Contents

-

-

-

-

-

- Which Option Income Strategy Is The Best?

- Iron Condor

- Double Diagonal

- Hybrid Combo

- Conclusion

-

-

-

-

The goal of market-neutral income strategy is to use options to generate positive theta while managing delta and vega.

Theta is the reward.

Delta and Vega are the risks.

There are different interpretations as to what is considered best.

In this context, best refers to the strategy with the best reward to risk characteristics over a wide range of prices.

This is also the metric used by the book Option Strategy Risk / Return Ratios.

The author of the book, Brian Johnson, attempts to find the best market-neutral income strategy by deriving formulas for computing the reward/risk ratios of various strategies across a range of prices that the underlying asset might move over.

The book goes into great explanation of all the options Greeks – not just the book definition, but also gives you an intuitive understanding.

While we already know that an iron condor is a market-neutral income option strategy, the book gives us an understanding of why an iron condor is constructed that way.

Three Principles of Positive Theta

Brian explains that all income strategies are designed to generate positive theta via three principles.

- Sell near-the-money options and buy option further out-of-the-money

- Sell short-term options and buy longer-term options.

- For every option you sell, buy an option to reduce capital and reduce risk

He gives evidence why there is an inherent market edge in doing this.

This is why the short options of a butterfly are near-the-money and the long legs are further out away from price.

This is why we always sell the option at the near-term in the calendar while buying the option at longer-term.

It explains the mechanism by which calendars generate income.

This is why of the four legs of an iron condor, we have two shorts and we have two longs.

We don’t get something for nothing.

It doesn’t matter how you construct your option structure or how many legs you add, if you have positive theta, you are going to have negative gamma.

As Brian states:

“Theta represents our compensation for incurring the adverse symmetry of negative Gamma”

What that means is that our delta-neutral position will not remain delta-neutral as the price of the underlying moves.

This means we either have to adjust our position or exit.

No one said making money with income strategies is easy.

The book does not say this either.

The more the underlying price moves, the more difficult it is for option income traders to make money.

The effect of price movement is magnified as the options get closer to expiration.

Both theta and gamma increases – representing a greater increase in reward as well as in risk.

How do we evaluate and manage our risk versus reward? They are affected by so many things such as how far in or out of the money, how near or far from expiration, and the effects of all the Greeks.

There are two risk/reward ratios to consider, because there are two major risks to an income strategy – the delta risk and the vega risk.

Many options income traders know how to get their trade delta-neutral.

But that is not enough.

Vega represents volatility risk for the income trader.

A condor and butterfly have negative Vega.

A calendar has positive Vega.

The book explains how the Delta/Theta and Vega/Theta ratios are getting us closer to the Risk/Reward Ratio that we ultimately seek.

Why do we want to know the Risk/Reward ratio of our strategies?

Because this tells us how favorable our position currently is.

This ratio is different for different income strategies and this ratio can change as the trade progresses.

When the risk to reward becomes too unfavorable, this is when we have to adjust or exit.

When considering adjustments, the Risk/Reward ratio gives us a measure as to which adjustment is more favorable.

Which Option Income Strategy Is The Best?

According to the book the strategy with the best delta/theta risk-to-reward ratio across a wide range of prices is:

- Hybrid Combo

- Iron Condor

- Calendar

- Double Diagonal

- Iron Butterfly

The strategies are listed in order from best at the top to the worst at the bottom.

The best vega/theta risk-to-reward ratio are:

- Hybrid Combo

- Double Diagonal

- Iron Condor

- Iron Butterfly

- Calendar

These were calculated based on April 2013 option prices and Greeks for the RUT index.

The book also plotted the delta/theta and vega/theta curves of all these strategies.

It can be seen from these graphs that the iron butterfly scored poorly in comparison to the iron condor on the downside (when price of the underlying moved down).

The iron butterfly did about the same as the iron condor on the upside.

