Stock prices move up and down constantly because of small and large forces. These forces propel prices continuously up and down. If you can identify these forces and make sense of their influence, you can learn to predict stock price movements.

The Wyckoff Method is a technical analysis approach to navigating the financial markets based on the study of the relationship between demand and supply forces. It was first developed by Richard D. Wyckoff, a trader and market forecaster who started in the business in 1888 as a 15-year-old stock runner.

Wyckoff based the approach on his observations of the market activities of a group of better informed, more highly experienced traders/investors. They included James Keene, Jesse Livermore, Andrew Carnegie, J.P. Morgan, Jay Gould, along with many others.

These were the “super” traders who analyzed the market, knew why and how it moved, and made profits from it. They had the capacity to influence prices trends and directions.

Today, they are embodied by the largest hedge funds, pension plans, investment banks, among others.

Wyckoff was also an avid tape-reader and led his own brokerage company. Therefore, he was in a better position to observe how these super traders carefully planned and executed their trades.

Wyckoff integrated their best practices with his original ideas and articulated a chart-based method based on several principles, techniques, and laws to track and trade in harmony with them.

His method went on to become a darling of Wall Street and Wycoff successfully applied it in his newsletter known as The Magazine of Wall Street.

About the Wyckoff method/rules

The Wyckoff method uncovers intentions of super traders on the stock market, who he referred to as Composite Operators. Analysis of the trading volume and price on the tape is the basis of this method.

Wyckoff believed that the behavior observed via volume and price movements held the key to predicting future market movements. These observations made him believe that the stock exchange worked under a set of three laws.

- The law of supply and demand

If there is a scarce amount of an item (supply), the value of that item is increased to create the supply need to meet that demand. Or, when there is an excess amount of something, then the value of that item will reduce to attract the demand needed to absorb that supply.

- The law of cause and effect

For the price of a stock to change (effect), there has to be a cause. The effect is in direct proportion to that cause. Best price moves happen when there has been enough time to facilitate a period of distribution or accumulation (or in other words a cause). - The law of effort vs results

If there is an effort (volume on a move), the result (price action) must be in proportion to that effort and can’t be separated from it. If it is not, it is an indication of other principles in action.

Price action and the volume on a move ought to be in harmony. If you have a lot of volume, you should see a lot of move. If you don’t see the move, you need to find out what is happening.

This is where you become the detective and use your tools to evaluate that result (price action) with the corresponding effort (volume).

Trading stocks using the Wyckoff Method

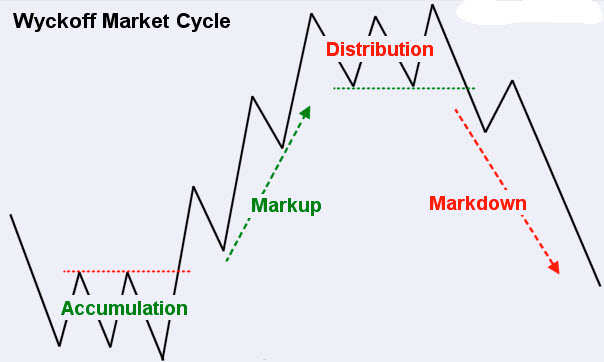

Traders can apply this method to monitor how the super traders accumulate big positions at the bottom of the market and sell them out at the top.

- Analyze the current position and future trend of a stock

Have an understanding of the current supply and demand structure of a stock allows you to be able to predict future price trends. When demand exceeds supply, stock prices move up, and when supply is higher than demand, prices will fall to create more demand.

Assessing these patterns allows traders to decide the type of positions they ought to take and understand the duration of their trades.

- Pick stocks that follow market trend

One of the best ways to know which stocks to choose is by looking at a company’s beta, the covariance between the volatility of the stock, and the movements of the market. Picking stocks with betas greater than 1 during times when market players expect the market to rise, is likely to give you greater returns than the market.

But if you worry that the market will fall, you should short certain stocks with higher betas, or trade stocks with negative betas since they have negative correlations with the market.

This stock selection method allows traders to book profits when trading in both bull and bear markets.

- Choose the correct stocks in relation to your price target

Traders ought to select stocks in relation to the price targets that they are aiming to hit when trading. Also, don’t forget the law of cause and effect, which points out that trades should only be made when there is a significant “cause” to trigger an “effect.”

- Determine when a stock is prone to move

The Wyckoff method also lays out some other important steps that traders can use to know whether a stock is worth buying or selling. Acquainting yourself with these steps and understanding market supply and demand for stocks can help you to know whether using the method during times of market downfall or rally is warranted.

- Place your trades during peaks of market cycles

Knowing when stocks are going to climb and drop is beneficial to making a return on your money.

It is most essential for traders seeking to buy stocks when the market is undervalued during a downfall and is bound to reverse into a rally.

Conversely, if you are looking to short stocks, initiate trades during market dislocations when there is an inclination that stock will reverse down.

Bottom Line

As stated earlier, stock prices change for various reasons. Some people tend to that think it’s impossible to predict the changes, but others believe observing charts and past price movements can determine when you ought to buy and sell.

The Wyckoff method is an important tool that is used by many successful institutional and professional traders. This method can be applied to any time frame in every freely traded market.

Having a practical and actionable understanding of the method can allow you to learn to identify the overall direction of the market. It also gives you an edge as you trade alongside the large hedge funds, pension funds, and investment banks that initiate and stop big trends.

The Wyckoff method teaches traders to anticipate market turns, and by comprehending the 3 laws outlined above, you will be ready to act at the right time of the markets.

The post Wyckoff Method Price Action Guide appeared first on Warrior Trading.