Most people often start to day trade with a small account and then build their bankroll and skills as time goes by.

Not only is starting out small a great way to limit your losses, it is also an excellent way of gaining the experience you need to be confident.

A small account requires you to make smarter stock selections since you don’t have as much capital to throw around. So being picky is a good thing!

But what is a good strategy for small accounts?

There is no one perfect strategy – no matter your account size.

However, we have found the bull flag pattern to be a great beginners day trading strategy that is easy to learn and identify.

Trading a small account

If you are going to be trading with a small account, you will not have a lot of room for error. Entries will be key for managing your risk so be patient and pick the best possible spots to get in.

Ensure to stay away from setups that are not A+.

Your main goal with a small account is to protect your capital and take profits when you can. It will be a grind but as you grow your account you will allow yourself more of a cushion to take more risk on.

Additionally, you have to exercise extreme patience while waiting for your setup to evolve and trigger a buy/sell signal in a small account.

Don’t just trade to trade as that will almost certainly send your account down the drain with fees and losses hurting your capital.

You also need to know when to jump out of a trade and trim your losses before they mount. That means you need to learn how you to use a stop loss order and a popular profit-taking strategies that are used by day traders.

Discipline is key no matter your account size, but it is especially important when you have limited capital.

Make sure to check out Ross’s YouTube video below on his latest small account challenge:

Why stock selection and risk management is crucial

Stock selection and risk management skills are critical in trading a small account.

The market has thousands of stocks, ETFs, and mutual funds that you could trade. Traders have to pick between 5 to 10 stocks worth trading daily, and maintain a decent accuracy of winners versus losers in order to make profit.

They do this by looking for stocks that have big upside potential. Almost every single day, there is always at least one stock makes a 20-30% intraday move. These are the types of stocks professional day traders love.

To get a piece of the action, traders usually jump into these stocks as soon as one of them starts popping up. Keep in mind that the stock market runs on crowd mentality and rumors, so when a stock begins to make a move, other traders get on the bandwagon.

However, it’s important to remind everyone that just because some experienced traders can make stock selection easy, it does not mean profitability is easy.

Trading is difficult, and it requires quite a lot of dedication to make consistent profits.

Bull flag pattern

While there is no bullet proof strategy no matter the account size, we favor the bull flag pattern for trading a small account, due to its low risk entry points with potential big winners.

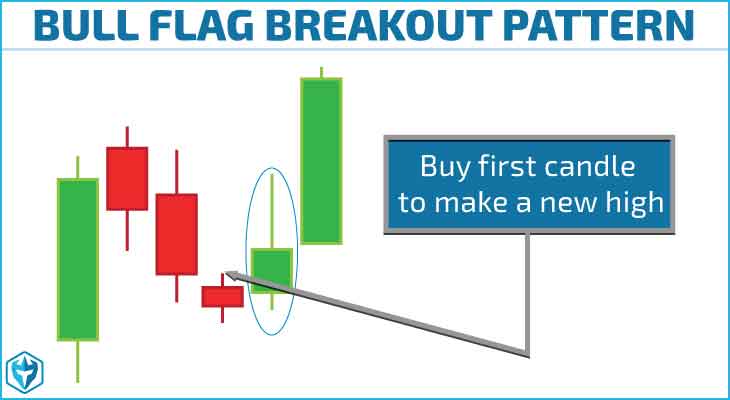

A bull flag is a chart pattern that forms when a stock is in a strong uptrend. The reason why it is called a flag pattern is because when it forms on a chart, it looks like a flag on a pole and since we are in an uptrend it is considered a bullish flag.

The bull flag is a subset of Ross Cameron’s Warrior Trading momentum trading strategy and you can use it on any time frame.

Ross likes to trade this pattern on the 2 and 5-minute time frames as a way of scalping short-term price movements. However, bull flags are also good for swing trading and great on daily charts too.

Typically, a bull flag pattern has the following features:

- Stock has made a strong move up on high relative volume, forming the pole.

- The price of the stock consolidates near the top of the pole on lighter volume, forming the flag.

- Stock breaks out of consolidation pattern on high relative volume to continue the trend.

How to trade the bull flag pattern with limited capital

Bull flag patterns are an excellent setup for traders with small accounts or limited capital because they are easy to identify once you understand what to look for.

Like most patterns, volume must be present on the breakout. This confirms the pattern and increases the likelihood that the breakout will be successful.

Here is a checklist for trading bull flag patterns after identifying one:

- Stock is moving up on high relative volume, preferably from a news catalyst like earnings or CEO resignation.

- Stock consolidates at or near highs with a defined pullback pattern.

- Buy when the stock breaks out above the consolidation pattern on high volume.

- Place a stop order below bottom of consolidation pattern.

- Your profit target ought to be at least 2:1 risk/reward. Therefore, if you are risking 30 cents, then first profit target is 60 cents from your entry price.

Trading the bull flag is pretty straightforward and strategy that any aspiring trader can learn.

The challenging part of trading this pattern is spotting it in real-time.

However, the scanners we stream daily for Warrior Starter and Warrior Pro students make it easier to identify the pattern.

Bottom Line

If you are interested in day trading but don’t have a lot of money to start with, you should begin by learning the fundamentals of risk management and work on developing a great strategy like the bull flag using a trading demo account.

Once you feel confident in yourself, you can jump into trading real capital.

The stock market is accessible to people with limited capital and, with discipline and patience, there is the potential to make great returns as you become more experienced.

However, as with all trading, trading a small account carries some risks.

Losses are inevitable, even for professional traders. Just make sure that you are comfortable with this before trading with your cash, and never risk more than you can afford to lose.

The post What Is The Best Strategy For Small Accounts? appeared first on Warrior Trading.