*Gasp* No, can it be?

What risks can such a popular options strategy possibly have?

Don’t get me wrong.

The Wheel Options strategy has advantages, such as selling premiums on calls and puts. Buying stocks at a lower cost basis.

Supplementing with additional income on stocks you already own.

And all the other benefits that you already know about.

But it is also important to understand some of its drawbacks.

All options strategies have drawbacks.

And the Wheel is no exception.

Contents

-

-

-

-

-

- High Capital Requirement

- Buying While Stock Is Going Down

- Opportunity Cost

- Capped Profit Potential

- Undefined Risk

- Final Thoughts

-

-

-

-

High Capital Requirement

The Wheel strategy’s first step involves selling puts to collect premiums.

For example, an investor sees UPS trucks driving around the neighborhood delivering packages and thinks it is a good stock to own.

Great.

The investor decides to sell puts on UPS (say on July 20, 2023) at the smallest size possible: one contract.

Date: July 20, 2023

Price: UPS @ $186.55

Sell one August 25th, 2023 UPS 175 put @ $2.67

The investor collects a credit of $267.

Because this is a cash-secured put, the investor needs to allocate enough cash in the account to buy 100 shares of UPS if the stock is assigned at expiration at a strike price of $175.

This is a capital requirement of $17,500. If the account size is, say, $25,000, allocating $17,500 of capital in one stock is simply too risky and lacks the needed portfolio diversification.

At expiration on August 25, UPS’s closing price is $168.87, which is below the strike price.

So, the investor is obligated to buy 100 shares at $175 per share, paying $6.13 more than the stock’s current price.

At 100 shares, that is a $613 price disadvantage.

The investor is compensated slightly by the $267 credit. So, it is only a $346 loss.

Sure, the investor did pay 6% less than the stock price on July 20 because $175 is 6% less than $186.55.

This is fine for a longer-term investor who wants to hold the stock for the long term.

Buying While Stock Is Going Down

Another problem is that the investor ends up buying a stock that is in a downtrend:

Ideally, when we buy a stock, we want it to go up.

The investor wants to buy low and sell it back at a higher price.

So, the investor must wait until the price of UPS comes back to $175, which could be a long time.

Opportunity Cost

After holding through 6 months and two earnings cycles where the stock gapped down, we still have the uncertainty of when (if ever) the stock will come back up to $175.

During that time, the $17,500 of capital is tied up in the stock, unable to be used for other investments.

It represents an “opportunity cost” – the loss of the use of the capital.

Capped Profit Potential

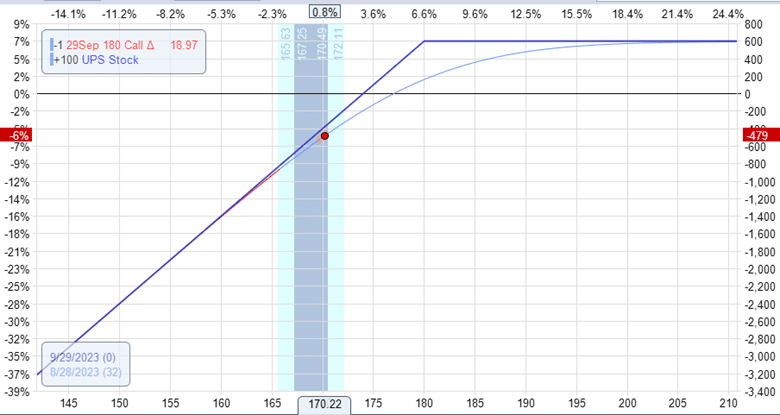

Now that the investor owns 100 shares of UPS, the second step of the Wheel is to sell a covered call on the stock.

Ideally, you would want to sell a call with a strike price higher than $175 to get some stock value appreciation.

Selling a call with a strike price lower than $175 would mean selling the stock at a lower price than you had bought it for, locking in a loss.

The investor sells a call option with a strike of $180 and collects a $97 credit.

Date: August 28, 2023

Price: UPS @ $170

Sell one September 29 UPS 180 call at $0.97

Look at the payoff graph.

If the stock does get above $180 and any price above that, the maximum gain the investor would make is about $600.

But if the stock continues to drop, the downside is unlimited.

Undefined Risk

The problem with the Wheel is that the call option caps the upside potential.

Yet the downside loss is uncapped.

The Wheel is sometimes marketed as a beginner’s options strategy.

But is an undefined risk strategy a good idea for beginners?

Hopefully, they understand when to cut the trade because they can get into trouble if they simply sell one call after another while the stock continues to go down.

Even as a long-term investor, there could come a point when the investor has to say no more to the investment.

Final Thoughts

Before trading any strategy, one must know its strengths and weaknesses.

In a bull market, the Wheel strategy looks great when most stocks tend to go up.

But have you back-tested the strategy in a bearish year such as 2022?

This is when we might see some of the weaknesses of the Wheel strategy appear.

We hope you enjoyed this article on the wheel options strategy risks.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/wheel-options-strategy-risks/