This video is about options trading and how much money you should allocate to each trade, also known as position sizing. The video talks about the Kelly Criterion which is a formula used to figure out optimal bet sizing in gambling. The speaker says that the Kelly Criterion can be applied to options trading as well.

The Kelly Criterion says that the percent of your portfolio you should allocate to a trade is equal to the probability of winning the trade minus the probability of losing the trade, divided by the average amount of money you make on winning trades (win rate x reward ratio). The speaker uses his own statistics as an example: he has a 60% win rate and a 1.34 risk reward ratio, which means he should allocate 30% of his portfolio to each trade.

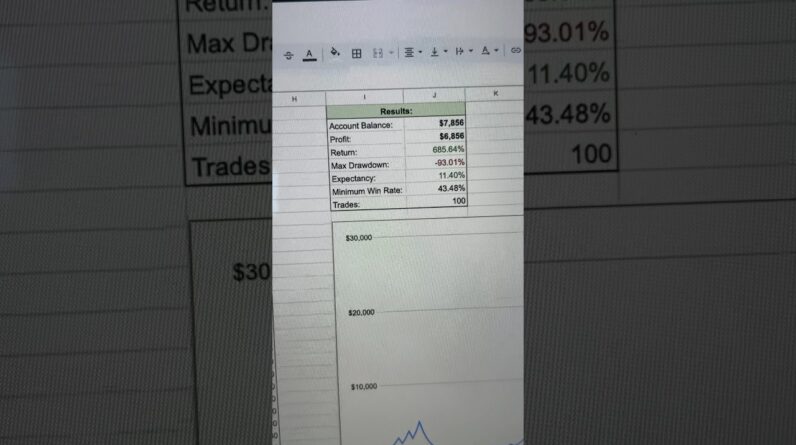

The video then shows a simulation of how this would work, starting with $1,000 and after 100 trades, the portfolio would grow to $7,856 for a 686% return. The video ends with the important note that this is just a simulation and your results may vary depending on your win rate and risk reward ratio.

Overall, this video discusses options trading and position sizing using the Kelly Criterion. The speaker emphasizes that the Kelly Criterion is a formula used in gambling but can be applied to options trading as well.