Contents

- Introducing The Albatross Spread

- How Are They Different?

- Does That Mean One Is Better Than The Other?

- What Are The Greeks?

- Fun Fact

- FAQs

- Conclusion

The albatross spread is a cross between an iron condor and a butterfly.

It is also known as a wide iron condor where the wings are very large.

Let me explain.

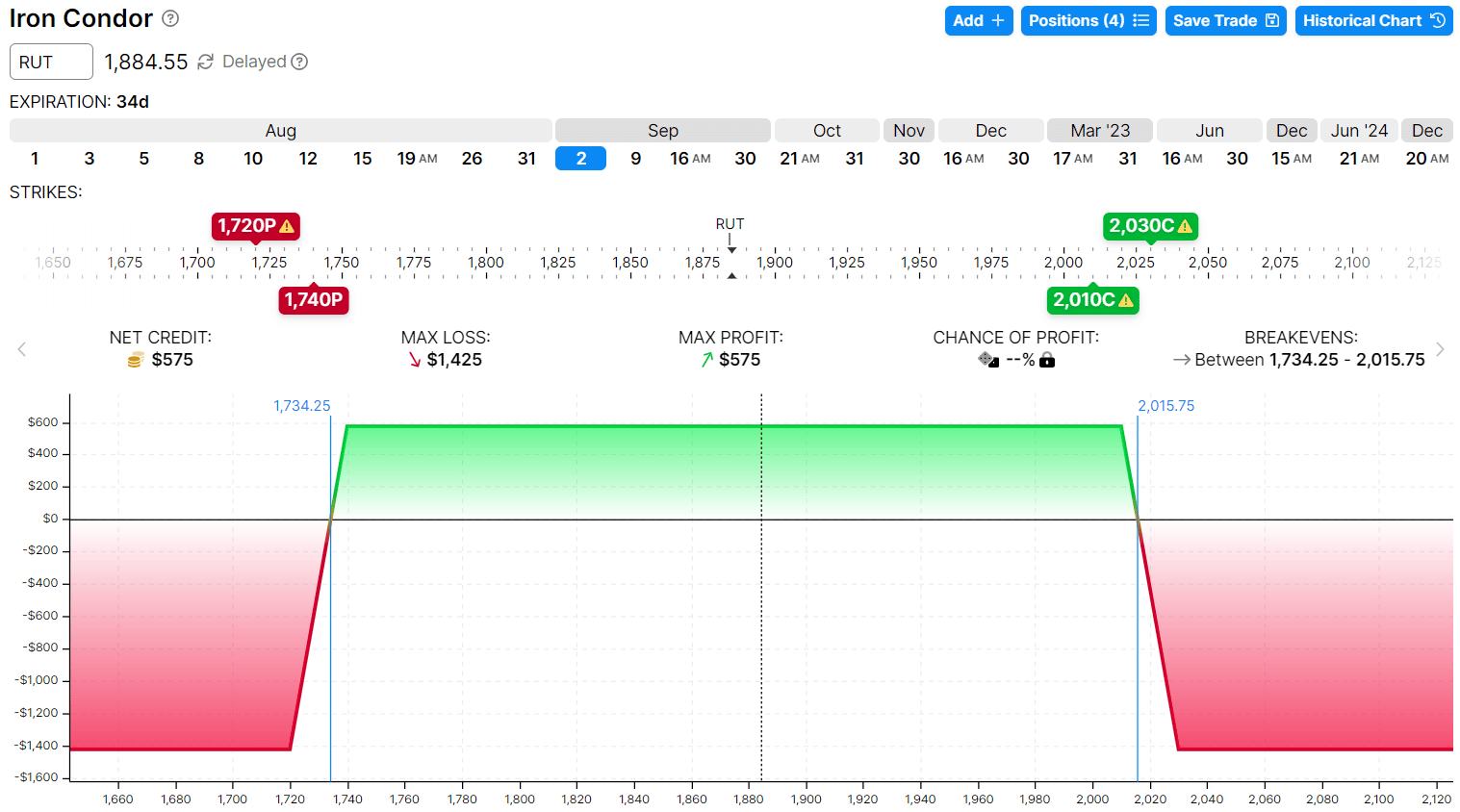

The below is a typical far out-of-the-money iron condor that we typically like to do.