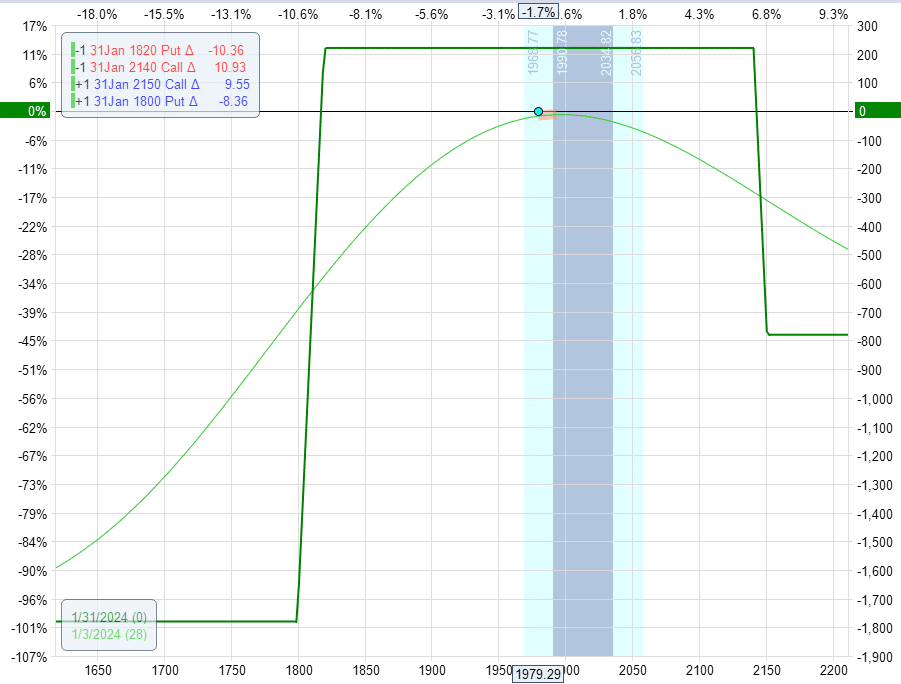

Iron Condor

The iron condor that Brian used is not the typical iron condor that we are used to seeing.

It is in fact an unbalanced iron condor.

Let me reconstruct the unbalanced iron condor so that you can see what it would look like in today’s January 3, 2024 prices on the RUT:

The Greeks of this condor are:

Delta: 0.6

Theta: 9.1

Vega: -24.2

The short legs are at the 10-delta with expiration a month out.

The call spread is narrower than the put spread in order to balance the delta closer to zero.

