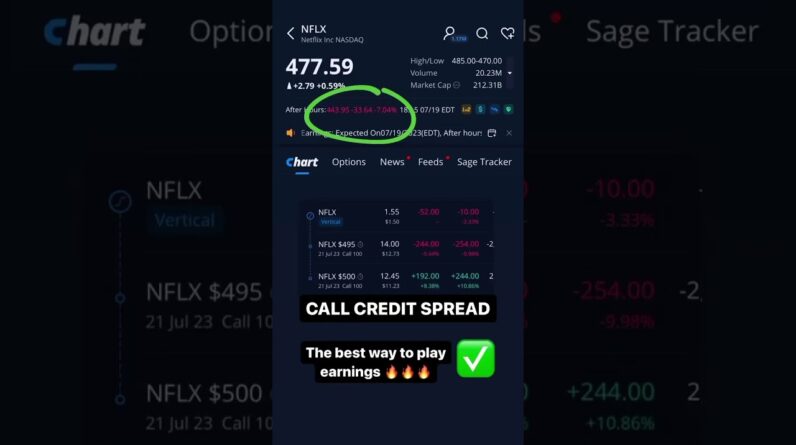

When it comes to trading options during uncertainty around earnings, there’s a way to make the odds work in your favor using Credit Spreads.

NFLX released its earnings report earlier today and the stock price predictably took a nose dive. It dropped 8%, which translates to a whopping $40! But here’s the cool part: by using a Call credit spread, we can make some sweet profits by the expiration date if the NFLX stock closes below our strike prices of $495 and $500.

The idea behind a Credit Spread is to sell premium and give yourself a buffer of protection. This means that in times of uncertainty or volatility, we can make trades that are more forgiving. Genius, right? 💡

By trading Credit Spreads Options, you can keep calm and carry on even in the face of uncertainty around earnings reports. It’s all about having a game plan that takes market conditions into account and using it to your advantage. We’re in this together, and with a little perseverance and knowledge, we can totally succeed.