Date: July 29, 2022

Price: RUT @ $1884

Buy one Sep 2 RUT 2030 call @ $8.60

Sell one Sep 2 RUT 2010 call @ $11.55

Sell one Sep 2 RUT 1740 put @ $16.80

Buy one Sep 2 RUT 1720 put @ $14.00

Net credit: $575

Max Loss: $1,425

Max Reward: $575

Delta: -0.009

Vega: -0.37

Theta: 0.119

The short strikes are at around 17-delta, and the wing widths are 20 points apart.

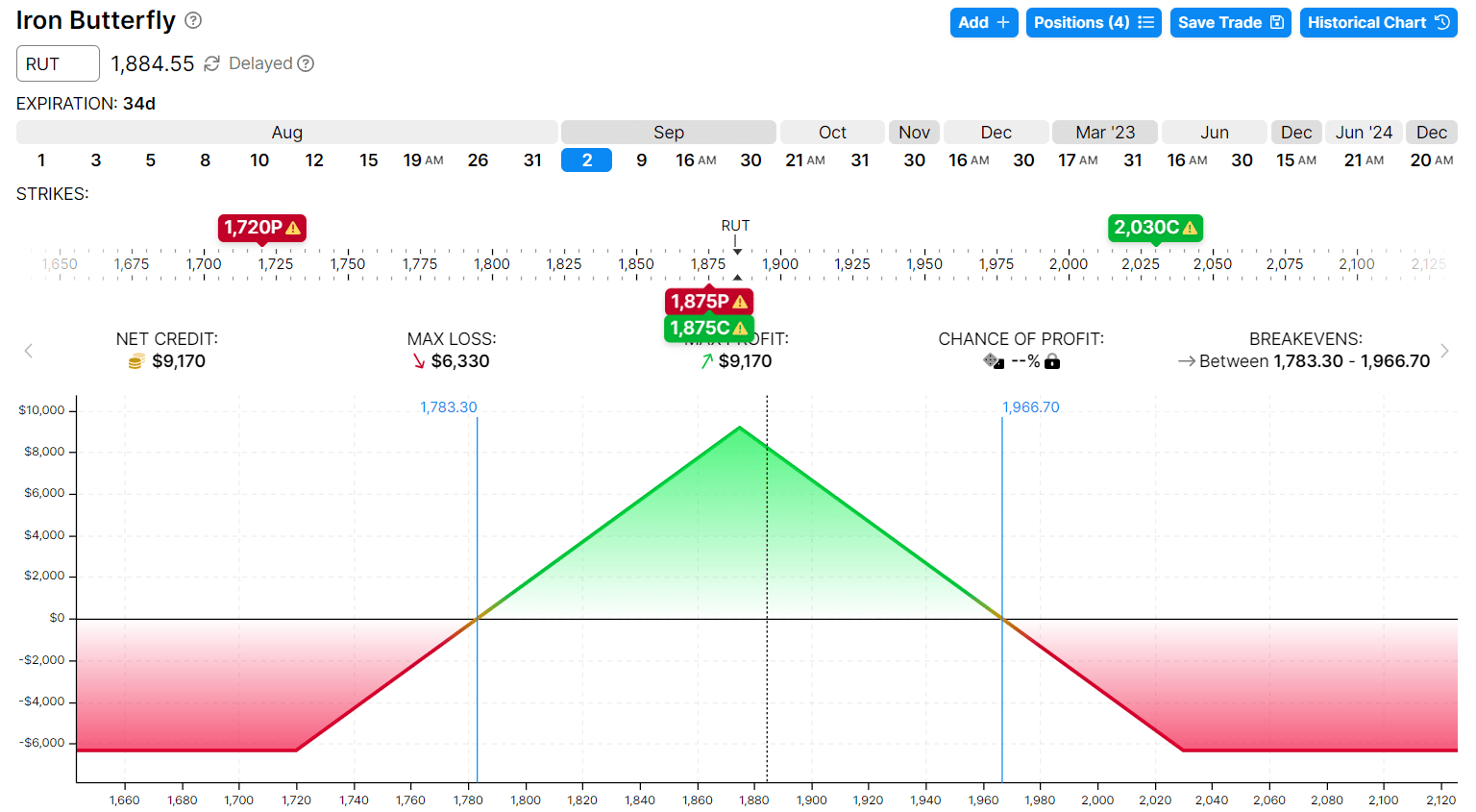

The butterfly options spread is when we move the two short strikes to the at-the-money strikes like this:

Date: July 29, 2022

Price: RUT @ $1884

Buy one Sep 2 RUT 2030 call @ $8.60

Sell one Sep 2 RUT 1875 call @ $61.85

Sell one Sep 2 RUT 1875 put @ $52.45

Buy one Sep 2 RUT 1720 put @ $14.00

Net Credit: $9,170

Max Loss: $6,330

Max Reward: $9,170

Delta: -0.094

Vega: -1.97

Theta: 0.657

Introducing The Albatross Spread

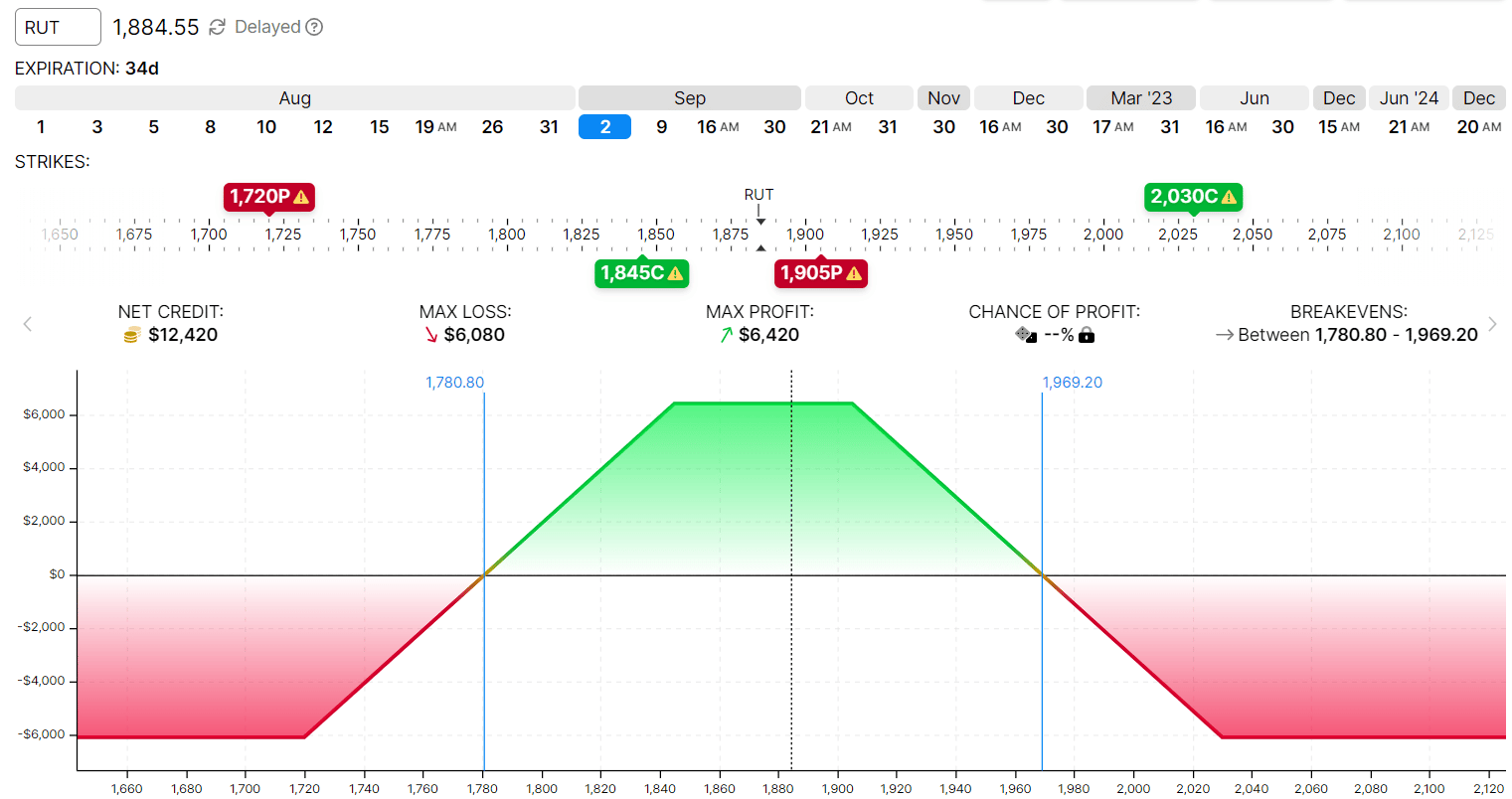

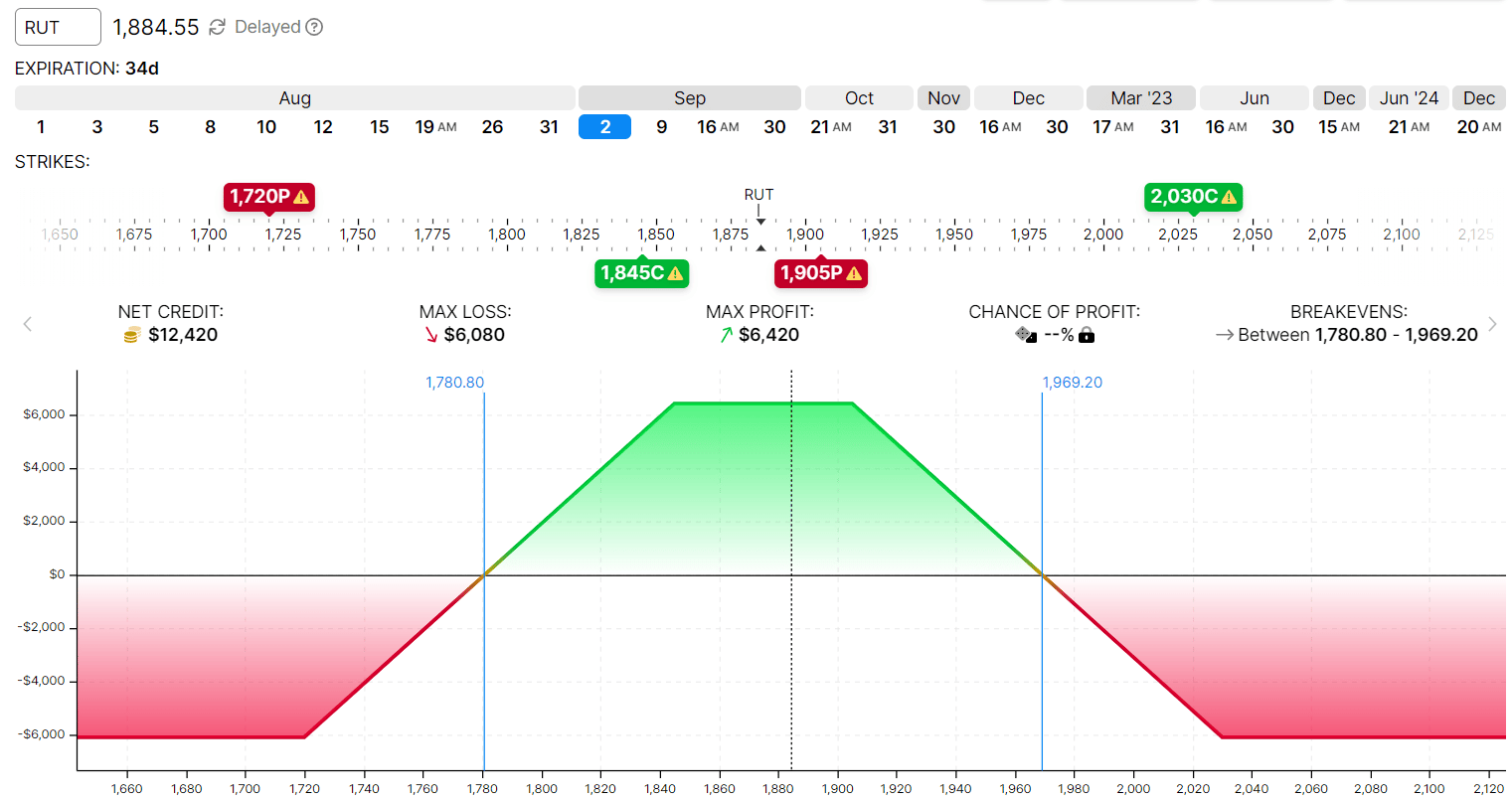

The albatross spread is in-between the two.

