Some articles on the web, including our iron condor strategy, recommend using higher price stocks when trading delta neutral option strategies.

Have you ever wondered why?

Let’s start with a thought question. Is having one iron condor on RUT the same as having ten iron condors on IWM?

Contents

-

-

-

-

-

-

-

-

-

- Ten Iron Condors On IWM

- One Iron Condor On RUT

- Better Strike Selection

- SPY Delta Neutral Butterfly

- SPX Delta Neutral Butterfly

- Does That Matter?

- Calendars

- Conclusion

-

-

-

-

-

-

-

-

The RUT is the cash-settled Russell 2000 index.

The IWM is the ETF that tracks the Russell 2000 index.

It can be bought and sold, and options can be assigned.

The price of IWM is one-tenth the price of RUT.

On March 17, 2022, the RUT is trading at $2031, and the IWM is trading at $202.

Ten iron condors on the IWM should be equivalent to one iron condor on RUT with equivalent strike selections.

Ten Iron Condors On IWM

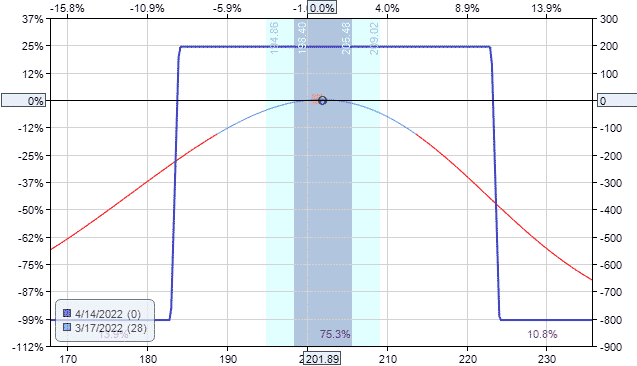

Date: March 17, 2022

Price: IWM @ $202

Buy ten Apr 14 IWM $183 put @ $1.80

Sell ten Apr 14 IWM $184 put @ $1.94

Sell ten Apr 14 IWM $223 call @ $0.43

Buy ten Apr 14 IWM $224 call @ $0.37

Net Credit: $195

Max Risk: $805

Delta: -0.23

Theta: 6.52

Vega: -14.61

Gamma: -1.63

The strikes are selected to reduce the Delta as close to zero as possible so that the condor looks like this.

source: OptionNetExplorer

One Iron Condor On RUT

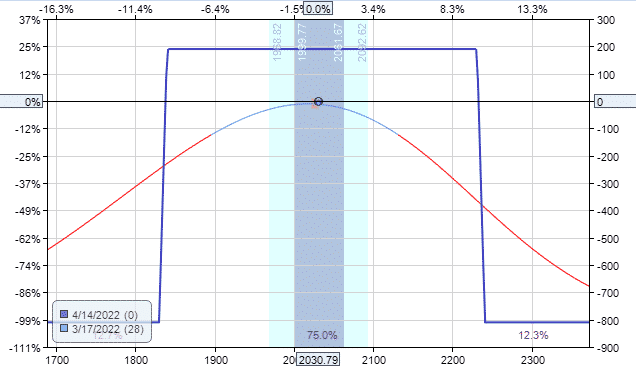

If you are going to trade ten IWM condors, it is better to trade one RUT like this:

Date: March 17, 2022

Price: RUT @ $2031

Buy one Apr 14 RUT $1830 put @ $15.65

Sell one Apr 14 RUT $1840 put @ $16.85

Sell one Apr 14 RUT $2230 call @ $5.20

Buy one Apr 14 RUT $2240 call @ $4.50

Net Credit: $190

Max Risk: $810

Delta: -0.23

Theta: 7.07

Vega: -15.24

Gamma: -0.01

The payoff graph looks the same, with nearly identical max profit and max loss:

The Delta, theta, and vega at the start of the trade are mostly the same.

The one difference is in the gamma.

The IWM condor has a much larger gamma of -1.63, whereas the RUT condor has a gamma of only -0.01.

This gamma difference is because IWM is $202 per share, whereas RUT is $2021.

Better Strike Selection

Another benefit of using RUT is that you have more strike selections.

We know that the risk of the condor is reduced when we reduce the width of the wings (meaning the distance between the long call and short call).

In the IWM condor, this is as small as we can go with a long call at $224 and a short call at $223. There is no $223.50 strike.

In the RUT condor, we can go narrower by changing the 10-point wing to a 5-point wing since the $2235 strike is available.

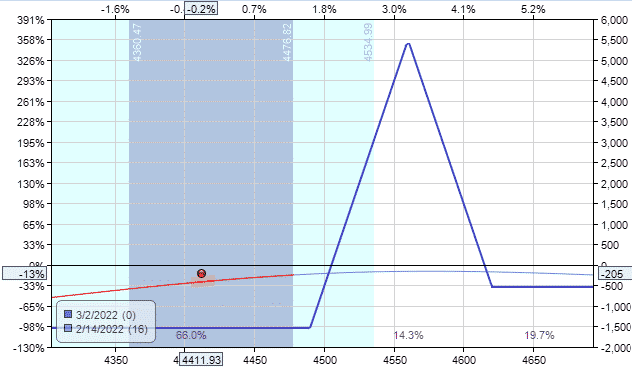

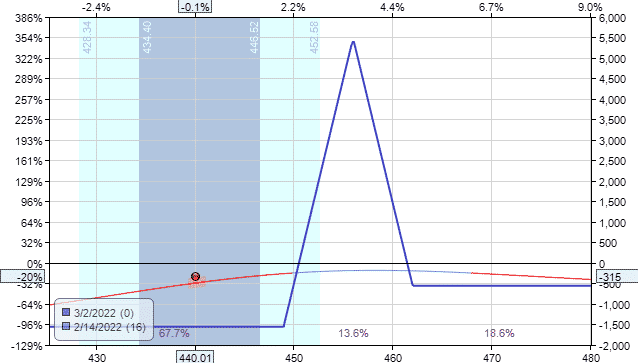

SPY Delta Neutral Butterfly

Let’s look at another delta-neutral strategy — this time on SPX versus SPY.

