If you are an active trader or are simply interested in trading, chances are you have heard of Jim Dalton.

A renowned trader and mentor, he is widely reputed for his expertise in studying market behavior.

Who exactly is he, and what makes him so popular?

Are his training programs on the Market Profile concept worth all the attention?

Contents

-

-

-

-

-

- The Basics

- His Trading Career

- Mind Over Markets

- Markets in Profile

- His Contributions to the Market Profile

- His Training and Methods

- Swing Trading

- Scalping

- Trend Trading

- Final Thoughts

-

-

-

-

The Basics

Jim Dalton is a stock, forex, and futures trader.

He boasts more than five decades of experience, having previously worked as a board member of the Chicago Board of Trade (CBOT) and the Chicago Board of Options Exchange.

Although he is currently a full-time trader, his wisdom is highly sought-after.

He is recruited by industry-leading trading firms, hedge funds, and retail traders who look to take his Market Profile Intensives.

In this article, we will briefly cover Jim’s approach to trading.

He advocates for it as a brilliant method to keep tabs on the ebbs and flows of market pricing, keeping the trader in check with market pace and sentiment.

Jim is also a best-selling author behind some of the industry’s popular titles, such as Mind Over Market and Markets in Profile.

His Trading Career

In his early career years, Jim gained immense trading knowledge and experience working as a floor trader at the Chicago Mercantile Exchange (CME).

This gave him a unique opportunity to interact with trading dynamics while observing market activity in person at the heart of the action.

Such hands-on immersion at a young age, before the existence of computerized accounts and retail trading, allowed him to observe what worked and what didn’t from a young age.

This experience allowed him to craft his unique strategy and view of the markets.

One thing that stands out about Jim Dalton is his passion for trading.

He lives for it. As such, he has played a major role in the conception and development of major advances in the world of trading.

He has been instrumental in helping traders of all backgrounds understand the importance of value areas, the concepts of balance/imbalance of market environments, and the relationship between time and price movements through the use of the Market Profile.

Mind Over Markets

Jim’s Mind over Markets book teaches you how to unlock the power of Market Profile analysis and how you can use it for day trading and analysis.

First published in 1993, the book has undergone multiple updates to keep up with the changes in market structure and behavior analysis techniques.

The basics of the book delve into the dynamics of the markets by creating an understanding of time, volume, and price.

This book not only helps one understand how this knowledge will help create an analysis process but also provides practical skills and how to apply these skills to one’s system.

The idea here is to teach you the ability to make objective observations so that you can then make the trades as they come up.

Additionally, the publication was co-authored with Eric Jones and Robert Dalton – both highly respected trading and investment professionals.

Markets in Profile

While Mind Over Markets explains the fundamentals of the Market Profile approach, Markets in Profile takes things up a notch.

It combines details about the Market Profile (MP) with two other frameworks: neuroeconomics and behavioral finance.

This book takes a wholesome approach to trade by creating a unified theory that displays how market profile work across markets such as stocks, futures, and forex.

This book helps develop a bullet-proof trading strategy applicable to any paced market. It aims to reveal the underlying market dynamics that are at play at any given time.

For instance, it considers the emotion of market participants.

These emotions play a huge role in the market as traders tend to make decisions based on emotions rather than logic.

Another area that this book tackles well is investor psychology.

It helps show how to assess investor psychology and how it can affect the financial markets in the longer term.

Markets in Profile helps the trader understand the fluid nature of the market so you can make confident trading and investment decisions.

His Contributions to the Market Profile

The Market Profile is an analytical tool designed for financial markets.

It was invented by traders in the Chicago Board of Trade (CBOT) around the 1980s.

Over time, the tool has become a go-to source for important market information, especially for day traders.

An interesting coincidence about the Market Profile is that it was invented when Dalton was just starting his trading career.

This allowed him to grow and learn as the tool developed.

While he is not the inventor of the Market Profile, he is one of its most outspoken proponents.