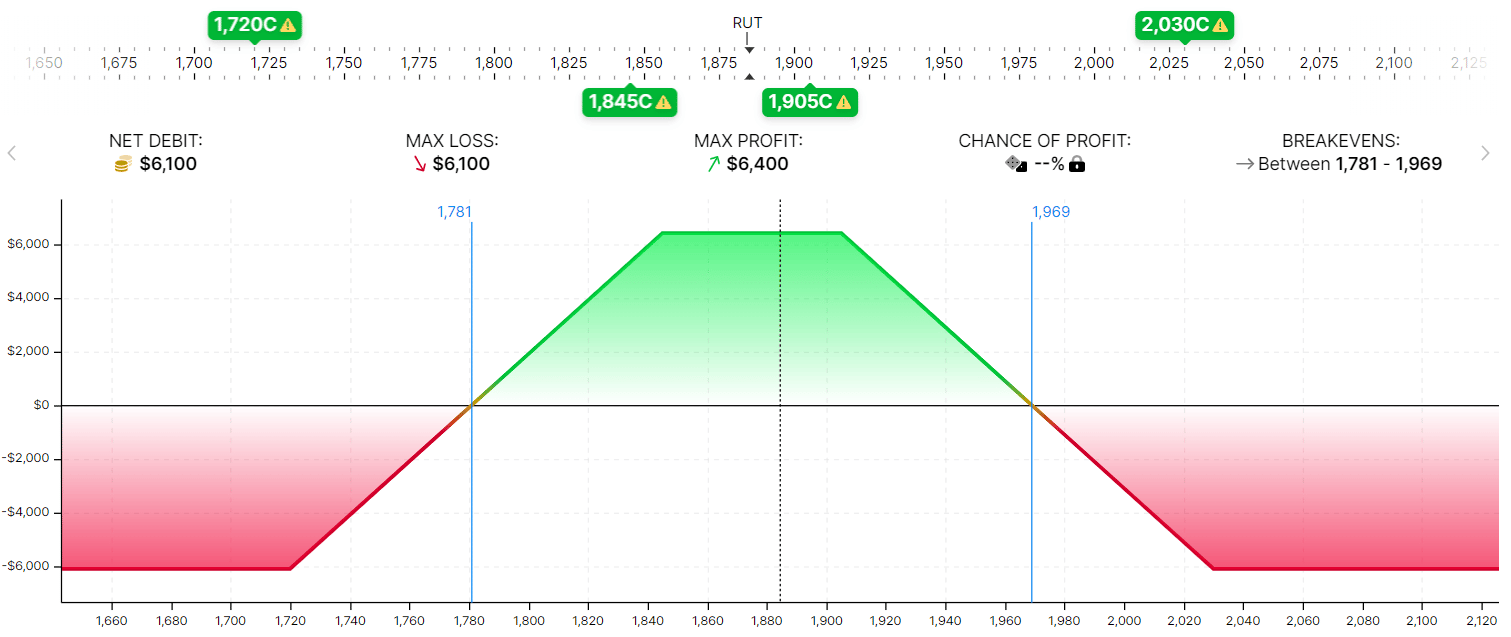

Date: July 29, 2022

Price: RUT @ $1884

Buy one Sep 2 RUT 2030 call @ $8.60

Sell one Sep 2 RUT 1905 call @ $45.80

Sell one Sep 2 RUT 1845 put @ $41.15

Buy one Sep 2 RUT 1720 put @ $14.00

Net Credit: $6,435

Max Loss: $6,065

Max Reward: $6,435

Delta: -0.087

Vega: -1.88

Theta: 0.626

It has short strikes at around the 60 and 40 deltas.

They are not at-the-money but much closer than that of the iron condor.

The width of the wings in our example is 25 points apart.

How Are They Different?

The main difference we notice is the risk-to-reward ratio based on the max risk and reward numbers.

The condor has a high risk-to-reward.

