage account. Level III spreads are not yet available, which puts it at a disadvantage compared to its rival here.

Traders can buy and sell long calls and puts in either cash or margin accounts. Covered calls and cash-secured puts can only be traded in a margin account.

Option chains for calls and puts can be found on Webull’s computer platform. Expiration dates appear in a top row. Strike prices appear vertically. Other columns exist for:

- Open interest

- Implied volatility

- Last price

- Volume

- Bid

- Ask

Quotes on option prices are delayed by 15 minutes.

Although the trading experience is rather simple, it gets even more basic on the broker’s mobile app. Here, there is less trading data. For example, implied volatility and open interest numbers are missing.

Robinhood: One of the first differences I noticed on Robinhood’s browser platform was the ability to trade multi-leg strategies. I did have to create these myself as spreads are not integrated in the software.

Somewhat oddly, the trading experience is more advanced on Robinhood’s mobile app. There are pre-installed strategies on Android and Apple phones. Straddles and strangles are two examples.

Neither platform offers traditional chains, which is Webull’s format. Instead, Robinhood’s mobile app has buttons for bullish, bearish, and neutral sentiments. The platform recommends trades based on a selection.

Robinhood’s website uses call and put and buy and sell buttons. Then you click on the contracts you want to add to an order.

Security Research

Webull: Webull has a stock screener (but not an ETF or option screener). It offers just a few search variables, such as:

- Exchange

- EPS

- Technical events like:

- MACD Golden Cross

- Bullish engulfing

Stock profiles have a large amount of details, including trade stats and analyst recommendations. The latter come from multiple analysts. Facebook has trade recommendations from 51 analysts, for example.

Robinhood: Although I wasn’t overly impressed with Webull’s simple stock screener, it’s more than Robinhood offers. The broker has no screener at all. It does provide Popular Lists of stocks and funds. Examples include China and Consumer Goods.

Clicking on one of these tags will produce a list of stocks. The list can be sorted by price, market cap, and symbol.

Bottom Line

Neither Robinhood nor Webull is ideal for day trading. But they do offer basic trading tools that can be used to trade a variety of assets with low margin rates.

However, based on software and tools we do think Webull has the advantage over Robinhood.

The post Webull vs Robinhood – Which One Should You Choose? appeared first on Warrior Trading.