When selling out-of-the-money put credit spreads for premium, one of the most important questions to ask is what delta to sell them at.

Contents

-

-

-

- What Delta Is This Put Spread?

- The Conservative Zone

- The Balanced Approach

- The Aggressive Play

- Conclusion

-

-

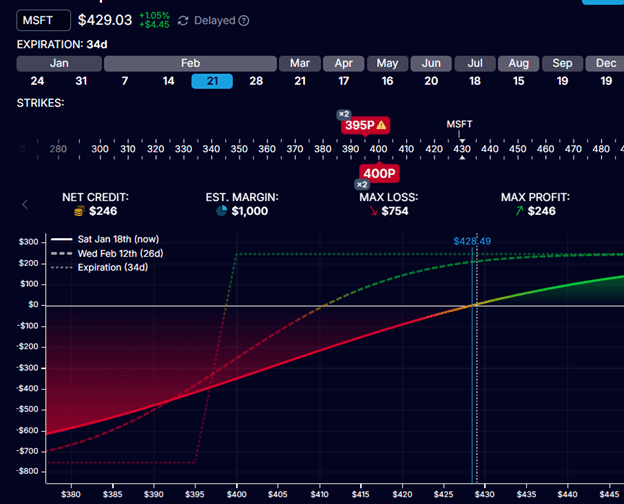

As a review, here is a put credit spread on Microsoft (MSFT), currently trading at $429:

We are selling two contracts that expire 34 days out on February 21, 2025, with the following order:

Sell to open two contracts of February 21 MSFT 400 put @ $3.23

Buy to open two contracts of February 21 MSFT 395 put @ $2.00

Net credit: $246

This put spread is 5 points wide, and we collected $246 at the start of the trade.

We keep this credit if both options expire out-of-the-money at expiration (which means the options become worthless).

Our max profit in this trade is $246.

If MSFT is below $395 at expiration, both options are in-the-money, and the trade loses $754.

This trade has a risk-to-reward of 3 – risking $754 to potentially make $246.

From another perspective, this put spread has a 32% return potential.

Because $246 / $756 = 32%.

What Delta is this Put Spread?

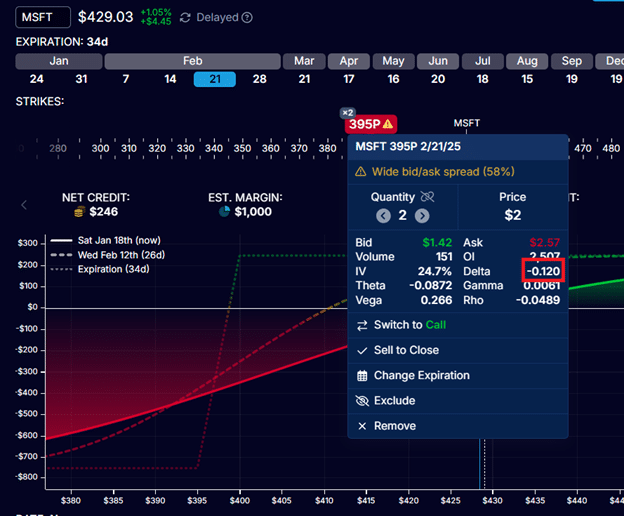

In our example, the 395-strike put option we purchased has a delta of -0.12.

The delta for put options is a number between 0 and -1.

It represents the probability of an option expiring in the money.

There is a 12% chance that this put option will expire in the money.

There is a 12% chance that MSFT will be below $395 at expiration.

A put option at the 400-strike has a delta of -0.169.

But because we are selling this option (as opposed to buying it), we flip the sign.

A short put option at the 400-strike has a delta of positive 0.169.

This is what OptionStrat modeling software is showing the delta as:

Since we are selling this put spread, we look at the delta of the short put.

In this case, it is 0.169.

The short put has a 17% chance of being in-the-money at expiration.

Therefore, this put spread is being sold at the 17-delta.

Let’s consider three delta range zones in which people tend to sell put spreads:

- The conservative zone (10 to 20 delta)

- The balanced approach (30 delta)

- Aggressive play (40 delta)

The Conservative Zone

Put spreads at the 10 to 20 delta are conservative because they are highly likely to work out in your favor.

The chances of it expiring worthless and you keeping all the premium is 80% to 90%.

The above example was a credit spread sold within the conservative zone at the 17-delta, with an 83% chance of working out.

However, the premium that you keep is small.

It is rare to sell put spreads below the 10 delta.

One of the drawbacks of selling at low deltas is that if you lose on the trade, the loss can be much larger than the small premium collected – hence the phrase “picking up pennies in front of a steam roller.”

