There are many different options an investor can trade. One way to differentiate these options is whether they are in the money options or out of the money options.

This article will define in-the-money options and talk about some thoughts on when we should trade them.

Let’s get started.

Contents

-

-

-

-

-

- The Basics, What are In the Money Options?

- Intrinsic Value And In the Money Options

- Are In The Money Options Always In The Money?

- Should I Buy In The Money Options?

- Should I Sell In The Money Options?

- When to Trade In The Money Options

- Liquidity for In The Money Options

- Concluding Remarks

-

-

-

-

The Basics, What are In the Money Options?

Determining whether an option is in the money is very easy.

For calls, any strike below the stock’s current price is in the money.

If the strike is above the current price, the option is out-of-the-money.

Conversely, for a put, any strike above the current price is in the money.

If the put strike is below the current price, it is out-of-the-money.

As would imply, unless the stock is trading exactly at the strike price, one leg, either the calls or the puts, will be in the money at all times.

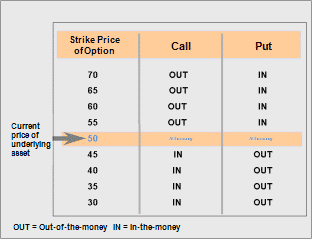

Let’s look at an example with the underlying trading at $50.

We can see that calls are in the money for any strike below 50, while puts are in the money for every strike over 50.

Source: TradeStation

Intrinsic Value And In the Money Options

Whether or not an option is in the money will directly affect how much the option is worth.

An option’s value is determined from two variables: Intrinsic and Extrinsic Value.

The intrinsic value of options contracts is what they would be worth if they were executed today.

Extrinsic value is the time value remaining on the contract.

Due to the definition, all in-the-money options will have intrinsic value.

This intrinsic value will be the difference between the share price and the trading price.

The option will also most likely have some extrinsic value.

This is unless the option is very deep in the money and the strike has no chance of being breached.

Both of these together will result in the options premium or current trading price.

Are In The Money Options Always In The Money?

As the price of the underlying moves around, an option first purchased in-the-money can move out-of-the-money if the stock price falls below the strike price (in the case of a call) and likewise for a put if the stock price rises above the strike price.

This, generally speaking, will cause the option to decline in value as while maintaining extrinsic value, the option loses its intrinsic value.

Conversely, options bought or sold out-of-the-money can trade in the money if the same thing happens.

This is important for people who buy out-of-the-money options as the value of an options contract on expiration is simply its intrinsic value.

Thus celebrate if your option is in the money on expiration as a buyer but cry yourself to sleep if the same happens and you are a seller!

Source: Wikipedia

Should I Buy In The Money Options?

Many investors will advocate only buying in-the-money options.

Their thesis mainly revolves around these options having less extrinsic value than at-the-money options, thus will suffer less from theta decay.

They also view this as a more conservative options strategy than buying out-of-the-money options.

Despite this, for a single contract, an in-the-money option has more risk than an out-of-the-money option.

This is because the in-the-money option has higher intrinsic value and thus more premium than the out-of-the-money contract.

Due to this, the delta is also higher.

The most we can lose on a single contract is the premium paid.

We have a lot more risk with the in-the-money option.

An in-the-money option indeed has less theta than an at-the-money option.

Though this thought also implies that the investor believes the theta and, therefore, gamma is overpriced.

If they believed this, why not simply buy shares in the first place instead of trading the options?

Should I Sell In The Money Options?

Conversely, many people will argue for selling in-the-money options due to the large premium received.

Despite this, the only reason this oversized premium exists is because of the large intrinsic value of the contract.

This premium is only ours to keep if the option ends out-of-the-money.

Since it is in the money as easily as it can expire worthless, it can simply move further in the money, increasing its premium and intrinsic value tick by tick.

When to Trade In The Money Options

These are a few of the misconceptions when trading in-the-money options.

Despite this, trading in-the-money options can be very smart in given circumstances and conditions.

The first is that an investor has a strong directional view of the future price of a stock.

As in-the-money options have a higher delta than out-of-the-money options, they will act more like stock and less like a volatility product.

In-the-money options allow an investor to express this view while still having a risk defined structure.

For example, short selling is risky, both as shares could be called and that ultimately a stock has an unlimited risk to the upside.

Buying in-the-money puts can sometimes be used as an effective alternative.

Both short selling and in-the-money puts will benefit significantly from a decline in share price, yet if we are wrong about our view, the most we can lose for the in-the-money put is the debt we paid.

This can prevent losses spiralling out of control in the example of a short squeeze or unimaginable situation (such as GME and AMC).

Conversely, in-the-money calls can be wise in certain situations.

Investors often like to bid up out-of-the-money options due to their lottery-like payoffs.

This can lead to sometimes overpriced volatility and call skew on these options.

If an investor was bearish and thought these out-of-the-money options were expensive, they could sell them, but what if they are bullish?

Well, they could trade a covered call, sell an in-the-money put or buy a call vertical where they buy the in-the-money call while selling the out-of-the-money call.

All these options express a bullish view with overpriced call skew.

Liquidity for In The Money Options

Some investors do not like to trade in-the-money options as they argue they have less liquidity.

This claim can sometimes be partially true.

As investors trade more frequently, out-of-the-money options, those spreads tend to be marginally tighter.

Despite this, even if spreads are wider, you will not necessarily pay that much more.

This is because, almost always, between the spread, there is hidden liquidity.

If you have a competitive order, a market maker will take you up on a trade, even if it is for a few extra pennies for their part.

In addition, sometimes the spreads may appear to be wide when they are really not due to the large value of the contracts.

For example, the spread between a bid and an ask of nine cents and ten cents is the same as the spread between nine and ten dollars.

Nevertheless, it is a fair point that liquidity can sometimes be worse.

Do not force a bad fill if you are not getting filled at what you consider an advantageous price for you on an in-the-money option.

Concluding Remarks

In-the-money options are options that can be exercised with intrinsic value.

This means that for in-the-money calls, the option’s strike price is below the current trading price.

For in-the-money puts, the strike price is above the current trading price.

There are advantages and disadvantages to trading in-the-money options.

They can make them a perfect choice in some scenarios and not in others.

It is important to note that generally speaking, trading in-the-money options involves a directional bet with also a smaller volatility component.

While liquidity is often less on in-the-money options, this is often overstated, and most popular tickers will have liquid in-the-money options to trade.

Do you frequently trade in-the-money options?

Are there any strategies you like to use?

If so, I would love to hear some of your ideas in the comments below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

The post What Are In The Money Options first appeared on Options Trading IQ.

Original source: https://optionstradingiq.com/in-the-money-options/