There’s a concept in trading known as “carry trading,” which is basically how much the asset pays (or costs) you to own it, aside from price appreciation (although there are some exceptions which we’ll explore in this article).

A bond, for example, has positive carry in the form of regular interest payments.

On the other hand, buying a physical agricultural commodity might have negative carry because it doesn’t pay interest or dividends, but has storage and feed costs.

On the face of it, you might assume that a positive carry trade is always better than a negative carry trade. But we have to remember that markets are pretty efficient, and in effect, you’re typically “paying” for carry in the form of reducing your reward/risk ratio.

As a basic example, consider a high-dividend stock compared to a no-dividend growth stock.

The dividend stock has positive carry, but that is a result of the company paying out their earnings to shareholders because they’re too mature to grow more. Look at it as financing the dividend by reducing the potential price appreciation.

On the other hand, the growth stock has no carry at the shareholder level but because they’re reinvesting their earnings to grow more, has a much higher potential price appreciation.

Characteristics of Carry Trades

There’s a distinct difference between a trade with some carry and a “carry trade.” There’s no lines drawn, but if you enter the trade for the income without expectation of price appreciation, that’s a carry trade.

The equity curve of carry traders is typically marked by a smooth upward equity curve, followed by occasional blow-ups.

Think of something like a short-volatility ETN. It’s a slow grind upwards followed by nasty crashes when the VIX spikes. Let’s look at a chart of SVXY, an ETN that systematically shorts VIX futures during an 18-month period:

Types of Carry

A carry trade has evolved to mean anything that gives a smooth stream of returns. These don’t necessarily have to be fixed quarterly payments like those from bonds or dividend stocks.

As a matter of fact, many call passively investing in US indexes like the S&P 500 one huge carry

Examples of Positive Carry Trades

Futures Basis Trading

The “basis” in futures trading refers to the difference between the price of the spot price and the price of a futures contract on said asset.

For example, suppose the spot VIX index is at 18, while the front-month VIX futures contract is at 22. The basis here is 4, or the difference between spot and the futures price.

VIX futures trade at a premium to spot VIX because shorting the VIX is dangerous and traders need to be rewarded for taking on that risk. On any given day, a crisis can occur, causing the VIX to multiply, while the best a short-seller of VIX futures can do is play for a reversion back to the mean.

A basis trader might want to sell that VIX futures contract and collect the risk premium provided by the market. This is known as being “short the basis,” the trader sells the futures contract short, hoping to collect the basis at expiration, because the futures contract will cash-settle according to the spot price.

On the other hand, by being “long the basis,” expecting the gap between the futures and spot price to widen as expiration nears.

Short US Equity Volatility

The academic definition of carry might refer to fixed payments and whatnot, but the payoff of shorting US equity volatility looks like carry.

Volatility in the stock market is mean reverting and tends to cluster. This means that when volatility spikes up, it’s likely to revert back to a local average; it doesn’t last long. However, volatility events tend to cluster together. If you look back at recent stock market crises, you’ll see many occurences of spiking, returning to the mean, but spiking again quickly.

So the result of a spike in the VIX is pretty predictable. It’ll come back down in due time. The tough part is managing the tail risk. How do you know that the current spike is the “top?,” and do you have the margin to sit through the trade going violently against you until it comes back down?

Take a look at the following chart of the VIX over the last decade or so. On the left is the VIX spot index, and the right is the front month VIX futures contract. Because you can’t trade the spot index, you can see how the market’s forward-looking expectations sometimes differ from the spot index.

However, the chart makes it clear that shorting volatility works and is relatively predictable, at least in the big picture. This trade creates a stream of trades with small returns, followed by occasional big loss when you short too early which is pretty characteristic of carry strategies.

Trading history is littered with the corpses of fund managers with massively high Sharpe ratios and Madoff-looking equity curves, only to blow up their account when volatility spikes far more than expected.