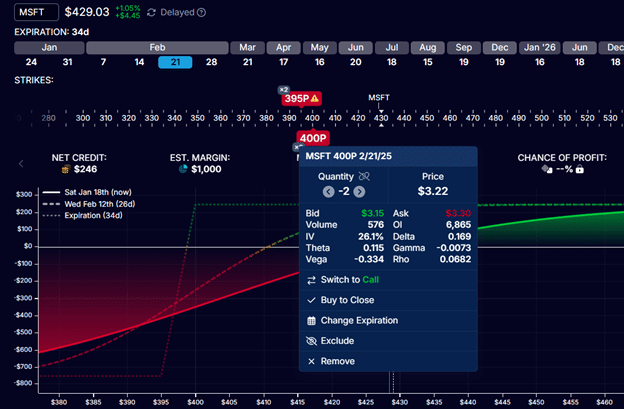

The Balanced Approach

For this reason, some people like a balanced approach and sell at slightly higher deltas at around the 30-delta.

This is the middle ground between risk and reward, where we collect a moderate premium.

These trades have a statistically 70% success rate (if held to expiration).

If we were to sell at the 30-delta, the profit and loss graph would look like this:

Here, we are risking $580 with the potential to make $420.

The risk-to-reward is 1.3.

The premium that we collected is higher at $420.

The chances of profit are lower at 70%.

The Aggressive Play

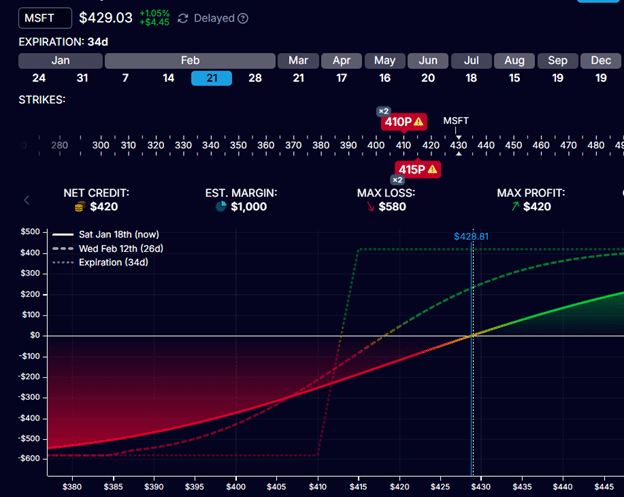

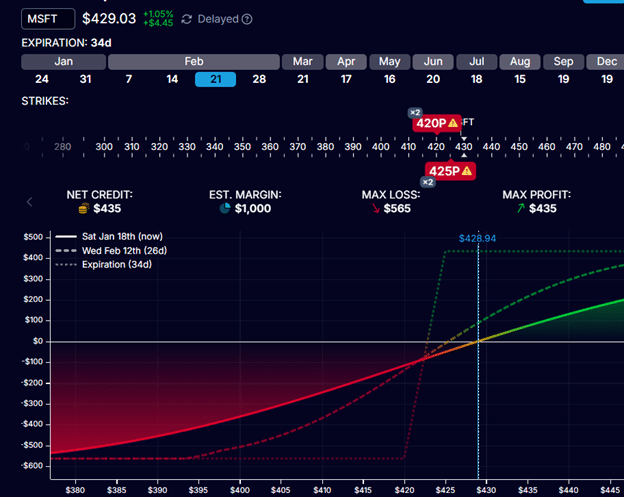

Now looking to sell at the 42-delta:

Selling put spreads around the 40-delta is an aggressive play aiming to collect high premiums.

This premium collected in this example is the highest at $435.

With a max loss of $565, it has a return potential of 78% on risk.

This is when a trader has higher confidence that the underlying price will increase, favoring this play’s success.

The trade will likely lose if the price moves down against the trade.

Let’s take out the technical analysis of the picture and the trader’s ability to read price action.

The trade statistically has only a 60% chance of working out at expiration, assuming the normal random movement of a stock price.

This play requires more active management because it does not take a very large move by the stock for the 40-delta put option to be in the money.

The short strike at $425 is only 4 points away from the stock’s current price of $429.

Conclusion

What delta to choose depends on what type of trader you are and your risk tolerance.

It also depends on the market outlook and your sentiment on the stock.

A bullish market or a bullish outlook on a stock can warrant higher deltas.

You probably don’t want to trade these if the market is in a downtrend or a bear market.

Bear call spreads may be more appropriate.

Personally, I like to sell around the 15-delta.

The 15 to 16 delta places the put spread around the one-standard deviation move away from the current price.

That works for me.

Find what works for you.

We hope you enjoyed this article on the best delta for spreads.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/best-delta-for-put-spreads/