NYSE margin debt shows how much money investors have borrowed from brokers to buy stocks.

When margin debt reaches higher levels, it can signal excessive market optimism and potential vulnerability to any kind of pullback.

Two notable instances are the major market downturns in 2000 and 2008.

If you decide to trade on margin, you’ll face strict account rules, including maintaining specific equity requirements and meeting margin calls if your investments decline below a certain threshold.

While margin trading can amplify your gains, it also magnifies losses and requires significantly stricter risk management.

Understanding margin debt levels helps you gauge market sentiment and identify potential warning signs for a broad market pullback.

Contents

-

-

-

-

- Understanding NYSE Margin Debt

- Market Sentiment Signals

- Risks To Consider

- Regulatory Framework

- Final Thoughts

-

-

-

Understanding NYSE Margin Debt

NYSE margin debt represents the total amount investors borrow from brokers to purchase securities, acting as an indicator of market sentiment and levels of investor leverage.

When you open a margin account, you must meet specific FINRA and the Federal Reserve requirements.

More details about these rules are below.

Your broker will use the securities in your account as collateral for the loan, charging you interest on the borrowed amount.

If your equity falls below the maintenance margin requirement, you’ll receive a margin call, requiring you to either deposit additional funds or sell securities to meet the minimum threshold.

If you do not meet the margin call, your broker may start to automatically sell your positions until you are back in margin compliance.

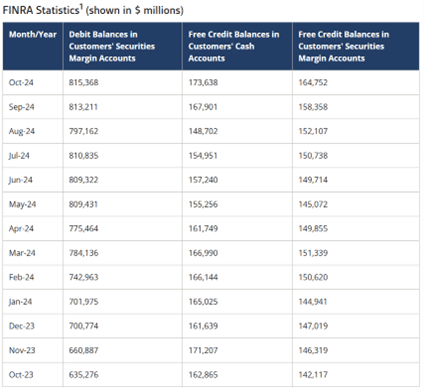

The NYSE publishes monthly statistics on the total amount of margin borrowed, which can help you gauge overall market leverage.

High levels of margin debt often indicate market optimism but can also signal potential market vulnerability, especially during economic downturns when forced selling due to margin calls can intensify market declines.

The converse is also true; when very limited amounts of margin are used, it can signal market fear.

Market Sentiment Signals

Market sentiment signals derived from margin debt levels provide some insights into investor psychology and potential market direction.

When margin debt reaches peak levels, it often suggests excessive investor exuberance and increased risk-taking, which historically has preceded major market downturns, as seen in 2000 and 2008.

You’ll notice that the opposite, lower margin debt levels, typically indicate cautious investor sentiment, with market participants less willing to borrow and invest.

This reduced risk appetite can signal potential market bottoms, though it’s never a guarantee.

The trend in margin debt is equally important – rising levels generally correlate with advancing markets, while falling levels may suggest growing pessimism.

It would help if you didn’t rely solely on margin debt signals when making investment decisions. Instead, view these indicators as part of a broader analysis toolkit.

Higher margin debt doesn’t automatically mean a market crash is imminent, but it does suggest increased vulnerability to sharp corrections due to potential forced selling.

Similarly, lower margin debt levels might indicate reduced market risk but don’t necessarily signal immediate buying opportunities.

As with everything in the market, using margin debt in conjunction with other economic and technical factors can help spot market reversals or, at the very least, signal it is time to reduce or increase the amount of capital you are looking to invest in the market.

Risks To Consider

As stated above, when personally trading on margin, you will face some additional risks.

The most immediate concern is the obligation to repay borrowed funds with interest, which can become particularly difficult during periods of higher rates.

Suppose a margin position is held over the end of a month instead of liquidating the position and reopening it. In that case, many brokers will just pull the interest payment out of available cash.

This use of leverage can be great when the market is moving higher, but any type of market correction can cause a lot of damage or an overleveraged portfolio.

This leads us to our second risk, the margin call.

If your position and cash drop below the maintenance margin level set by your broker, you will get a warning to either add cash or sell a part of your position.

If you don’t, your broker will often automatically close a portion of your position or your entire position to meet the margin call.

Depending on the stock traded, this type of forced selling could have a cascading effect and cause additional margin calls, pushing the stock lower.

One way to think of this is the opposite of the short squeeze.

The reasons above are why many investors, even large ones, prefer to use cash except when only 100% is necessary to trade on margin, such as when waiting for a position to settle.

If you want to trade on margin, using the NYSE Margin debt can be a good way to determine when to stay in cash and add margin to your trades.

Regulatory Framework

Trading on margin comes with strict regulatory oversight designed to protect investors and markets.

These include FINRA’s 25% minimum equity rule and the Federal Reserve’s Regulation T, which limits initial borrowing to 50% of the purchase price of a position.

There is also a minimum account balance; you must deposit at least $2,000 into your trading account to utilize margin.

Your broker may impose stricter requirements than these federal minimums, but that is a broker-by-broker decision.

Finally, If you’re a pattern day trader, defined as placing more than 3-day trades in a rolling 5-day period, you’ll need to maintain at least $25,000 in your account.

Your account is also continuously monitored by the SEC and FINRA, and you must report your margin debt levels monthly (as we referenced above).

Two other things to pay attention to: you can’t exceed 75% margin debt relative to your portfolio’s value, and not all securities are eligible for margin trading.

Volatility and how easy they are to source and borrow play into whether a security is available for margin trading.

Final Thoughts

NYSE margin debt reflects the borrowed capital investors use to trade stocks, serving as a barometer for market sentiment and leverage.

High levels often signal investor exuberance but heighten market vulnerability during downturns, as seen in 2000 and 2008.

Low-margin debt, on the other hand, can indicate cautious sentiment and reduced risk-taking, potentially marking market bottoms.

While trading on margin amplifies gains, it also magnifies losses, requiring careful risk management and adherence to strict regulations.

Trends in margin debt offer insights into market psychology but are best used alongside other technical and economic indicators for trading or investing.

Careful use of this metric can help traders time their capital deployment and navigate the fine line between opportunity and risk.

We hope you enjoyed this article on the NYSE margin debt and why it is important for an investor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/nyse-margin-debt/