CVaR is a metric found in some trading platforms, particularly the Tastytrade platform.

It stands for “Conditional Value at Risk”.

The “a” for the preposition “at” is lowercase.

Contents

-

-

-

-

-

- Example of CVaR

-

-

-

-

It is a risk assessment metric that helps traders understand the risk of extreme losses beyond a certain confidence level.

A typical confidence level might be the 95% or the 99% confidence level.

Since the Tastytrade platform uses a confidence level of 95% for its CVaR calculation [reference], we will use that in our example.

A 95% confidence level means that things will turn out okay (or at least survivable) 95% of the time.

That means the remaining 5% of the time is considered our “worst-case scenarios.”

This 5% is our “tail risk.”

When these worst-case scenarios do occur: Notice that I say “when” they occur.

I didn’t say “if” they occur.

When you trade long enough, they will occur.

Statistically, they will occur once out of twenty times – that’s 5%.

So when these tail risk events occur, what will be the average loss incurred?

That is CVaR – the average expected loss that will incur for events outside our confidence level.

Example of CVaR

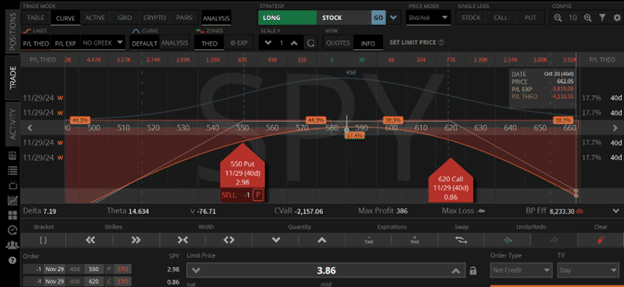

Below is a screenshot of strangle trade on SPY in the Tastytrade platform with the CVaR metric shown.

This strangle sells the 550 put and the 620 call at 40 days till expiration.

The credit received is $386.

So that will be our max profit.

Our max loss is unlimited because strangles are undefined risk strategies.

This is why the max loss shows the “infinity” symbol, indicating a theoretical potential for an infinite loss.

How can we define our risk-to-reward ratio when there is no number for our risk?

We can not.

So, we use CVaR instead.

Roughly speaking, CVaR can be considered the average loss when the worst case happens.

The example screenshot shows CVaR as -$2157.

The so-called “risk to reward ratio” of this strangle is then $2157 / $386 = 5.6.

It is important to remember that this is only an estimate at the 95% confidence level.

This strangle can lose much more than $2157.

In fact, no one can tell you exactly how much this strangle can lose.

That is the nature of undefined risk strategies.

That is not to say that strangles are a bad strategy.

It is Tom Sosnoff’s favorite strategy.

How did I know this?

He mentioned that in a webinar with OptionsPlay.

Tom said he had always been an options seller from the start.

About 75% of his trades are undefined risk trades, and 25% are defined risk.

He takes about 100 trades daily, following the concept of trading small and frequently.

Strangles are his bread-and-butter strategy.

He likes to start them at around 45 days till expiration and takes profit at 25% of max profit or exits at 21 days till expiration.

In his long career, Tom Sosnoff has done many things in the options world.

It is fair to say that he played a major role in developing the Tastytrade platform.

With strangles being his favorite strategy, I’m not surprised that CVaR would be on the Tastytrade platform.

Because CVaR is the perfect metric to quantify the risk in a strategy with undefined risk.

We hope you enjoyed this article on the CVaR metric in options trading.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/cvar-metric/