US stocks continue their weakness this week, with the S&P 500 touching down at $4136, sitting right at its significant support level established in mid-March. Volatility is elevated again near the recent highs with the VIX sitting at 34 as earnings season hits its midpoint.

When there’s persistent weakness in stocks, everyone comes out of the woodwork to give you a laundry list of reasons why the market is doomed. And there are some real headwinds to this market which is already at arguably elevated levels relative to history and the economic outlook ahead.

Chief among these headwinds are:

- Anticipated Federal Reserve tightening

- The Russia and Ukraine war

- China COVID lockdowns

- Persistently high inflation

So without further ado, let’s take a look at a few charts and see what’s going on in markets.

The S&P 500 is sitting right at its critical support level around 412 (or 4120 for futures) and it reached this level with very strong bearish momentum which is a red flag for any long setups. The pullback formation we highlighted a few weeks ago has obviously failed and the only sensible reason to be long this market is for mean reversion.

It’s always crucial to keep in mind the equity market’s tendency to mean revert, as being a composite of hundreds of stocks, they don’t tend to have very strong momentum on either side for too long.

On a relative strength basis, the expected is occurring. Blue chips in the Dow Jones Industrial Average (represented by the DIA ETF) remain the strongest, while the more risky and long-duration assets like small caps and the NASDAQ 100 are getting hit the hardest. The drought in lower quality tech companies in specific is likely responsible for much of the increased weakness in the NASDAQ, as those companies are seeing their previously arguably absurd valuations taking a huge haircut.

Shifting our focus to oil, not much of note has happened in crude, which remains in it’s weeks-long consolidation pattern and ends the week around $104 per barrel.

Chart of the Week

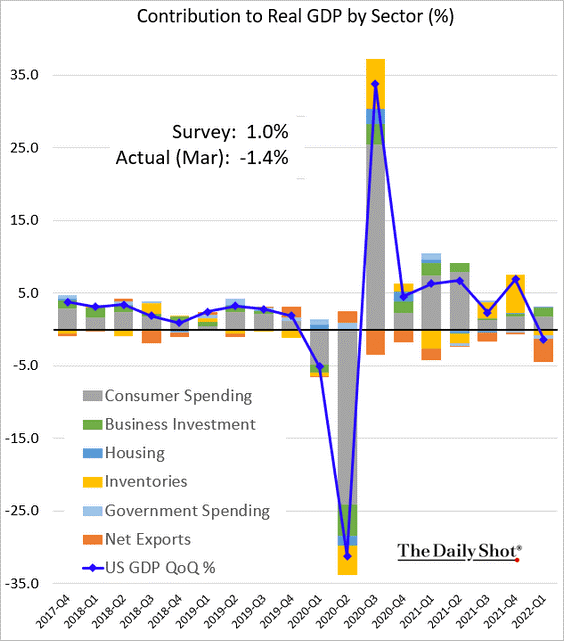

To the surprise of most, GDP actually contracted during the first quarter of 2022, owing to factors like the Russia and Ukraine war hitting the supply chain hard and persistent inflation crushing consumer confidence:

Last Week’s News

There were some big stories this week:

- Elon Musk offered to buyout Twitter (TWTR) at $54.20/share and sold $8 billion of Tesla (TSLA) stock to fund it. The FTC is now investigating the timing of Musk’s SEC filings

- GDP contracted in Q1 2022, declining 1.4% vs. an estimated 1.0% advance.

- Big Tech earnings a mixed bag, with Amazon (AMZN) disappointing, Facebook (FB) surprising big time, Google (GOOG) mixed, Microsoft (MSFT) mixed, Intel (INTC) disappointing, Apple (AAPL) surprising, and although it was last week, Netflix (NFLX) logging a big disappointment with many questioning the company’s future

- Activision Blizzard (ATVI) shareholders overwhelmingly approve Microsoft acquisition

- The American Association of Individual Investors sentiment report shows sentiment at lowest in over a decade

Earnings Next Week

We’re halfway through earnings season with many of the market’s juggernauts like Apple and Google already reporting. Currently, the S&P 500 is underperforming expectations, with 0.6% earnings growth across the reporting companies compared to a 5% estimate.