The market is pretty elegant like that. When a strategy is pretty easy to make consistent returns from, the market will punish you for executing it foolishly.

Currency Carry Trades

These are the most common forms of trades you’ll find when you look into carry trading. The basic way to structure the trade is borrowing a currency of a country with low interest rates, and using the proceeds to buy a currency with a higher interest rate.

Because interest in FX markets are marked daily, carry strategies can be implemented in the short-term and exited quickly without regard for quarterly payments.

For example, you borrow in a currency with an overnight lending rate of 1%, and buy a currency with a 4% overnight rate, you collect the difference, which is 3%. This is known as the interest rate differential.

Examples of Negative Carry Trades

Shorting Bonds

Credit traders often like to set up relative value portfolios where they buy bonds which look underpriced and sell those with an elevated default risk. They receive the income from the long side of the trade, but have to pay the interest payments on their shorts. As a result, the short side of a trade is a short carry trade.

Going further, many credit traders will use credit default swaps to express a bearish view on a company’s creditworthiness. They’re similar to options, except the buyer of the contract makes regular payments to the seller of the contract in exchange for protection, rather than a fixed, upfront price.

These are both negative carry trades that credit traders use to express a market neutral position.

Short Selling Stocks

In the stock market, the function of buying shares is much easier and cheaper than short-selling, unlike in the futures market. Short selling requires you to pay an interest rate on the shares you’re borrowing, making it a negative carry trade.

Locating shares typically involves typing a ticker into your trading platform’s locate montage and seeing if your broker has shares immediately available for you to borrow.

If not, you typically have to pay your broker a fee to go ‘locate’ shares from other securities lending desks. Sometimes shares aren’t even available to short, further exacerbating the disadvantages of short-selling in the equities market.

Those shares that your broker located for you have to come from another shareholder. And that shareholder is going to charge you interest for borrowing his shares.

For highly liquid equities like SPY or AAPL, the fee is typically very modest.

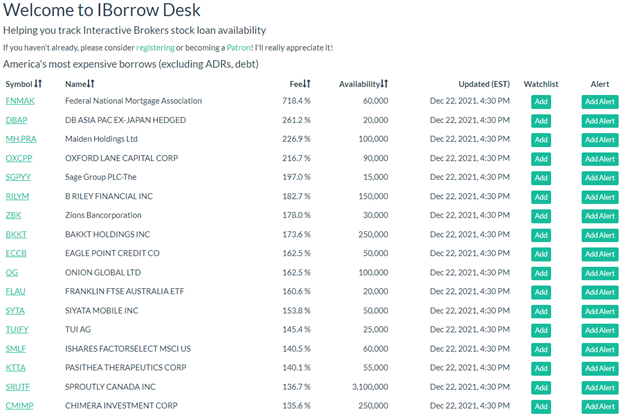

However, if the stock is heavily targeted by short sellers or has a low float, the fee can explode north of 100% and is subject to change at any time. If you’ve never shorted stocks before, take a look at Interactive Brokers’ most expensive borrows:

Of course, many of these are illiquid ETFs, preferred shares, and OTC stocks, but some of these are actual, actively traded common stocks.

Furthermore, short sellers must pay dividends, if any, to the original lender of the shares, further adding to the negative carry of short selling stocks.

Bottom Line

Carry trades are frequently used for “window dressing” by fund managers. Because carry trades tend to provide a smooth stream of income for a long time without loss, managers can create the illusion of a low-risk, high-return strategy in order to fool investors.

There are many such cases of fund managers simply systematically selling premium in the SPX and because they happened to start the fund during a period of persistently low volatility in the US equities market, their strategy looked ironclad–very low drawdowns and consistent returns.

What I mean to convey here is, on a mechanical level, carry trading is easy. However, doing it well and getting lucky enough to be in tune with a market regime are two distinctly different things.

The post What Is Carry Trading? appeared first on Warrior Trading.

Original source: https://www.warriortrading.com/what-is-carry-trading/