The butterfly has a lower risk-to-reward ratio. And the albatross has about a one-to-one risk-to-reward.

Does That Mean One Is Better Than The Other?

No, because the higher the risk-to-reward ratio, the greater the probability of profit.

The lower the risk-to-reward ratio, the lower the win rate.

When you have a favorable risk-to-reward ratio, you have a less favorable win rate.

And vice versa. It is a trade-off.

You can see that the iron condor has the highest probability of profit because you will be profitable if the price falls between 1734 and 2016 at expiration.

The butterfly has the least probability of profit because the expiration breakeven points of 1783 and 1967 are the narrowest of the three.

The albatross is in between the two, with expiration breakeven points at 1780 and 1969.

Although, in this case, the breakeven values are closer to that of the butterfly than to the iron condor.

We get the largest initial credit from selling the iron butterfly and get the least amount of credit from selling the iron condor.

The albatross is in between.

However, the amount of credit received is not a determinant of whether the trade is better or not.

What Are The Greeks?

The Greeks of the albatross are similar to the iron condor and butterfly.

The albatross, iron condor, and butterfly all have positive theta, with time decay being the profit driver.

They all are vega negative, which means that they benefit if implied volatility drops.

They all start out as delta-neutral trades. And they are all risk-defined trades.

Fun Fact

If you buy a large butterfly and then sell a smaller butterfly within it, you end up with an albatross.

For example, suppose you buy the iron butterfly as shown previously:

Buy one Sep 2 RUT 2030 call @ $8.60

Sell one Sep 2 RUT 1875 call @ $61.85

Sell one Sep 2 RUT 1875 put @ $52.45

Buy one Sep 2 RUT 1720 put @ $14.0

And then you sell an iron butterfly such as this one:

Sell one Sep 2 RUT 1905 call @ $45.80

Buy one Sep 2 RUT 1875 call @ $61.85

Buy one Sep 2 RUT 1875 put @ $52.45

Sell one Sep 2 RUT 1845 put @ $41.15

The resulting graph is the albatross in our above example.

FAQs

Can the albatross be done with all call options?

Yes, here is the same albatross but using all call options at the same strikes as before.

You may end up paying a debit instead of receiving a credit.

But the payoff graph and the Greeks are essentially the same.

You can change all the options to all puts and get the same thing.

This is the same reason that the butterfly and the condor can be done with all calls or puts.

However, it is preferable to do iron condors and iron albatross.

The word iron means to use both calls and puts.

Doing so lets you buy and sell only out-of-the-money options, which often have tighter bid/ask spreads.

While not applicable to cash-settled indices like the RUT, using out-of-the-money options decrease the risk of assignment when the strategy is applied to stocks and ETFs.

Is the albatross spread better than the iron condor?

Not necessarily.

One is not inherently better than the other.

There are pluses and minuses.

The albatross has a more favorable risk-to-reward ratio, whereas the iron condor has a larger win rate.

It is like asking whether the butterfly is better than the iron condor or not.

Neither are.

However, some investors may be more comfortable trading one or the other.

And some traders may like one more than the other.

Some traders will have more practice with more popular iron condors and hence have greater success with the iron condor.

But ultimately, the strategy’s success depends in part on the investor’s practice with the strategy and whether the strategy fits the investor’s personality.

It also depends on figuring out the optimal adjustment point and amount of adjustment for the particular strategy.

How is the albatross spread like an iron condor?

The albatross is an iron condor with closer-in short strikes and wider wings.

The net effect is that the albatross has a more favorable risk-to-reward ratio but a less favorable win rate.

As such, the albatross is preferred by traders that like a more favorable risk-to-reward ratio. And the iron condor is preferred by traders that want a better win rate.

The albatross and iron condor are both defined-risk delta-neutral premium-selling strategies. Hence they both have positive theta and negative vega.

They both benefit from time decay from volatility dropping.

Conclusion

Today we looked at another animal in the options zoo.

The albatross is a very large oceanic bird with long wings.

This is apt because the albatross consists of a put spread wing and a call spread wing.

The wings are wide, with a large separation between the short and long calls.

And a similarly large separation between the short put and the long put.

The wings are wider than the wings of iron condors.

Hence, they are known as wide-wing iron condors.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/albatross-spread/