The SPX is the S&P500 index, and the SPY is the corresponding ETF.

SPX is ten times as large as the SPY.

The price movement of the two is nearly the same.

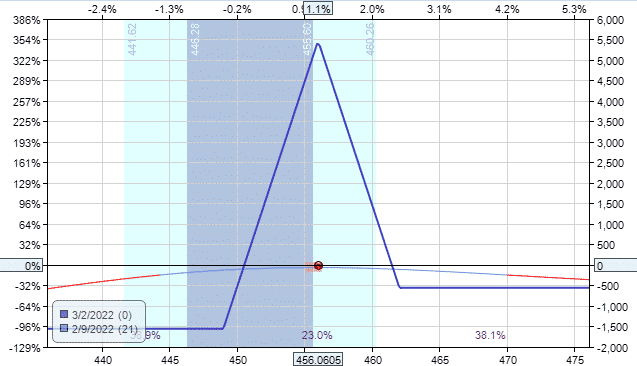

Here are ten butterflies on SPY:

Date: Feb 9, 2022

Price: SPY @ $456

Buy ten Mar 2 SPY $449 put @ $5.01

Sell twenty Mar 2 SPY $456 put @ $7.27

Buy ten Mar 2 SPY $462 put @ $10.09

Net Debit: –$555

Max risk: $1555

Delta: -0.65

Theta: 18.21

Vega: -51.53

Gamma: -2.19

Again, we selected the strikes to make the Delta as small as possible.

SPX Delta Neutral Butterfly

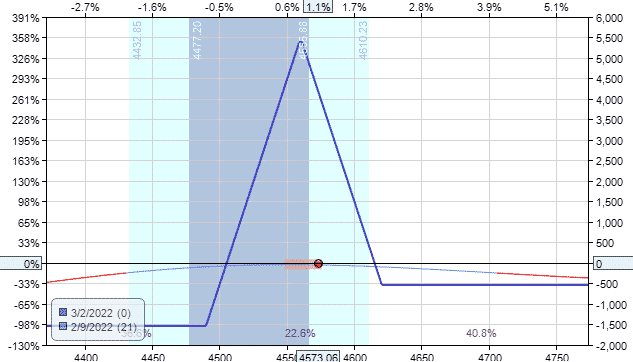

In comparison, here is one butterfly on the SPX:

Price: SPX @ $4573

Buy one Mar 2 SPX $4490 put @ $48.05

Sell two Mar 2 SPX $4560 put @ $69.65

Buy one Mar 2 SPX $4620 put @ $96.60

Net Debit: –$535

Max Risk: $1535

The graph looks quite the same:

And so do the Greeks, except for the gamma:

Delta: -0.53

Theta: 17.45

Vega: -47.94

Gamma: -0.01

The gamma is much lower for the larger-priced SPX.

Does That Matter?

Gamma is the rate of change of Delta.

A larger magnitude of gamma (ignoring the sign) means that the Delta will change more when the price moves.

Three days later, on February 14, the price of SPX moved out of the butterfly tent:

The SPX position is down –$205 in P&L, and Delta has gone up to 2.85.

For the SPY position, the P&L is down –$315, and Delta has gone up to 32.24. Although you can’t tell just by looking at the graph.

While they both started delta-neutral, the SPY trade ended up with a larger delta and a larger P&L loss.

Calendars

Here are the Greeks for an at-the-money calendar on Telsa (TSLA), a $860 stock.

Date: Feb 14, 2022

Price: TSLA at $866

Sell one Mar 4 TSLA $865 put

Buy one Mar 11 TSLA $865 put

Max risk: $775

Delta: -0.43

Theta: 20.44

Vega: 13.57

Gamma: -0.05

And here are the Greeks for a similar calendar on Intel (INTC), a $50 stock.

Date: Feb 14, 2022

Price: INTC at $48

Sell 43 Mar 4 INTC $48 put

Buy 43 Mar 11 INTC $48 put

Max risk: $774

Delta: 13.60

Theta: 37.24

Vega: 32.52

Gamma: -44.47

We had to do 43 calendars to invest the same amount as the Telsa trade.

That’s a lot of contracts, and the commission cost will be higher.

Note the much higher gamma on INTC than on TSLA.

Conclusion

For delta neutral option strategies, we start with a near-zero delta.

This Delta will increase as the price moves.

The amount that the delta increases will depend on how big the gamma is.

We want low gamma so that the rate of change of Delta remains small.

Delta-neutral strategies on higher-price assets tend to have lower gamma.

You can trade fewer contracts and save on commissions. Plus, they have greater strike selection availability.

This is not to say that you shouldn’t do delta-neutral strategies on lower-priced stocks.

You should if you see the proper setup.

We are saying that if you had a choice between ten contracts on SPY versus one contract on SPX, doing the latter is better.

We hope you learned something from this article on using high priced stocks for delta neutral option strategies. If you have any questions, please send us an email or post a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Original source: https://optionstradingiq.com/delta-neutral-option-strategies/