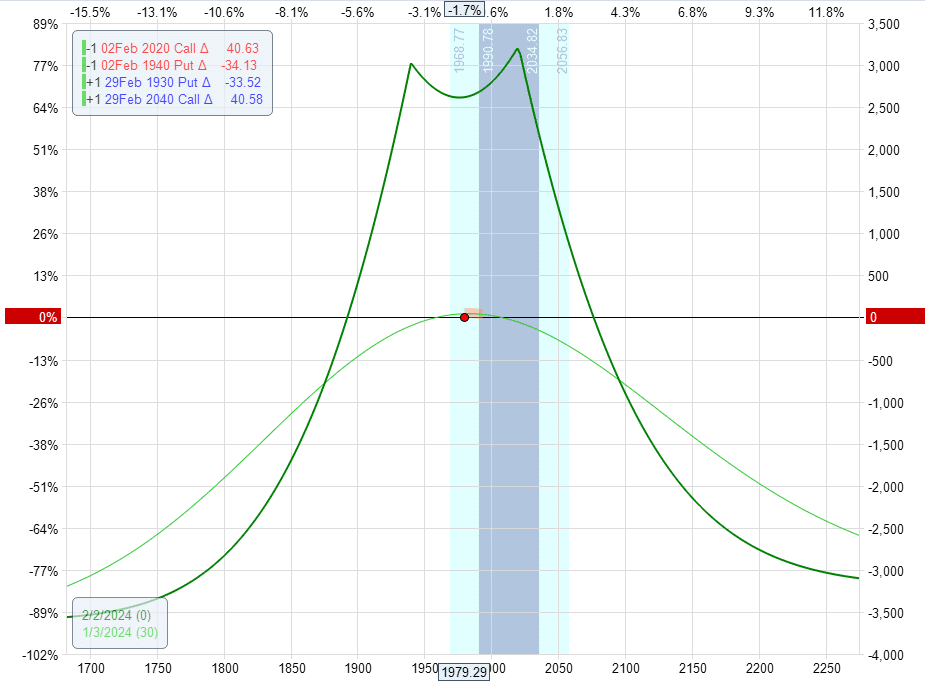

Double Diagonal

Most of us may be familiar with a double diagonal that looks like this:

The double diagonal that Brian presented is not your typical double diagonal.

Instead, its expiration graph looks more like a calendar as shown below:

Delta: -0.5

Theta: 84

Vega: -71

It sells an at-the-money straddle one month out.

And buys a strangle another month further out.

It is superior to the calendar because it has Vega closer to zero and has less volatility risk than a calendar.

Brian pointed out that calendars by themselves are suboptimal as income strategies based on their very poor vega/theta ratio.

On the one hand, at-the-money calendars want the price to stay still.

But if this happens, volatility tends to decrease, which is not good for a vega positive strategy like the calendar.

However, the calendar can be used in combination with other strategies to build hybrid strategies.