Here are some of the companies reporting this week:

Monday, May 2:

- Berkshire Hathaway (BRK.B, BRK.A)

- Enterprise Products (EPD)

- Nutrien (NTR)

- CNA Financial (CNA)

- WEC Energy (WEC)

- Williams Companies (WMB)

- NXP Semiconductors (NXPI)

- Mosaic (MOS)

- Global Payments (GPN)

- Clorox (CLX)

- Devon Energy (DVN)

- MGM Resorts (MGM)

- Moody’s (MCO)

- Logitech (LOGI)

- Onsemi (ON)

- CVR Energy (CVI)

- Chemours (CC)

- Avis Budget Group (CAR)

- Amkor Technology (AMKR)

- Expedia (EXPE)

- FMC (FMC)

- Diamondback Energy (FANG)

- Leggett & Platt (LEG)

Tuesday, May 3:

- BP (BP)

- Marathon Petroleum (MPC)

- Pfizer (PFE)

- American International Group (AIG)

- Prudential Financial (PRU)

- Progressive (PGR)

- CNH Industrial (CNHI)

- Starbucks (SBUX

- Cummins (CMI)

- Lear (LEA)

- Eaton (ETN)

- Teva Pharmaceuticals (TEVA)

- DuPont (DD)

- Estee Lauder (EL)

- Jacobs (J)

- Illinois Tool Works (ITW)

- Murphy USA (MUSA)

- Advanced Micro Devices (AMD)

- Leidos (LDOS)

- Fidelity National Information (FIS)

- Amcor (AMCR)

- ONEOK (OKE)

- KKR (KKR)

- Edison International (EIX)

- Biogen (BIIB)

- Andersons (ANDE)

- Yum China (YUMC)

- CenterPoint Energy (CNP)

- Assurant (AIZ)

- Delek US (DK)

- Molson Coors (TAP)

- CMS Energy (CMS)

- Franklin Resources (BEN)

- S&P Global (SPGI)

- Rockwell Automation (ROK)

- Caesars Entertainment (CZR)

- Thomson Reuters (TRI)

- Herbalife (HLF)

- Zebra Technologies (ZBRA)

- Restaurant Brands International (QSR)

- Airbnb (ABNB)

- Public Storage (PSA)

- Match Group (MTCH)

- Lyft (LYFT)

- Extra Space Storage (EXR)

- MicroStrategy (MSTR)

Wednesday, May 4:

- CVS Health (CVS)

- AmerisourceBergen (ABC)

- Energy Transfer (ET)

- Metlife (MET)

- Allstate (ALL)

- CDEW (CDW)

- Cognizant Technology (CTSH)

- Sunoco (SUN)

- Ebay (EBAY)

- Trane Technologies (TT)

- Barrick Gold (GOLD)

- Uber Technologies (UBER)

- Brookfield Infastructure (BIP)

- Regeneron Pharamceuticals (REGN)

- Pioneer Natural Resources (PXD)

- Marriot International (MAR)

- Moderna (MRNA)

- NiSource (NI)

- Yum Brands (YUM)

- Ferrari (RACE)

- Booking Holdings (BKNG)

- Marathon Oil (MRO)

- eXp World (EXPI)

- Etsy (ETSY)

- New York Times (NYT)

Thursday, May 5:

- McKesson (MCK)

- Anheuser Busch (BUD)

- ConocoPhillips (COP)

- CBRE (CBRE)

- Block aka Square (SQ)

- Kellogg Comapny (K)

- Ball (BLL)

- Intercontinental Exchange (ICE)

- Apollo Global Management (APO)

- Penn National Gaming (PENN)

- Monster Beverage (MNST)

- Zillow Group (ZG)

- DoorDash (DASH)

- Shopify (SHOP)

- ContextLogic (WISH)

- Opendoor Technologies (OPEN)

- AMC Networks (AMCX)

- Papa John’s (PZZA)

- Dropbox (DBX)

- HubSpot (HUBS)

- Redfin (RDFN)

- WWE (WWE)

Friday, May 6:

- NRG Energy (NRG)

- EOG Resources (EOG)

- Goodyear Tire (GT)

- Under Armour (UA)

- DraftKings (DKNG)

- Cigna (CI)

- Brookfield (BBU)

- Enbridge (ENB)

Economic Releases Next Week

We have a big Fed meeting next week, on Wednesday, May 4. Many are forecasting a larger-than-expected rate hike and this meeting might serve as another confirmation that the Fed is moving forward with their hawkish tone regardless of equity market weakness. This should serve as a test for the Fed, as they’ve historically flipped the course away from hawkishness everytime the equity market responded with weaknesses throughout this bull market.

Here’s this week’s economic data releases:

Monday, May 2:

- ISM PMI Manufacturing Index

Tuesday, May 3:

- Job openings and job quotes

- Factory orders

Wednesday, May 4:

- ADP employment report

- FOMC meeting

- ISM services index

Thursday, May 5:

- Initial and continuing jobless claims

Friday, May 6:

- Nonfarm payrolls

- Unemployment rate

- Consumer credit

The post Stock Market Overview for the Week of May 2, 2022 appeared first on Warrior Trading.