This would lead him to write the books mentioned above and eventually start Jim Dalton Trading, where he teaches the methods he developed.

Most methods are for day traders, but many of its principles can also be adapted to longer-term trading styles.

His Training and Methods

Dalton runs a YouTube channel where he regularly posts videos of himself coaching people on how to apply the Market Profile tool in practical settings.

This will hopefully lead you to Jim Dalton Trading, his education company, where one can learn how to trade the Profile through different levels of intensive instruction and access to Q&A with Dalton himself.

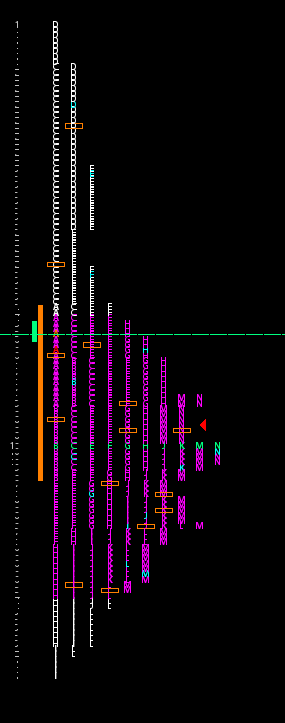

A market profile is created by compiling time blocks of market action that can identify participant engagement or lack thereof.

Each block of time (typically half-hour increments) tracks market movement through a unique identifier.

For instance, “A period” for the NYSE typically begins at market open, 9:30 EST, and closes at 9:59:59 EST. “B period” would then open at 10:00 EST.

This differs from viewing the market as a line graph or bar style.

Depending on the traders ‘ timeframe perspective, these profiles have many different variations and structures that can be assessed throughout the day or over many days.

According to Dalton, the Market Profile tool can be used for the following:

- Swing Trading

- Scalping

- Gap Trading

- Trend Days

This is not an exhaustive list, just some of the more common applications.

Swing Trading

Jim is a huge proponent of swing trading. His training in swing trading centers on the art of identifying good trading opportunities just before they begin.

According to his method, the best time to start tracking a swing trade opportunity is when either of the following hold true:

- After an excess high or low

- When the markets gap

- After a period of balance

Once an opportunity arises, he recommends monitoring it for continuation and utilizing the Profile for that day and previous days to look for areas of support and resistance.

Scalping

The Market Profile can also prove to be a fantastic scalping tool. In the day’s session, you can use it to obtain important data about trading volumes and market behavior.

Dalton looks for the following setups to look for locations of potential scalps.

- Half backs

- Overnight highs and lows

- Early morning highs and lows

- Point of control (either TPO or volume)

- Previous day value area highs and lows

- Poor lows and poor highs (an even close period to period)

- Utilization of initial balance

These areas of support or resistance identified on the Profile can provide a trade with a solid location to look to scalp a few ticks or points in their respective markets, especially when mixed with other tools like volume.

Trend Trading

The market profile can also help identify trend days.

As a trader, trend days are some of the most difficult to trade. Dalton’s use of the Profile can help make it a little easier to trade.

By looking at the Profile, you can look for “One Time Framing,” which means that each period of your Profile makes a higher high or lower low. By watching for this One-Time Framing and for when it stops, you can find some actionable locations to enter and cut trades on trend days.

Final Thoughts

Market Profile has played a huge role in trading, and an argument can be made that Dalton is a major driving force behind its adoption.

He has many years of experience with it and was uniquely positioned to learn, as it was developed alongside his trading career.

Jim has made a great deal of content surrounding Profile analysis.

His books are considered the standard for reading material on Market Profile, and his courses are some of the most popular.

With over 50 years of experience in the markets, he proves to be a solid resource of information to absorb.

There is no doubt that Jim Dalton has been a huge factor in the increased use and popularity of Market Profile in modern trading.

We hope you enjoyed this article on Jim Dalton.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/jim-dalton/