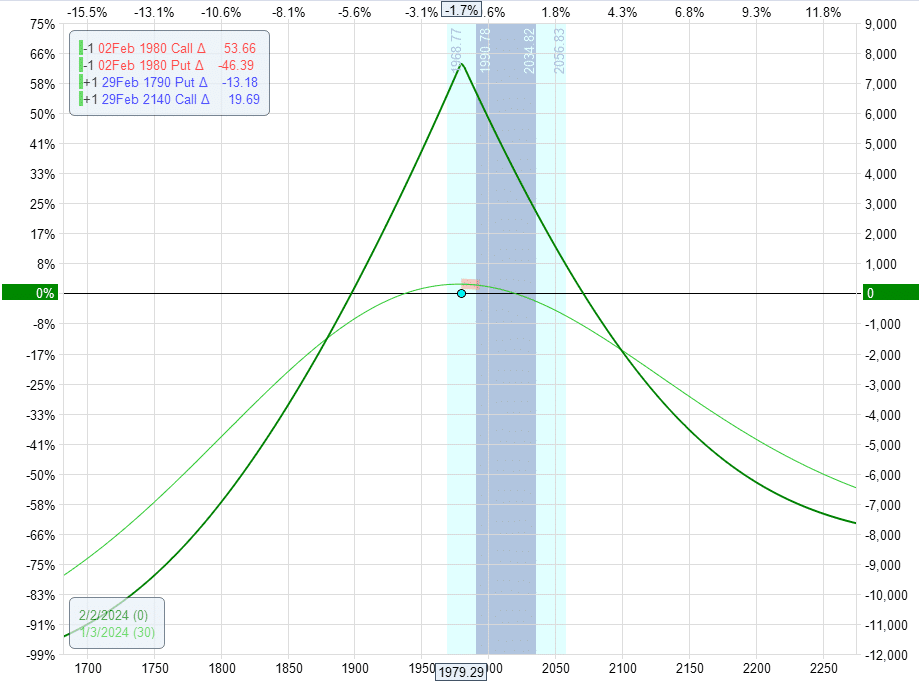

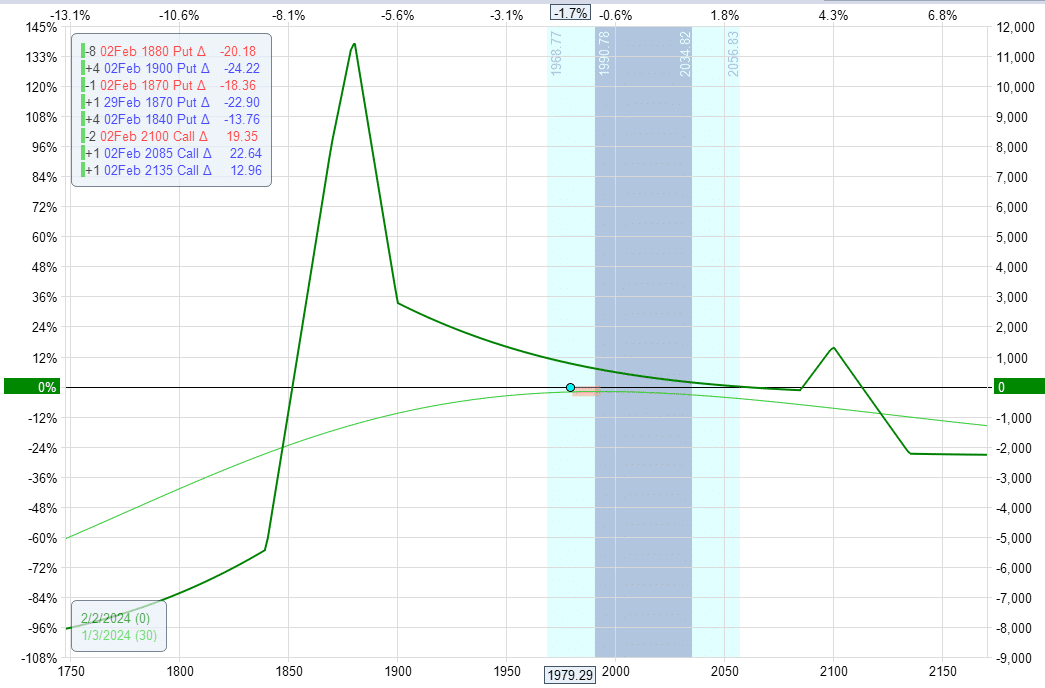

Hybrid Combo

The “Hybrid Combo” strategy that won first place in both the delta/theta ratio and the vega/theta ratio is an options structure that Brian Johnson came up with in trying to optimize for these two metrics.

This structure consists of three units to be executed in this order:

- 5% OTM put broken-wing-butterfly that has positive delta

- OTM put calendar around the same location that has negative delta

- Smaller 4% OTM call broken-wing-butterfly (BWB)

The ratio of the units is to have 4 put BWBs with one calendar and one call BWB.

As the market changes, this construction would need to change.

Since the book was written ten years ago, we reconstructed the Hybrid Combo using today’s prices on the RUT as of Jan 3, 2024.

Delta: 2

Theta: 44

Vega: -5

Looking at the Greeks, we see that Delta and Vega was kept at a minimum while keeping Theta high.

Conclusion

At the time of Brian Johnson’s book, he would have said that the best market-neutral income strategy would be the Hybrid Combo that he had constructed.

This is based on the criteria of best risk to reward characteristics over a wide range of prices.

Keep in mind that there are other factors besides this metric in choosing a trading strategy – such as for example, ease of construction and flexibility of adjustment, etc.

Some may find the Hybrid Combo to be too complex, difficult to construct, and to adjust.

I would argue that the best “traditional” income strategy would be the iron condor (or the unbalanced iron condor).

The analysis and rankings presented in his book does appear to support this conclusion. The iron condor did rank next in the best delta/theta risk-to-reward ratio.

It ranked third in the vega/theta ratio.

Since many would agree that the delta is the more important component, we would give this metric a higher weight.

Of course, your personal “best income strategy” is the one that you yourself can trade the best with and that you feel most comfortable with.

And this can be different for everyone.

We hope you enjoyed this article on the best market neutral income strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/best-market-neutral-income-strategy/